Gold Intraday: Was it a False Break?

Spot gold marked a day high near $1,765 before closing down 0.6% at $1,733 yesterday, as coronavirus vaccine hopes dampened safe-haven demand. U.S. biotech firm Moderna announced positive results for a coronavirus vaccine trial, which could be a key turning point for the current health crisis.

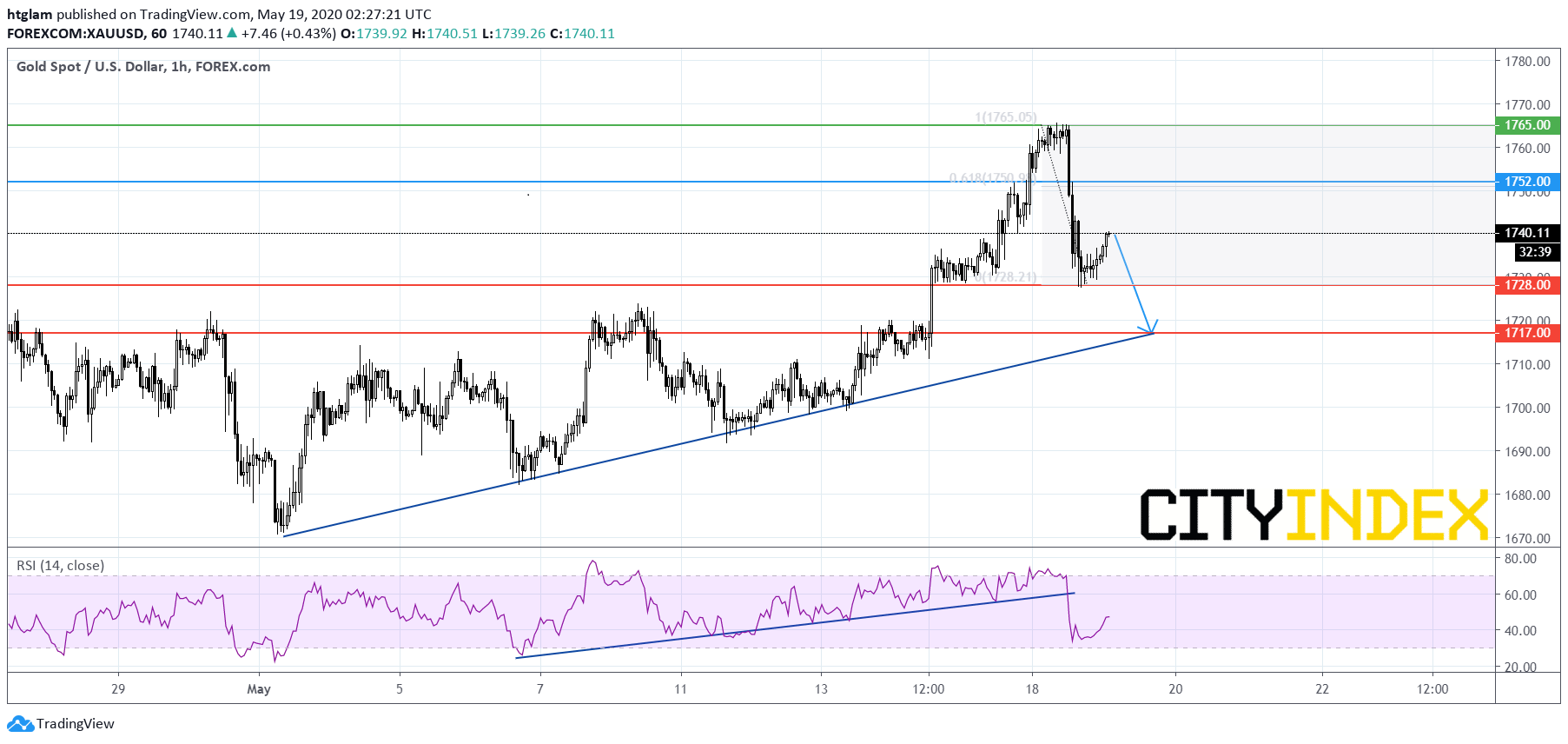

As gold price closed still below its April high, it may suggest that yesterday's upside breakout might be a false one.

From a technical point of view, intraday spot gold is under pressure as show on the 1-hour chart. It retreated sharply after breaking above its previous high. Bearish investors might consider $1,752 as the nearest intraday resistance, which is the 61.8% Fibonacci retracement of the decline. The 1st and 2nd support are likely to be located at $1,728 and $1,717 respectively. In an alternative scenario, a break above $1,752 may trigger a revisit to the previous top at $1,765.

Source: TradingView, Gain Capital