The price of gold has soared over 8% so far this week versus the US dollar. The precious metal has recovered the lost ground from earlier in the month when investors sold out of gold to cover losses elsewhere or to hold cash in a worst-case scenario mentality.

The number of coronavirus cases are continuing to escalate and the data coming through is starting to reveal the initial impact of coronavirus on the economy. It ain’t pretty.

However, following a “whatever it takes” mentality from global central banks and $2 trillion in stimulus in the US, the selling of gold has eased off and buyers are returning to the traditional safe haven. Month to date Gold is trading +2% higher.

However, following a “whatever it takes” mentality from global central banks and $2 trillion in stimulus in the US, the selling of gold has eased off and buyers are returning to the traditional safe haven. Month to date Gold is trading +2% higher.

Gold & Oil benefits

Rising gold prices are beneficial for those firms that mine and produce gold. Rock bottom oil prices are also an important part of the equation here, reducing input costs. Higher gold prices and lower fuel prices mean wider margins.

Rising gold prices are beneficial for those firms that mine and produce gold. Rock bottom oil prices are also an important part of the equation here, reducing input costs. Higher gold prices and lower fuel prices mean wider margins.

The benefit of gold stocks over physical gold right now it the additional benefit to margins from the lower oil prices. Both gold and gold stocks benefit from the rising price in gold, whereas only gold stocks offer the combined benefit of wider margins.

Workforce and the coronavirus outbreak is clearly an issue, these firms will need to take precautionary measures against the spread of coronavirus at their operations but for those that can continue production and development work, now is a good time to do so.

Whilst the precious metal miners plunged on the back of falling gold prices last week, traders have been quick to jump in on the rebound.

Stocks to watch

Barrick Gold is already up 12% so far this month outperforming the broader UK market, which is down 15% so far this month. However, the stock is also up 25% from a six month low struck last week.

Barrick is by no means alone. Polymetal International’s share price has soared by 33% after plunging to a six-month low on 19th March.

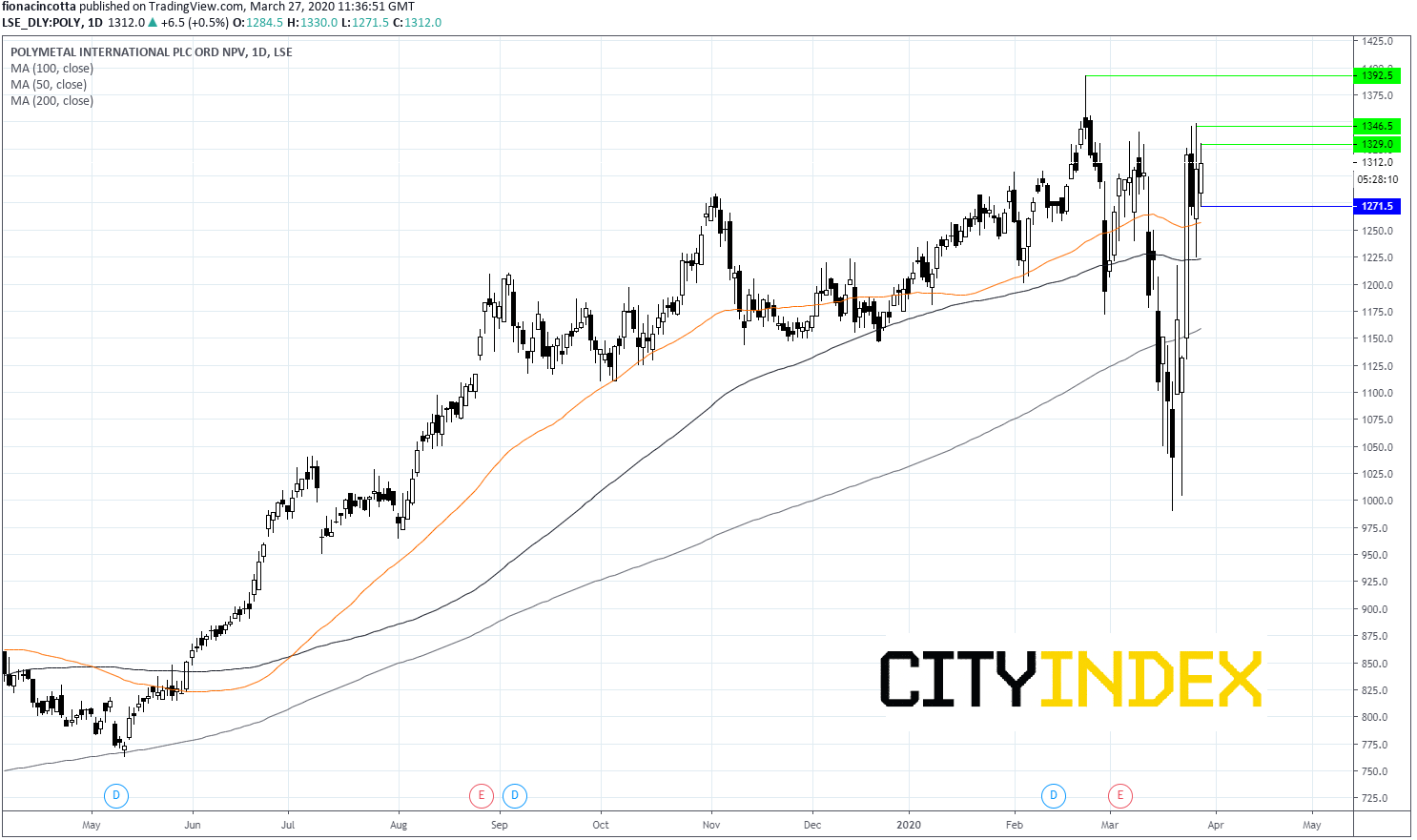

Polymetal Int. levels to watch

Polymetal trades above its 50, 100 and 200 sma on the daily chart, a bullish chart which is a rarity in this market!

Immediate support can be seen at 1272p today’s low, prior to 1255p (50sma) and 1222p (100 sma).

Resistance is at 1330p (today’s high) prior to 1346p (yesterday’s high) and 1392p (high 24th March)

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM