Gold: Prices Dragged by Lower Demand

On Friday, spot gold ended 0.6% higher to $1,879, though still marking a third straight month of decline, as the U.S. dollar began to gain strength. Over the weekend, the World Gold Council reported that Q3 gold demand dropped 19% on year to 892 tons, the lowest level since Q3 2009. Demand was 10% lower at 2,972 tons in the first nine months of the year, compared with the prior-year period.

Gold demand in China was mixed. The report highlighted that Q3 jewellery demand slid 29% on year to 333 tons, where China and India accounted for the largest volume declines, citing the COVID-19 effects. By contrast, bar and coin investment jumped 49% on year to 222 tons, as most major retail investment markets saw strong growth though the largest volume increases were seen in Western markets, China and Turkey.

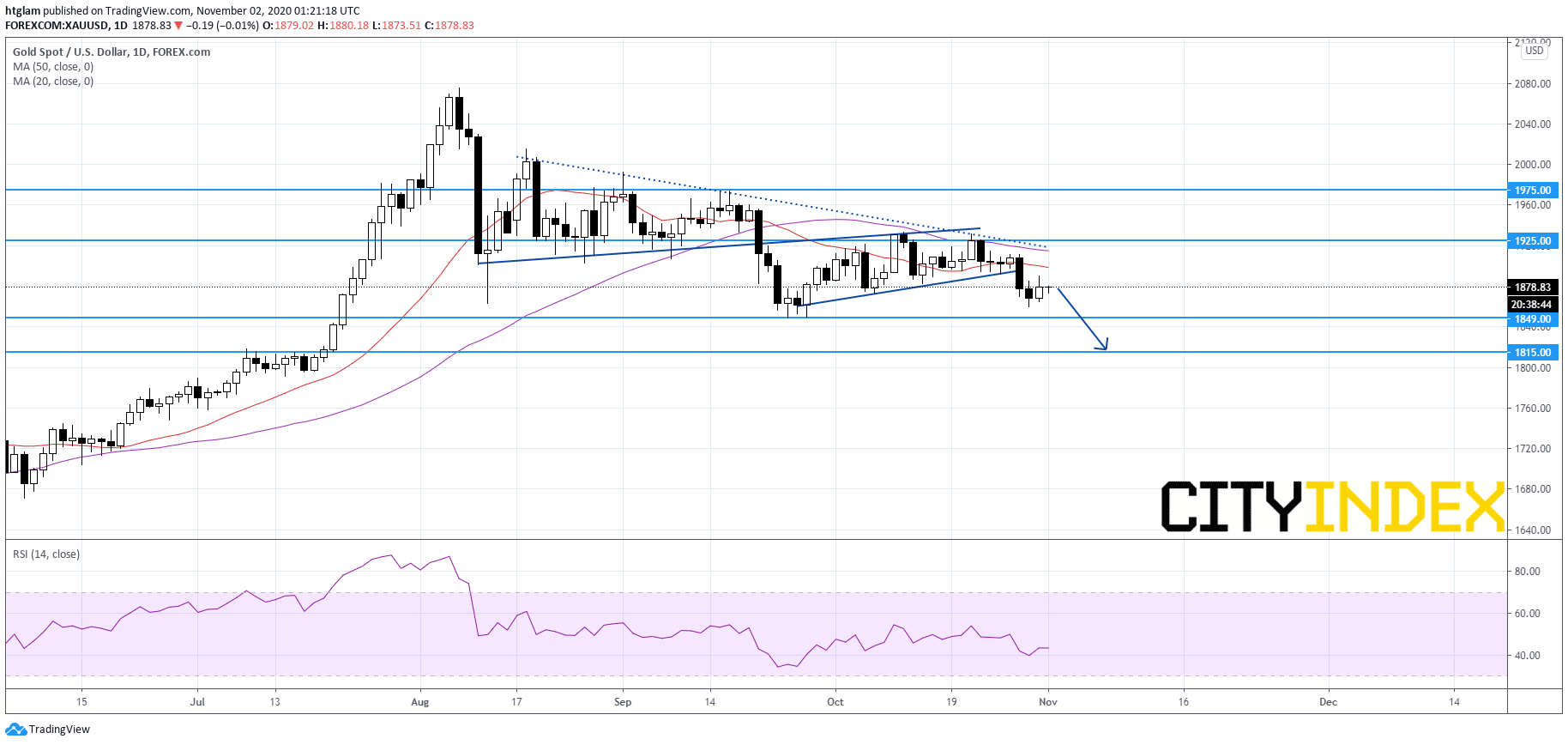

From a technical point of view, spot gold stays on the downside as shown on the daily chart. It remains capped by a declining trend line drawn from August, with a shorter-term bullish trend line broken. The level at $1,925 might be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $1,849 and $1,815 respectively.

Source: Gain Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM