Gold Intrday: Slight Change in Reactions to Data, Nonfarm Payroll in Focus

Philadelphia Fed President Patrick Harker warned, in a CNBC interview, that reopening the economy prematurely would be a "health catastrophe" and set back the recovery. Meanwhile Minneapolis Fed President Neel Kashkari said he expects a long and gradual economic recovery, rather than a quick bounce back. Their comments reinforce the view that loose monetary policy is likely to be maintained for a certain period of time, which would be a big plus for the precious metal.

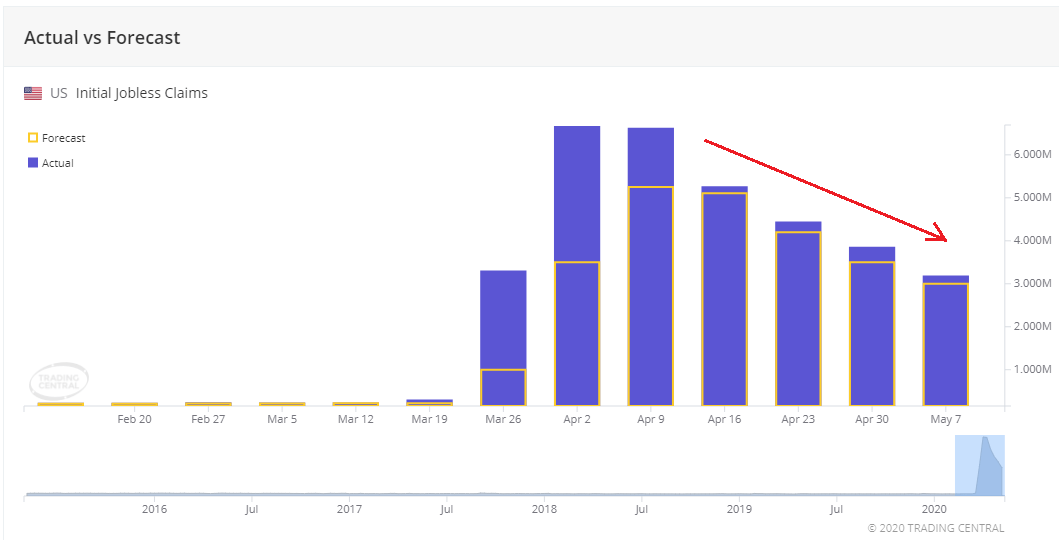

Source: Trading Economics

While a mighty 20.236 million U.S. private jobs losses in April, reported by ADP on Wednesday, did not lift up gold price, the latest initial jobless claims of 3.169 million yesterday, which showed a declining trend as indicated on the chart above, did not push down the price either. This may suggest that investors' interpretation of economic data changed quickly and their optimism over the outlook has now eased.

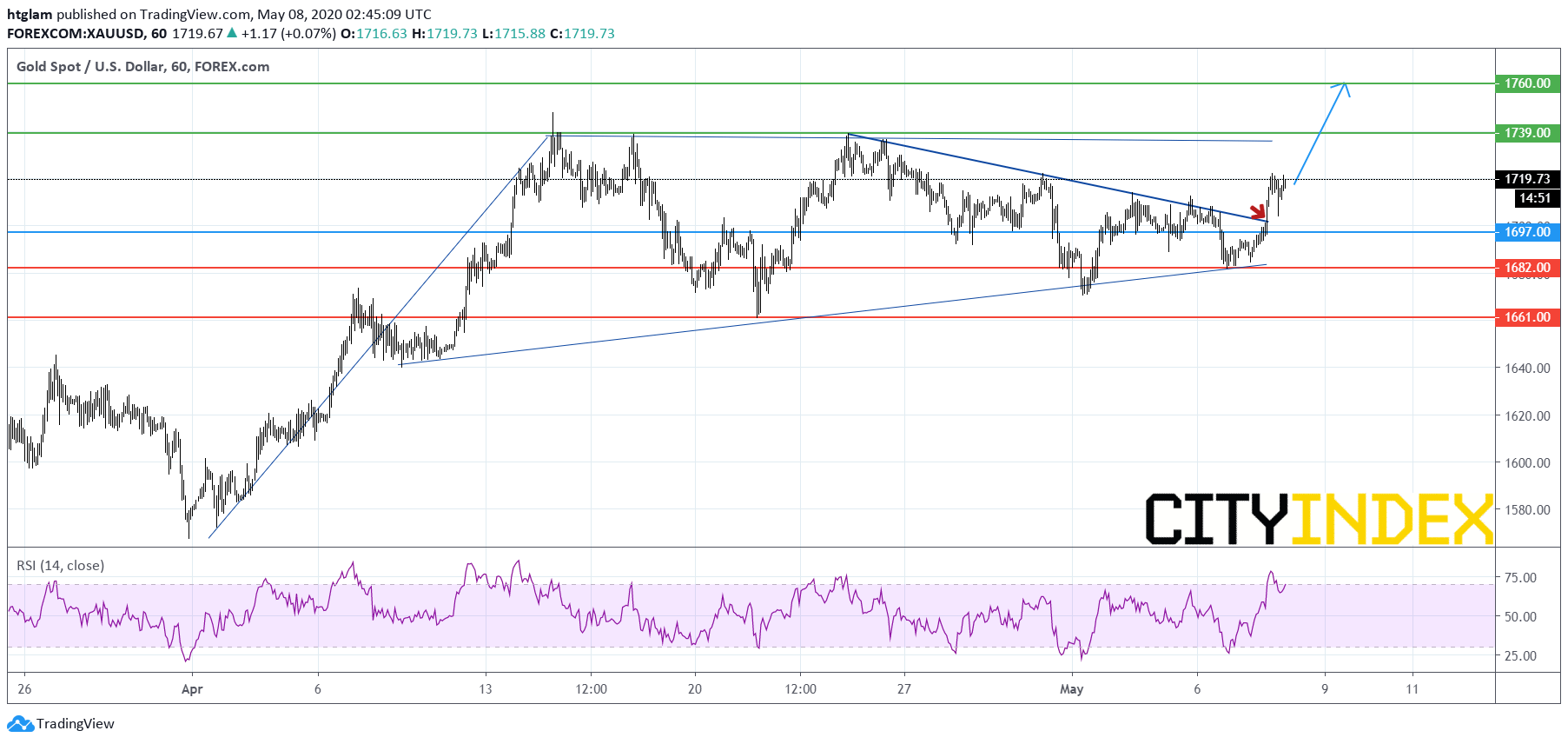

From a technical point of view, spot gold is showing initial signs of an upside breakout as shown on the 1-hour chart. It has broken above a symmetrical triangle pattern, while trading within a bigger bullish flat pattern. Bullish investors might consider $1,697 as the nearest intraday support, and gold would need to break above its nearest resistance at $1,739 to open a path to the next resistance at $1,760. Alternatively, losing $1,697 would suggest that it may return to $1,682 and $1,661 on the downside.

Source: TradingView, Gain Capital