Gold Intraday: Upside Potential Likely to be Limited

Spot gold climbed 1.0% on day to $1,715 yesterday, extending its rebound for a second straight session after a surprising growth in U.S. jobs reported last Friday. We stick to our view that gold is due for a deeper price correction in the short term, as the latest jobs report suggested that economic recovery is ongoing.

The U.S. Federal Reserve will release its monetary statement later today, even though it is likely to maintain a cautious view on the economic outlook, the resilience of labour market should be acknowledged.

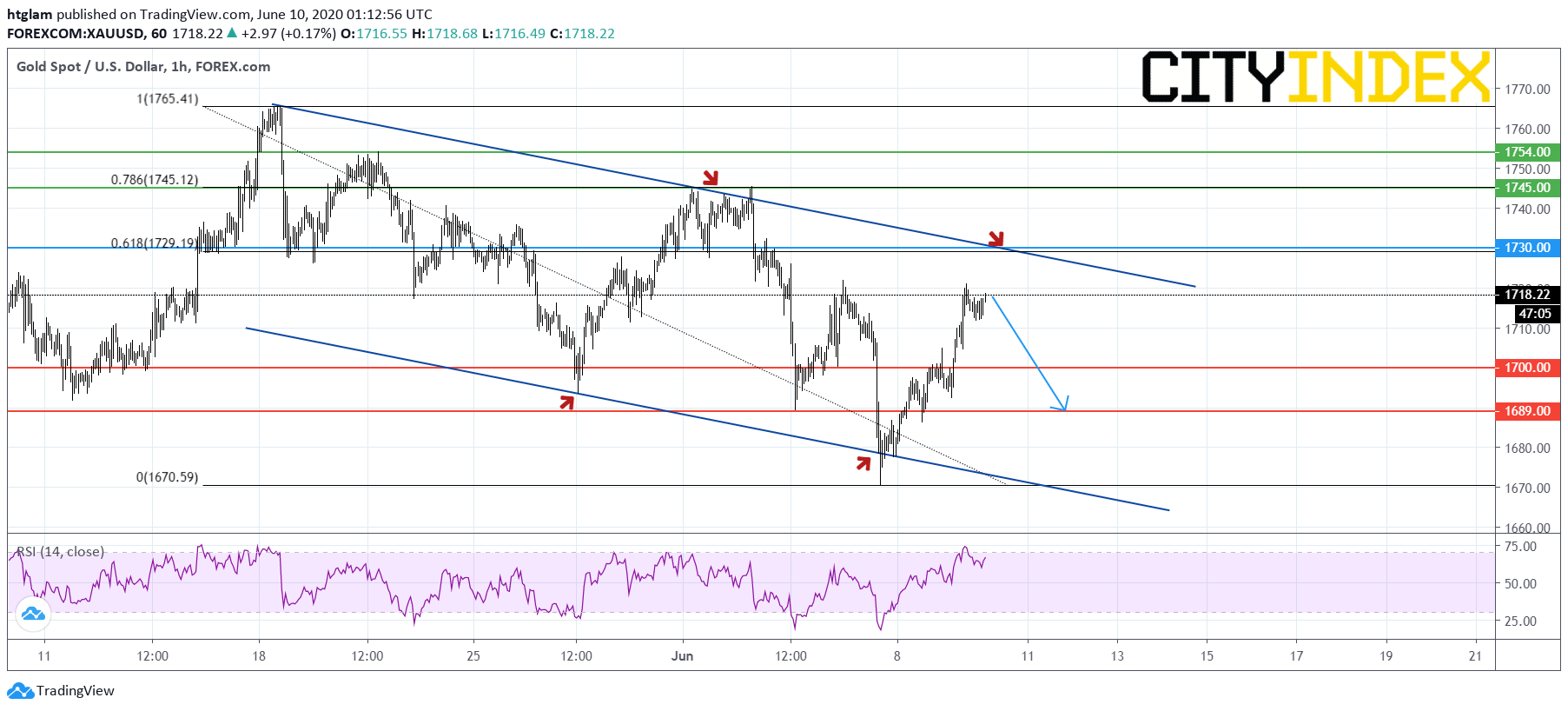

From a technical point of view, the upside potential for spot gold appears to be limited as shown on the 1-hour chart. Currently, it is trading within a bearish channel drawn from May 18, and is approaching the upper boundary of the channel. Bearish investors might consider $1,730 as the nearest resistance, which is also the 61.8% Fibonacci retracement of the recent decline. Below this level, prices are likely to retreat to test the 1st and 2nd support at $1,700 and $1,689 respectively. Alternatively, bullish investors may wait to see a clear break through from $1,730, which would trigger a further rebound to test the next resistances at $1,745 and $1,754.