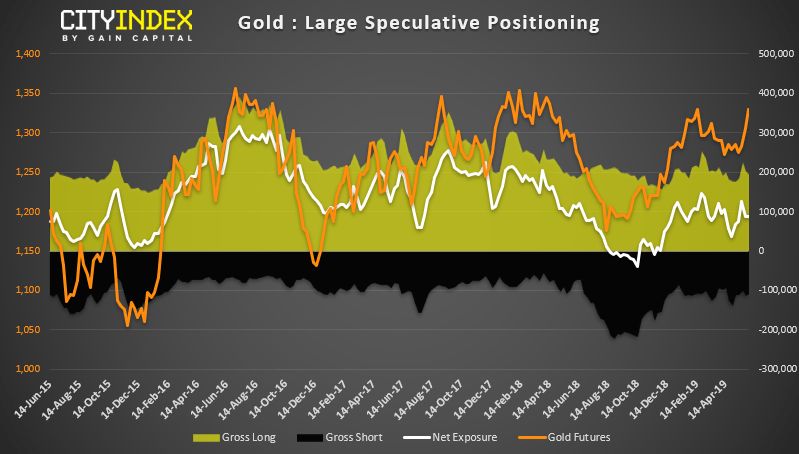

- Whilst gold is up just a modest 3.9% this year, it’s rallied 14.8% since the 2018 low and the trend structure remains bullish. Furthermore, by yesterday’s close the shiny yellow metal had racked up its most bullish 4-day run since June 2016 to underscore its recent pickup of bullish momentum.

- The main culprit for gold’s impressive display is thanks to Donald Trump’s latest threat of tariffs on Mexican goods. Not only is gold receiving safe-haven flows, but its move higher has also been supported by a weaker USD. Markets seem wary as to whether Trump can fight a trade war on two fronts (Mexico and China) which has seen the US dollar suffer.

- However, stopping just shy of the 2019 high, a solid reversal for the US dollar yesterday has left a large bearish hammer below key resistance. That its occurred whilst being overextended from it upper Keltner band strongly suggests the move is exhausted over the near-term. Therefor we expect prices to retrace or consolidate before gold eventually breaks to new highs.

Recent Videos:

70c Remains Pivotal For AUD/USD Post-RBA

USD/JPY Bears Looking To Fade Rallies Below 109

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM