Gold Intraday: Will Trump Trigger an Upside Breakout for Gold?

Spot gold has shown resilience over the past two trading sessions, recouping most of its losses made on Tuesday, as there are growing signs of an escalation of U.S.-China political battle.

In answering a question on the phase one trade deal with China, U.S. President Donald Trump told reporters that he is "not happy with what has happened" and will make an announcement regarding new policies on China later today.

China state-run news agency, the Global Times commented that the "Hong Kong Battle" between China and the U.S. has already begun, and U.S. "sanctions are like bluffing less than half a bottle of beer".

In one of the worst case scenario, if Trump decides to terminate the phase one trade deal with China, it could be a catalyst for gold prices.

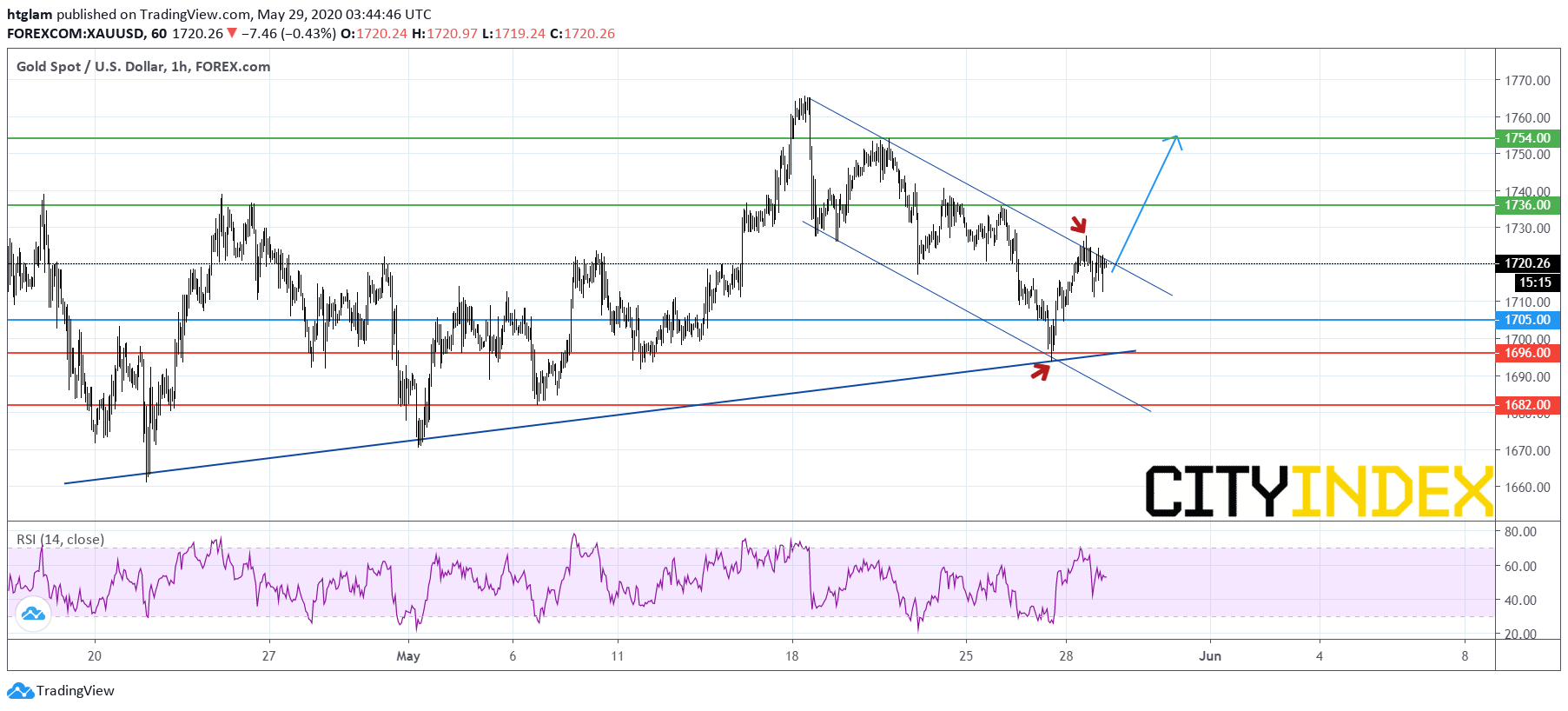

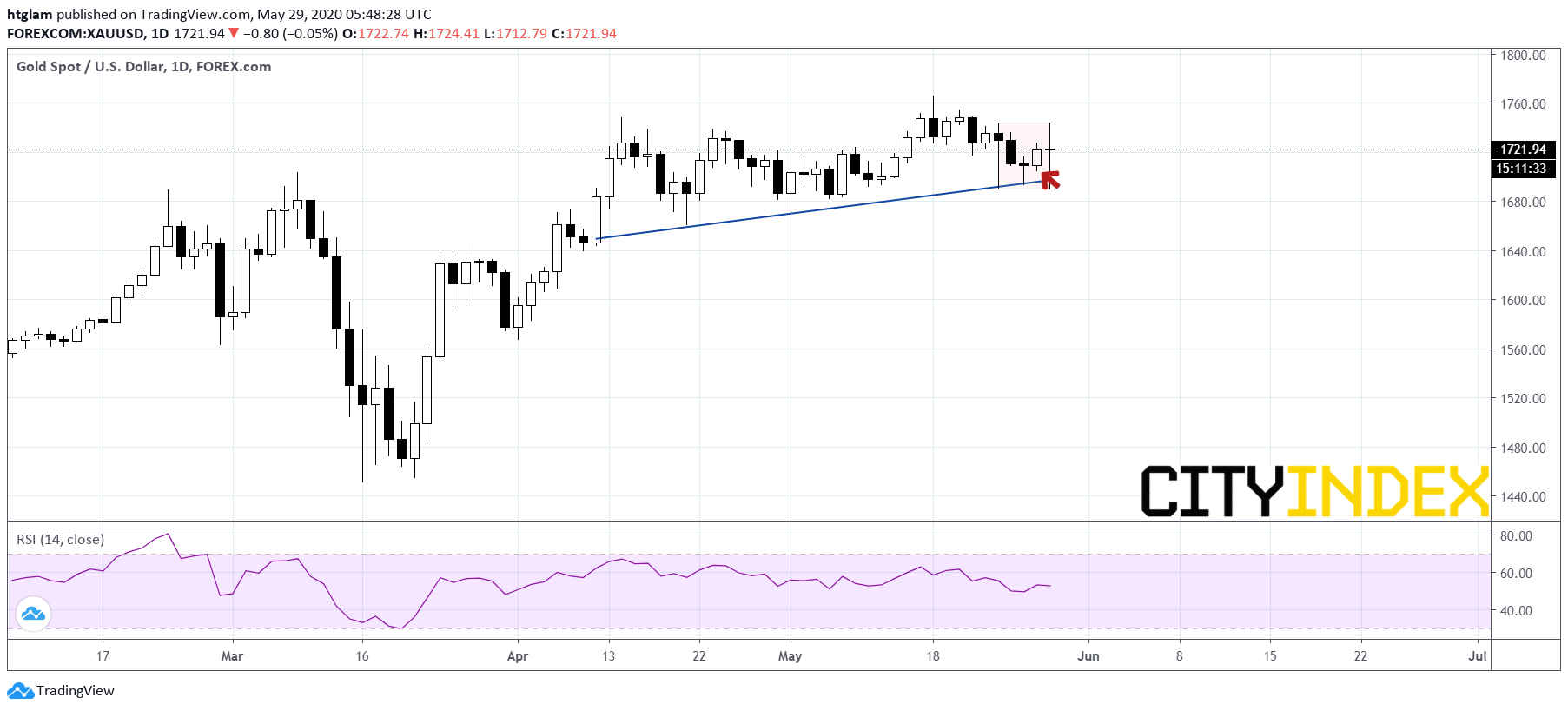

Technically, spot gold has not shown a clear upside breakout from the bearish channel drawn from May 18, as shown on the 1-hour chart. Nevertheless, a longer term rising trend line is still valid and a bullish morning star pattern has just formed on the daily-chart.

From a technical point of view, spot gold maintains a bullish bias above its nearest support at $1,705, with prices likely to test the 1st and 2nd resistance at $1,736 and $1,754. Alternatively, losing $1,705 might suggest the next support at $1,696 would be threatened.

Spot gold 1-hour chart:

Source: TradingView, Gain Capital

Spot gold daily chart:

Source: TradingView, Gain Capital