Gold Intraday: Under Pressure Ahead of Jobless Claims

Spot gold briefly traded below $1,700, the first time since May 13, before closing down 0.1% near $1,709 yesterday.

U.S. Secretary of State Mike Pompeo said he "reported to Congress that Hong Kong is no longer autonomous from China", after the decision by China to impose a new national-security law on Hong Kong. The Chinese government said it would take countermeasures against any "interference" in Hong Kong's affairs.

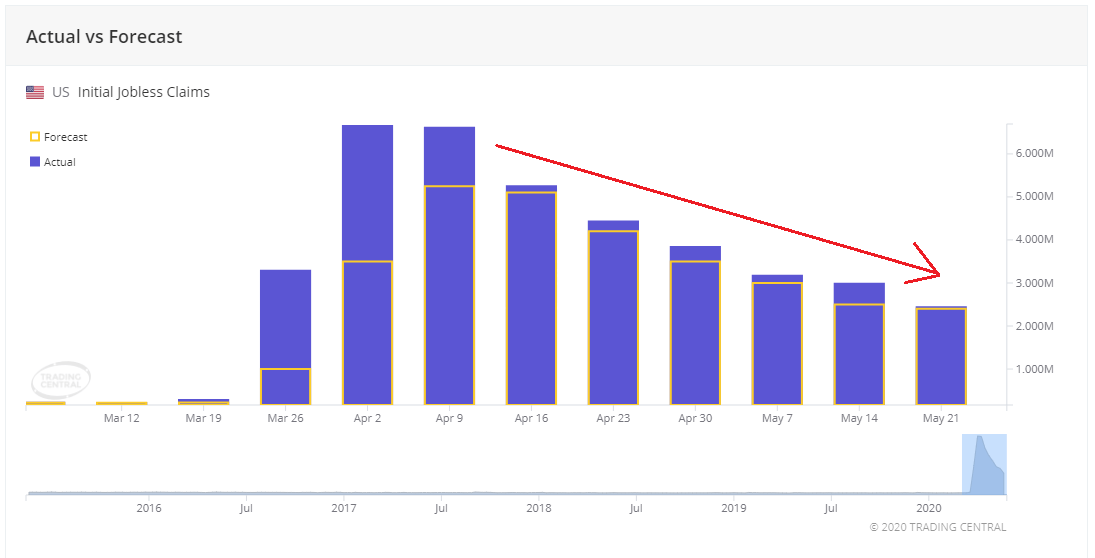

Yet, the latest twists and turns of U.S.-China relationship has not sparked gold prices, and a lack of more powerful triggering events might continue to put pressure on the precious metal. Later today, investors expect U.S. jobless claims to ease further to 2.1 million in the week ended May 23, which would mark a seventh consecutive week of decline.

Source: Trading Central

Nevertheless, U.S. President Donald Trump promised a "very interesting" response to China before weekend. Whether his plan will be powerful enough to boost gold prices remains to be seen.

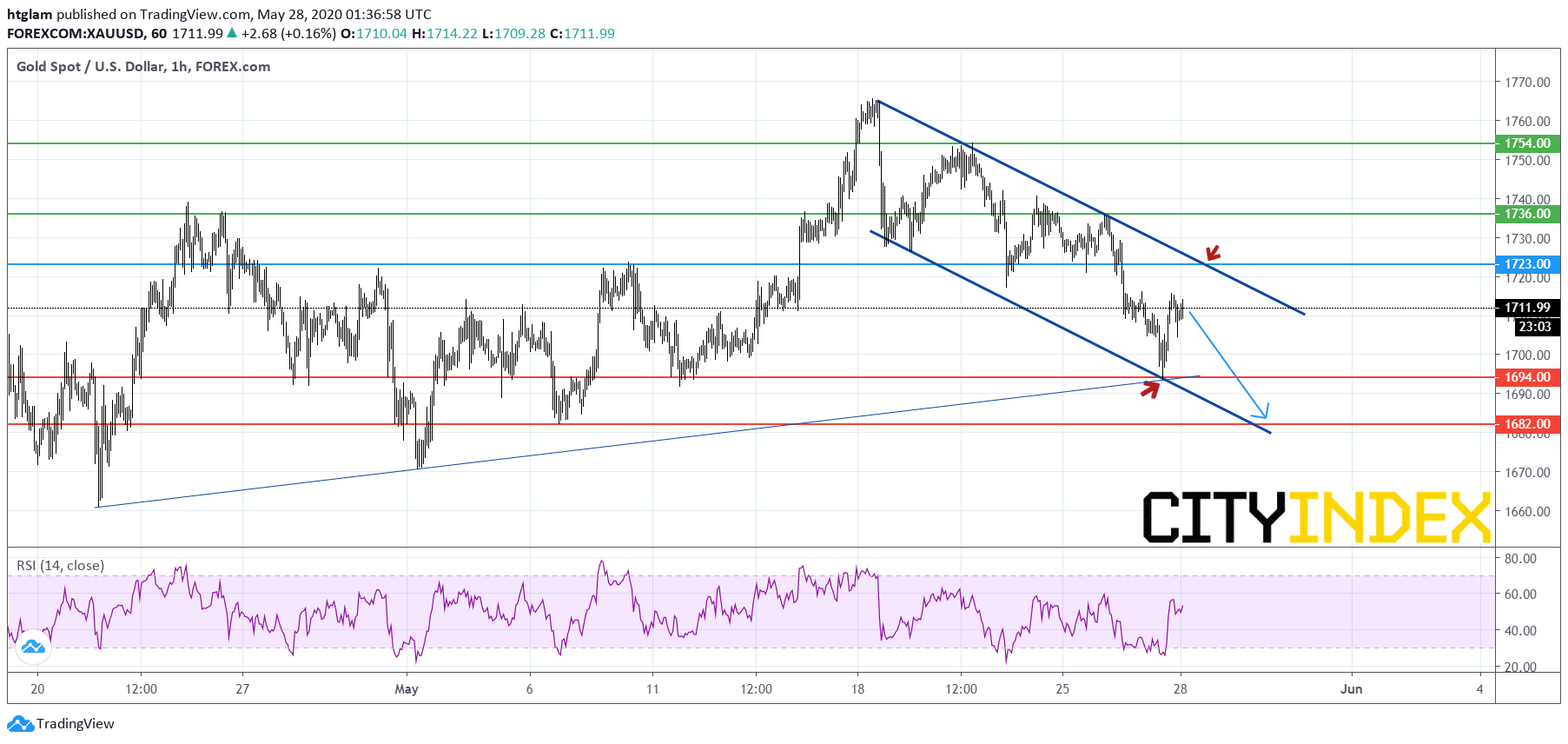

From a technical point of view, spot gold continues to edge lower as shown on the 1-hour chart as we expected yesterday. Despite a modest rebound, it has not surpassed the upper boundary of a bearish channel drawn from May 18 and is still trading at levels below last week's low. Bearish investors may consider $1,723 as the nearest intraday resistance, while a break below the 1st support at $1,694 may trigger a downside acceleration to the next support at $1,682. Alternatively, bullish investors might have to wait for a solid upside break-through $1,723 to confirm an upturn, which could open a path to $1,736 and $1,754 on the upside.