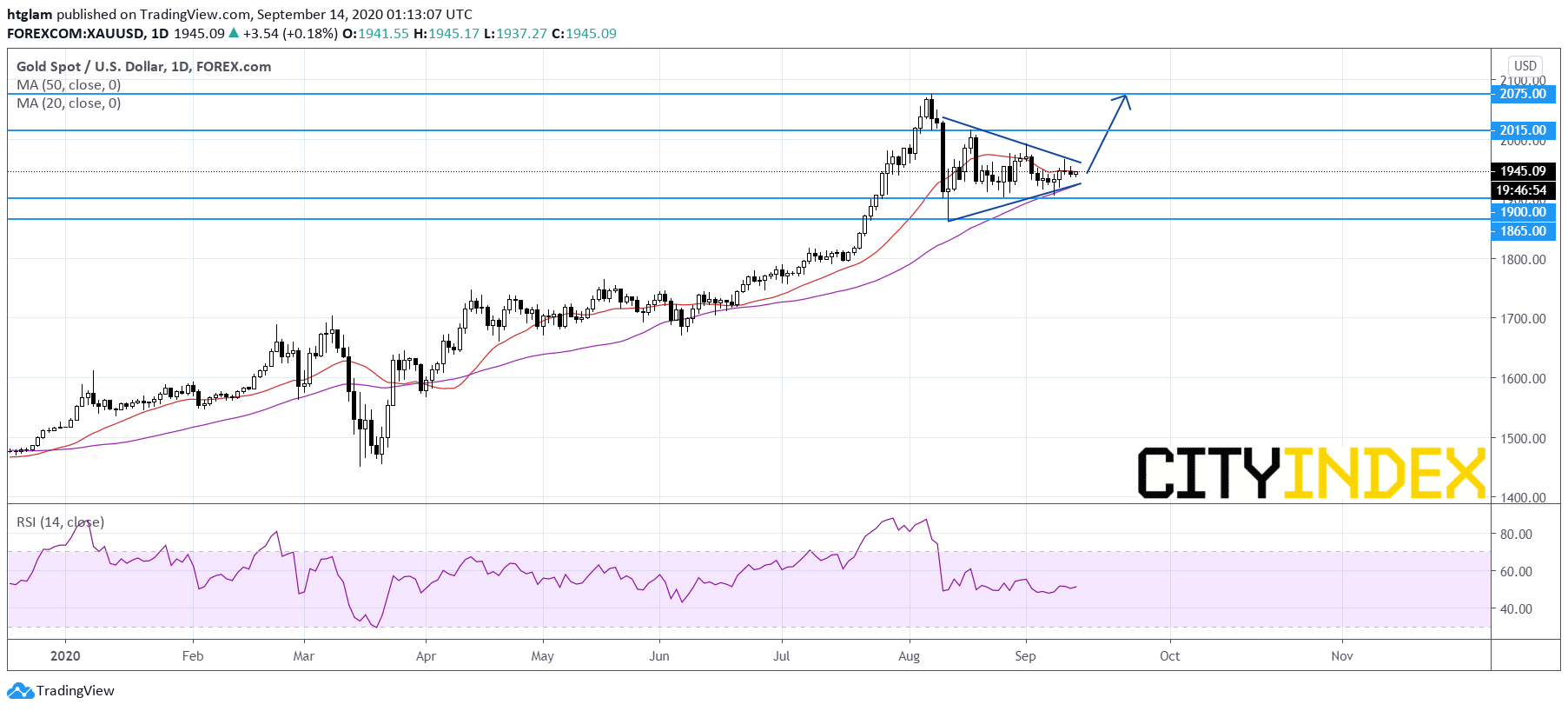

Gold: Narrowing Range, Cautiously Bullish

Spot gold has been trading within a narrowing range in the last few weeks, after volatile trading in early August. Pharmaceutical giant AstraZeneca and the University of Oxford said clinical trials for their coronavirus vaccine AZD1222 have resumed in the UK, following confirmation by the Medicines Health Regulatory Authority that it was safe to do so.

While gold prices have been dragged by vaccine development, investors continue to expect the Federal Reserve, which will hold a two-day monetary policy meeting mid-week, to keep its dovish stance.

From a technical point of view, spot gold maintains a bullish bias as shown on a daily chart. It is trading within a symmetrical triangle pattern, while support is provided by the ascending 50-day moving average. The level at $1,900 might be considered as the nearest support, with the 1st and 2nd resistance likely to be located at $2,015 and $2,075 respectively. Alternatively, a break below $1,900 would suggest that a deeper price correction is due and open a path to the next support at $1,865.