Gold Intraday: More Upside Potential

On Monday, AstraZeneca, Pfizer and BioNTech released promising phase 1/2 Covid-19 vaccine trial results and are progressing to larger trials. On the other hand, it is reported that U.S. Senate Majority Leader Mitch McConnell and House Minority Leader Kevin McCarthy met with President Donald Trump to discuss the Republican's proposed stimulus bill, which is expected to be released this week.

Spot gold gained 0.4% to $1,817.7, the highest level since September 2011. Despite the fact that vaccine's development should be negative to gold, commodity prices were lifted by expansionary fiscal policy, as spot silver jumped 3.0% to $19.90.

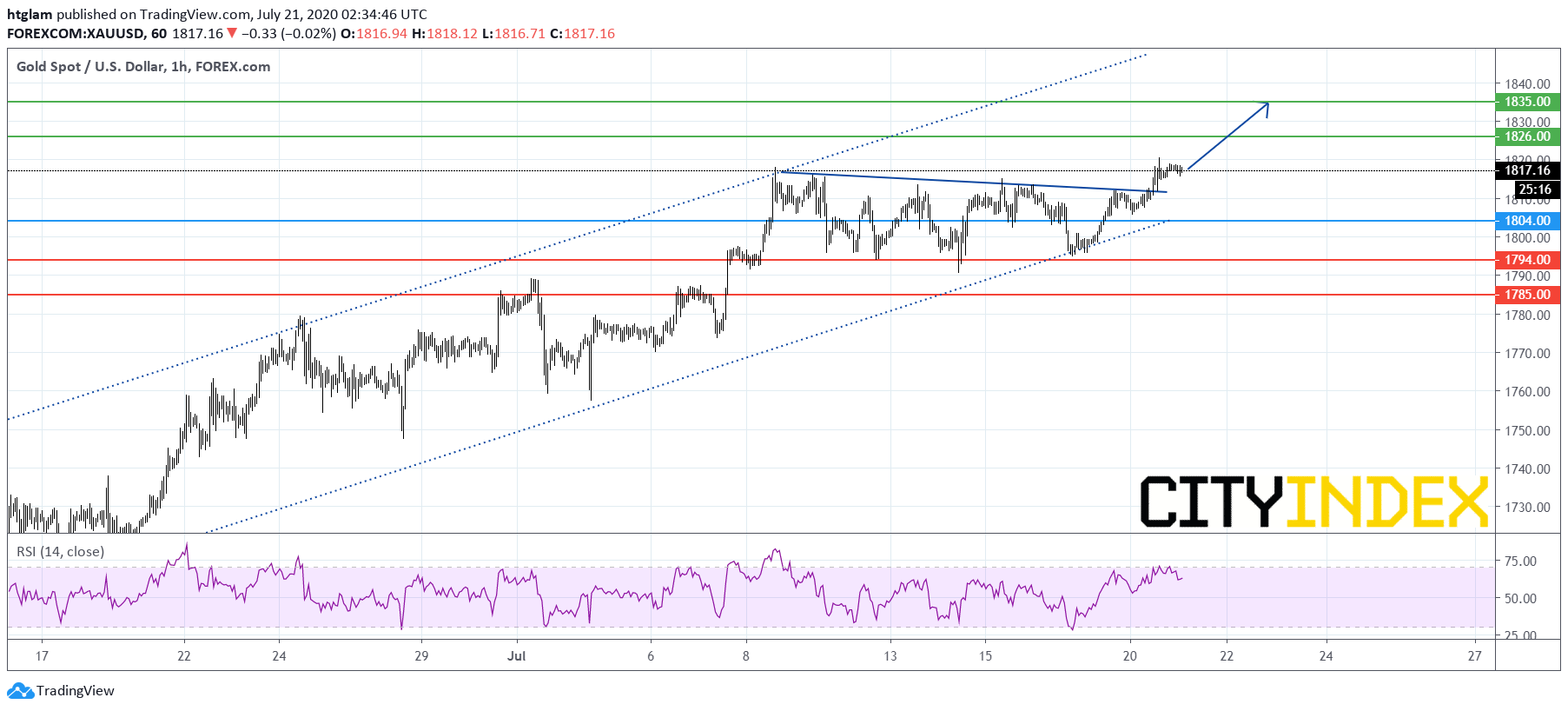

From a technical point of view, spot gold is gaining traction as shown on the 1-hour chart. Currently, it remains trading within a bullish channel drawn from mid-June and has broken above its recent consolidation range. Bullish investors might consider $1,804 as the nearest intraday support level, with prices trending test the next resistances at $1,826 and $1,835. Alternatively, a break below $1,804 might trigger a pull-back to the next support at $1,794.