Gold Intraday: Upside Break-through Awaited?

Spot gold advanced 1.2% on Friday and extended its rally to above $1,750 during Asian trading hours today. U.S. tech giant Apple announced temporarily closures of 11 stores in 4 states, after reopening a month ago, while China ordered to shut a Beijing Pepsi plant amid a new coronavirus cluster in the capital city.

Meanwhile, Goldman Sachs said it expects gold to reach $2,000 over the next 12 months, pointing out that "gold investment demand tends to grow into the early stage of the economic recovery, driven by continued debasement concerns and lower real rates".

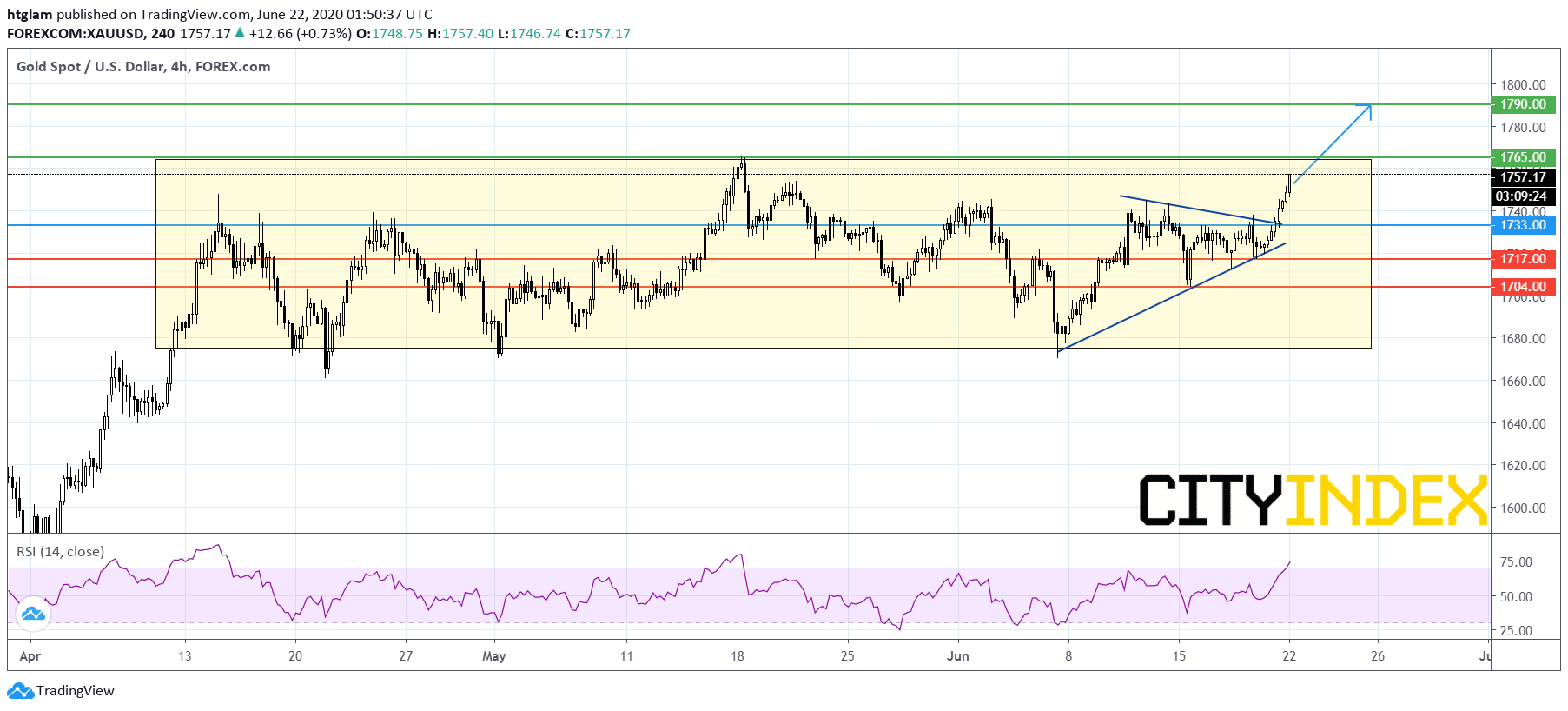

From a technical point of view, spot gold is challenging the top of its bullish consolidation range as shown on the 4-hour chart. In the shorter term, it has broken above a symmetrical triangle, while the relative strength index has climbed to the 70s. Bullish investors might consider $1,733 as the nearest intraday support, while a break above the nearest resistance at $1,765 could open a path to the next resistance at $1,790. Alternatively, losing $1,733 would suggest a loss of momentum and trigger a pull-back to the next support at $1,717.