Gold is having a rough day; can it be stopped?

With the US Dollar screaming higher today, it’s no surprise that Gold is moving aggressively lower. In theory, the US Dollar and precious metals move inversely to one another. The reason is that gold is traded in US Dollars. So a rise in the US Dollar, means that it takes fewer dollars to buy an ounce of Gold. Also, there may be another store of value where investors may wish to put their money. With a spike in yields, traders may be moving funds out of gold and into a higher yielding investment, such as bonds.

See: What is Gold Trading and How Can I Trade Gold Prices? | Gold Trading Online

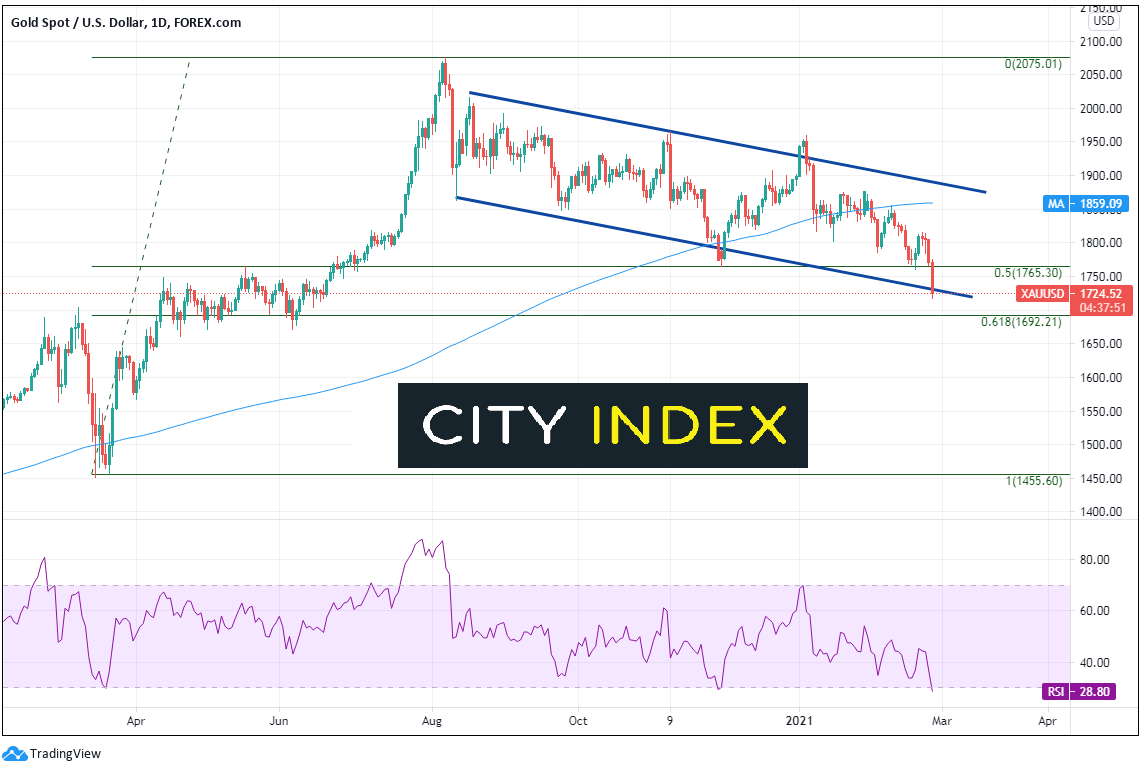

Gold (XAU/USD) has been in a decline since putting in recent highs on August 7th, 2020. Since then, the precious metal has been falling in an orderly channel. Price posted a false breakdown below the channel in early December 2020, only to move back into the area. Today, Gold prices broke through a confluence of support, including the December lows and the 50% retracement level from March 20th, 2020 low to the August 7th, 2020 high, near 1765.30. Price also moved below the bottom trendline of the downward sloping channel near 1730. Support doesn’t come into play again until the 61.8% Fibonacci retracement area from the previously mentioned timeframe near 1692.21! However, given that Gold is already down over 2.5% on the day, and the RSI is in oversold conditions, it may be ready for a bounce.

Source: Tradingview, City Index

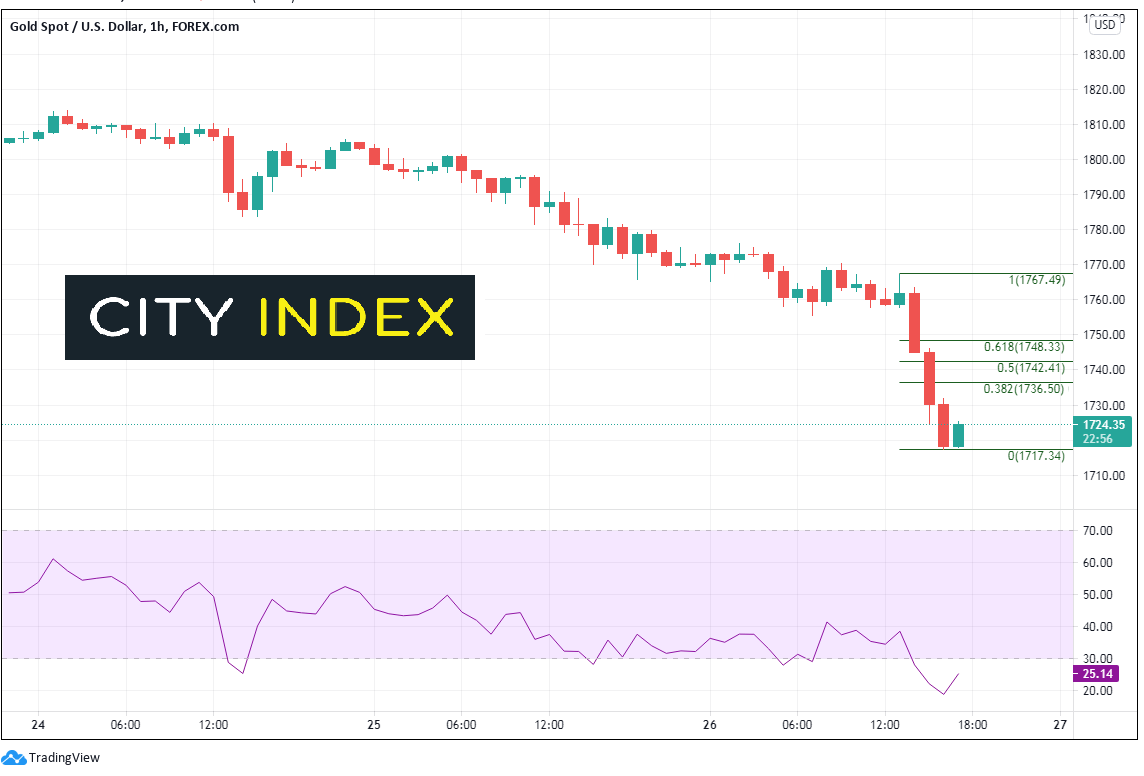

Where can price bounce to? On a 60-minute timeframe, with no longer-term timeframe resistance until 1760, the Fibonacci retracements on the day give a look at where sellers may be waiting to add to shorts. The 38.2% retracement is at 1736.50, the 50% retracement is at 1742.41, and the 61.8% retracement is at 1748.33. Notice the RSI is turning up, in extreme oversold territory, so a bounce may soon be ahead.

Source: Tradingview, City Index

Learn more about gold and silver trading opportunities.