Gold Intraday: Up Trend Threatened by Vaccine Progress

On Wednesday, U.S. pharmaceutical giant Pfizer and German biotech company BioNTech announced early positive data of its Covid-19 vaccine. Spot gold dropped as much as $30 from the day-high after the announcement and ended down 0.6%.

Pfizer said if the ongoing studies are successful and the vaccine receives regulatory approval, they "expect to manufacture up to 100 million doses by the end of 2020 and potentially more than 1.2 billion doses by the end of 2021".

Unlike the previous vaccine study results released by Moderna in May, scientists praised Pfizer for publishing the data and said the results support progressing to a larger clinical trial.

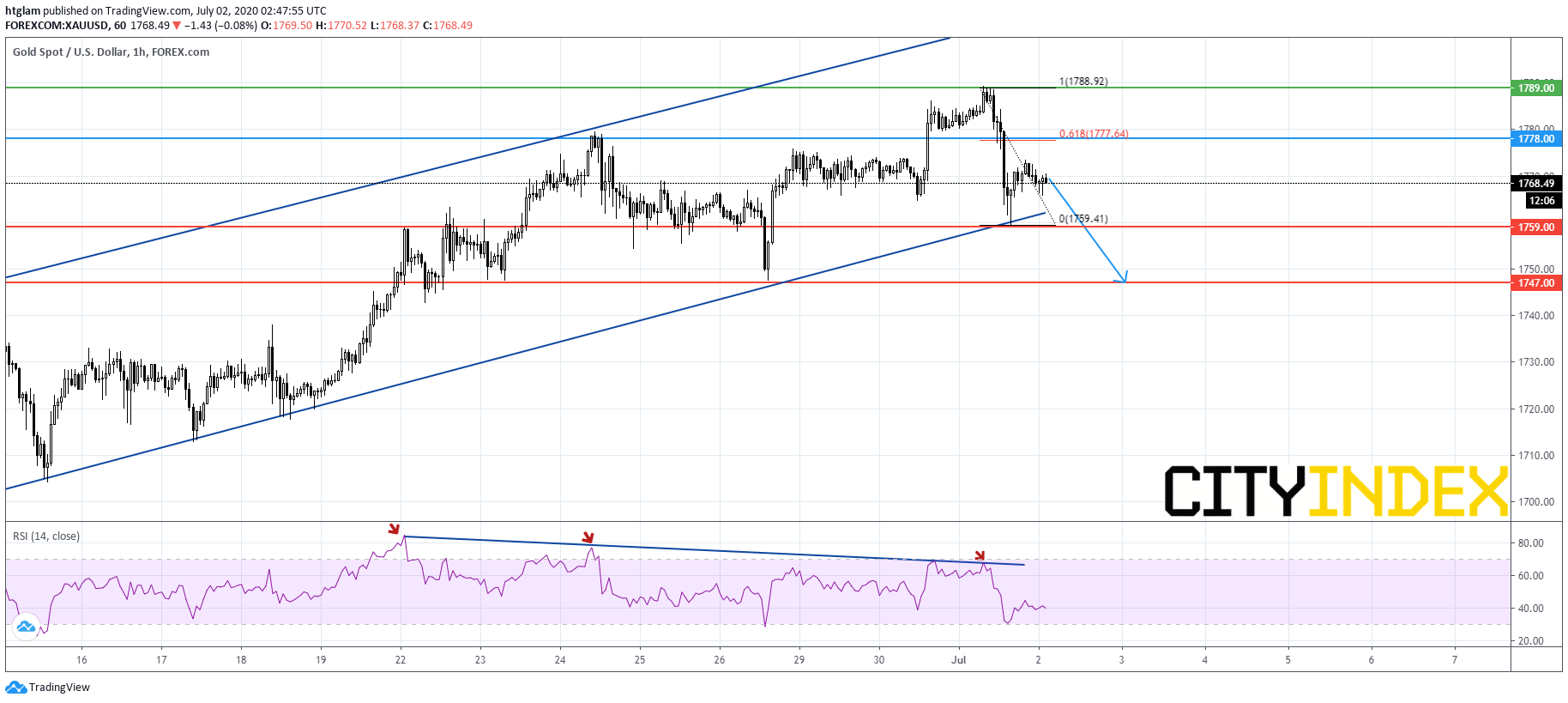

From an intraday technical point of view, spot gold risks breaking below a longer-term rising trend line as shown on the 1-hour chart. Another RSI bearish divergence is spotted when it marked a new high near $1,789. Unless the nearest resistance at $1,778 is surpassed, which is the 61.8% Fibonacci retracement resistance level of yesterday's decline, spot gold is likely to challenge the 1st and 2nd support at $1,759 and $1,747 respectively. Alternatively, a break above $1,778 might suggest that the next resistance at $1,789 would be tested again.

Source: TradingView, Gain Capital