US retail sales in May beat expectations, increasing by 0.5%, more than the 0.4% that was expected. April figures were also revised upwards. The dollar strengthened on the release; gold fell away from its session high and year to date high of $1361.9.

This is the second straight month that retail sales have increased. However, retail sales are notoriously volatile, we have seen some large swings in the data so far this year making it difficult for policy makers to gauge the mood of the US consumers. The better than forecast data, just ahead the FOMC next week, will have investors questioning whether the Fed will be prepared to cut interest rates whilst consumers are still spending well.

FOMC

The broad expectation is that the Fed will sit tight for this month. According to the CME FedWatch tool the market is only pricing in a 22.5% probability of a rate cut in June. However, this increases to 88.5% in July and 97.5% by September.

The fact is a lot will probably ride on what happens at the G20. Should Trump announce all out tariff increases to 25% then the Fed may grow nervous prompting them to act sooner rather than later. However, any signs of progress in the ongoing trade dispute could give the Fed the luxury of more time to see how the economy holds up.

Gold retreats

Gold retreats

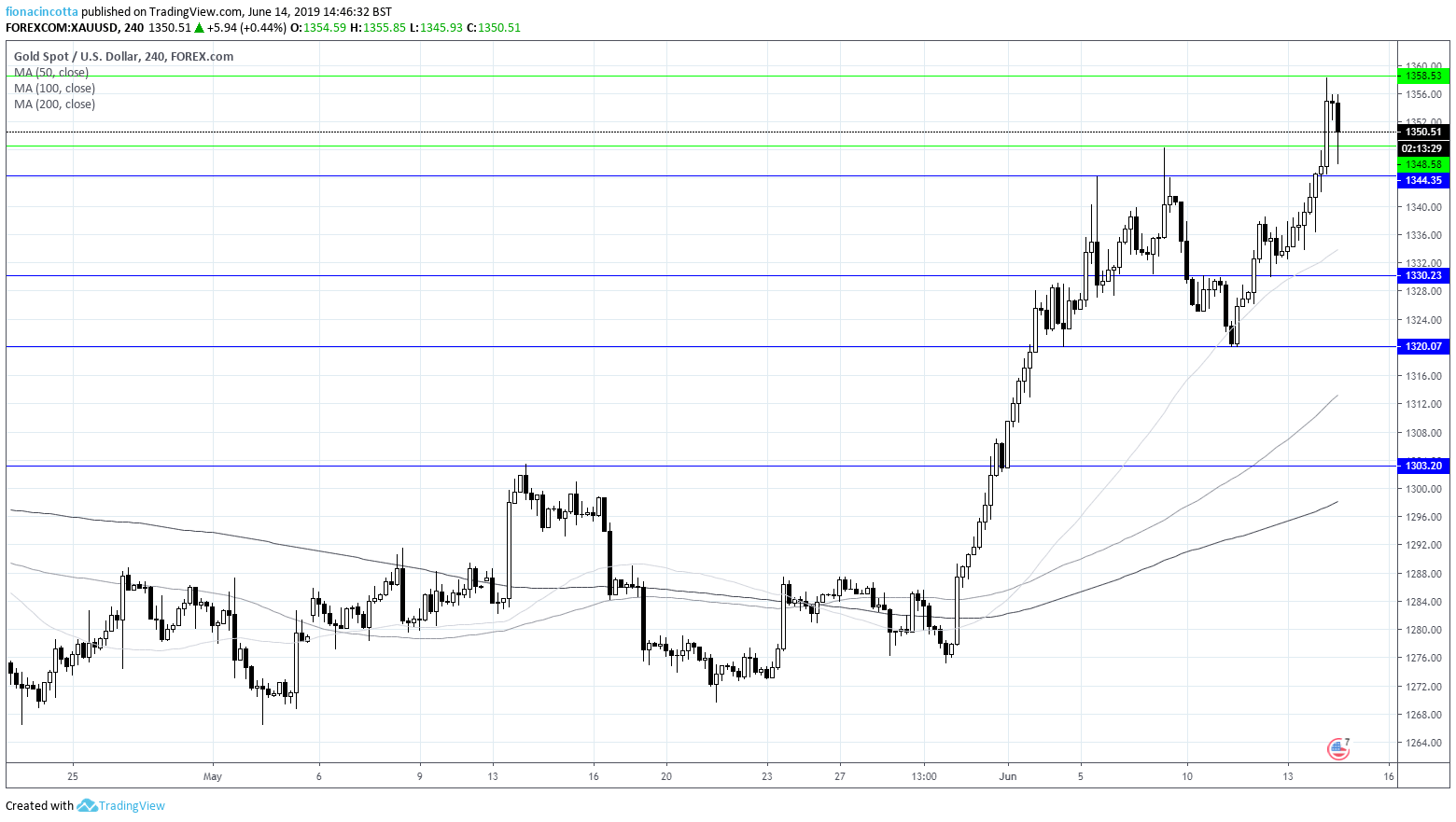

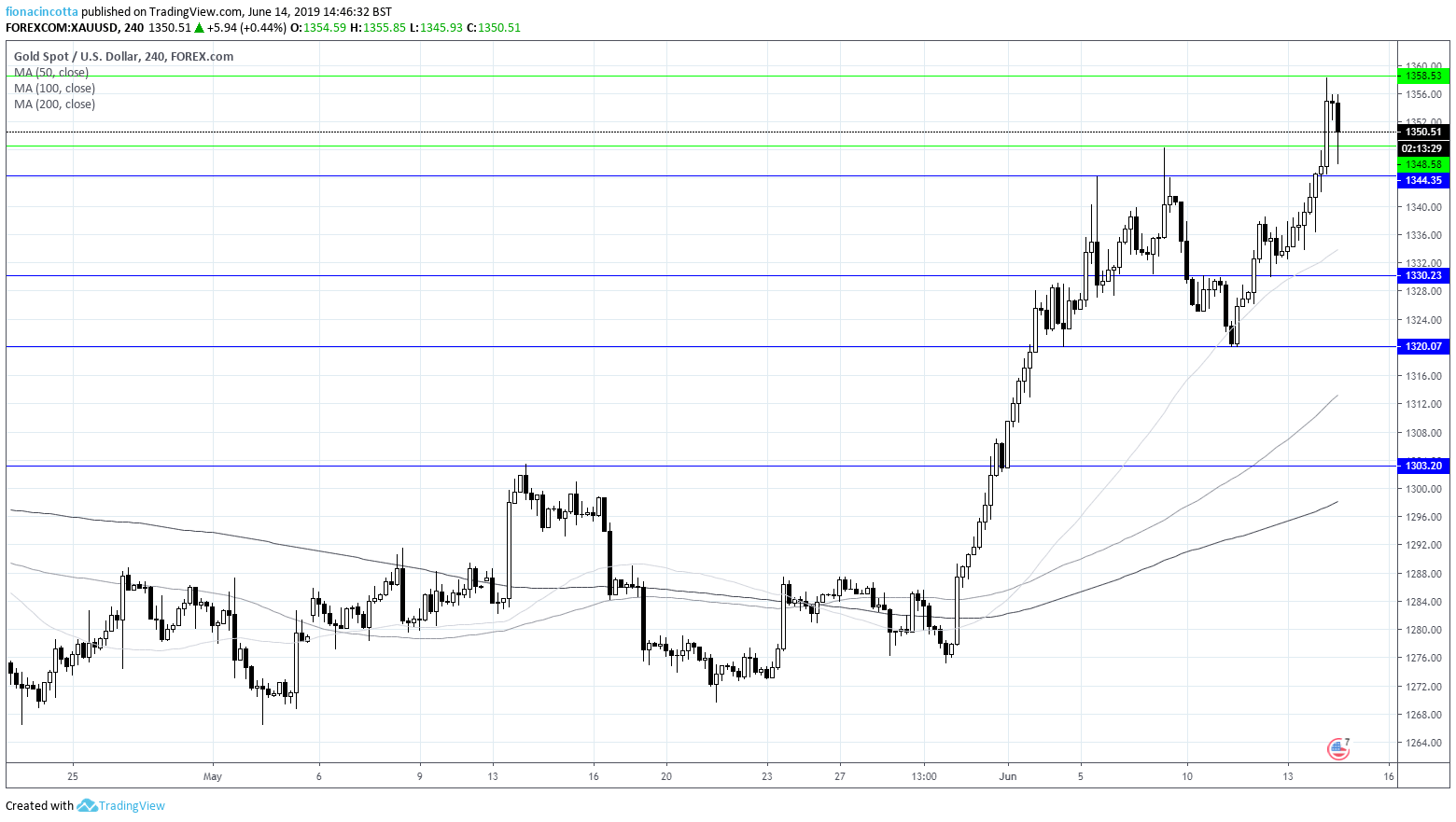

Prior to the release, gold had been trading over 1% higher hitting a year to date high; boosted by risk off sentiment following weak Chinese industrial production data, elevated geopolitical tensions and Fed rate cut expectations.

Following the retail sales data gold has since eased back to support at $1348. Strong consumer confidence data later this afternoon could accelerate gold’s decline.

Levels to watch:

Gold is currently testing support at $1348, although it remains above its 50, 100 and 200 sma. A break support at $1348 could see the precious metal test $1344 prior to $1330 and 1320. On the upside if $1348 holds, gold could advance back towards $1360.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM