Gold Loses Shine on Moderating Coronavirus Fears

Spot gold dropped 1.6% to $1,686.5 yesterday, the largest decline in nearly two weeks. Despite gloomy GDP data from the Eurozone and the U.S., the coronavirus crisis appears to be moderating. Following other European countries, U.K. Prime Minster Boris Johnson said he will propose plans to unlock the economy in the coming weeks and declared that his country has passed the coronavirus peak.

In the U.S., the number of new coronavirus cases rose just 1.2% on Thursday, the smallest increase in April, according to Johns Hopkins University. Meanwhile, National Institute of Allergy and Infectious Diseases director Anthony Fauci said on a NBC interview he expects the Food and Drug Administration to approve remdesivir, a potential treatment to coronavirus patients, relatively soon.

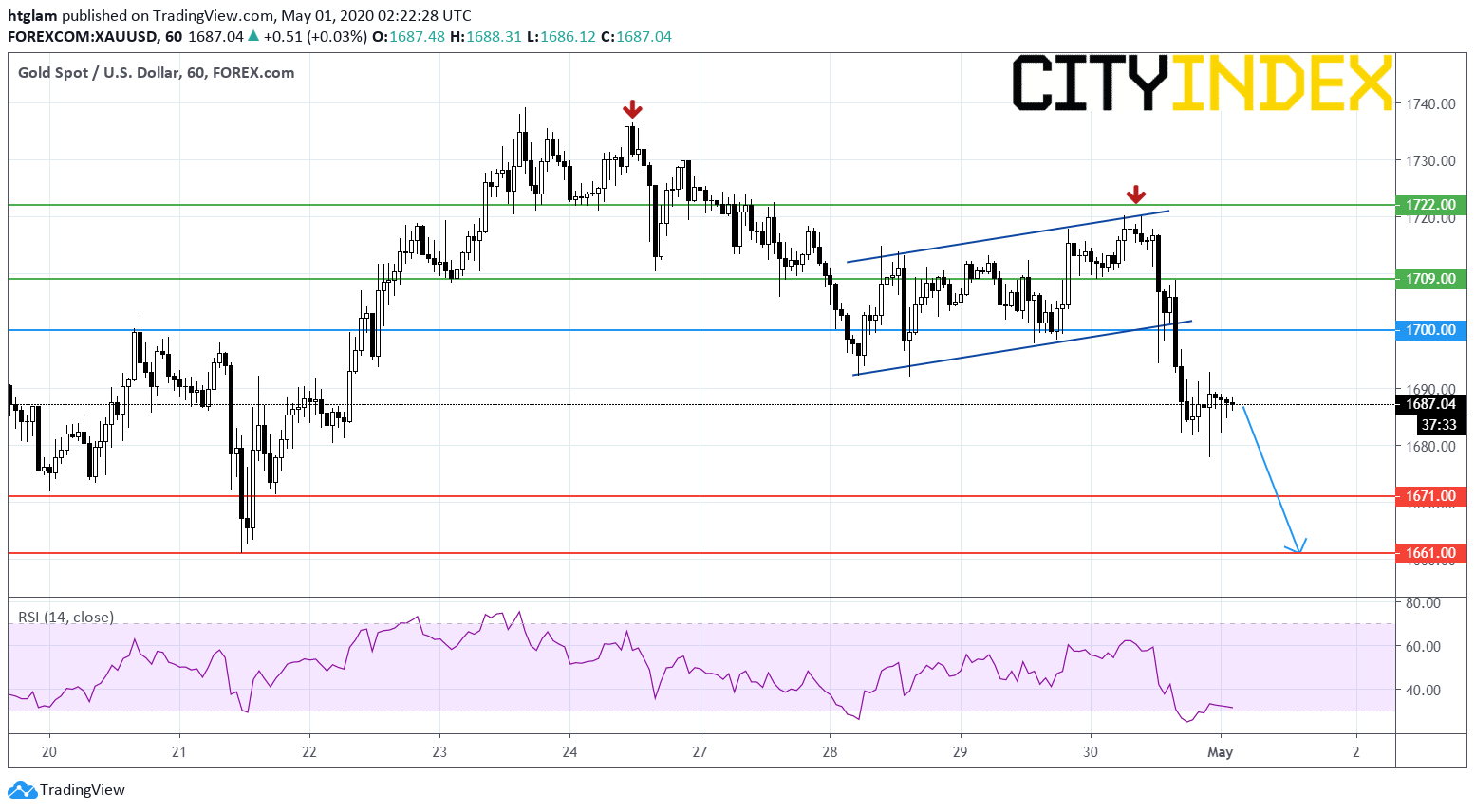

Form a technical point of view, spot gold extended its bearish run as shown on the 1-hour chart. After a recent decline, it has broken below its previous trading range and has potentially formed a lower-high. Bearish investors might consider $1,700 as the nearest intraday resistance, with potential downside targets at $1,671 and $1,661. In an alternative scenario, a break above $1,700 may trigger a revisit to $1,709 and $1,722 on the upside.

Source: TradingView, Gain Capital