Gold Intraday: The Day After NFP

Last Friday, the U.S. nonfarm payrolls showed that the economy shed 20.50 million jobs in April and jobless rate jumped to 14.7%, though these figures were better than dismal expectations. Spot gold was down 0.8%, while the three major U.S. indices rallied nearly 2.0%.

Nevertheless, investors and policy makers are still cautious that whether the worst is yet to come. Before we see a more prolonged improvement in data, gold price is likely to be supported by high level of uncertainty and loose monetary policy.

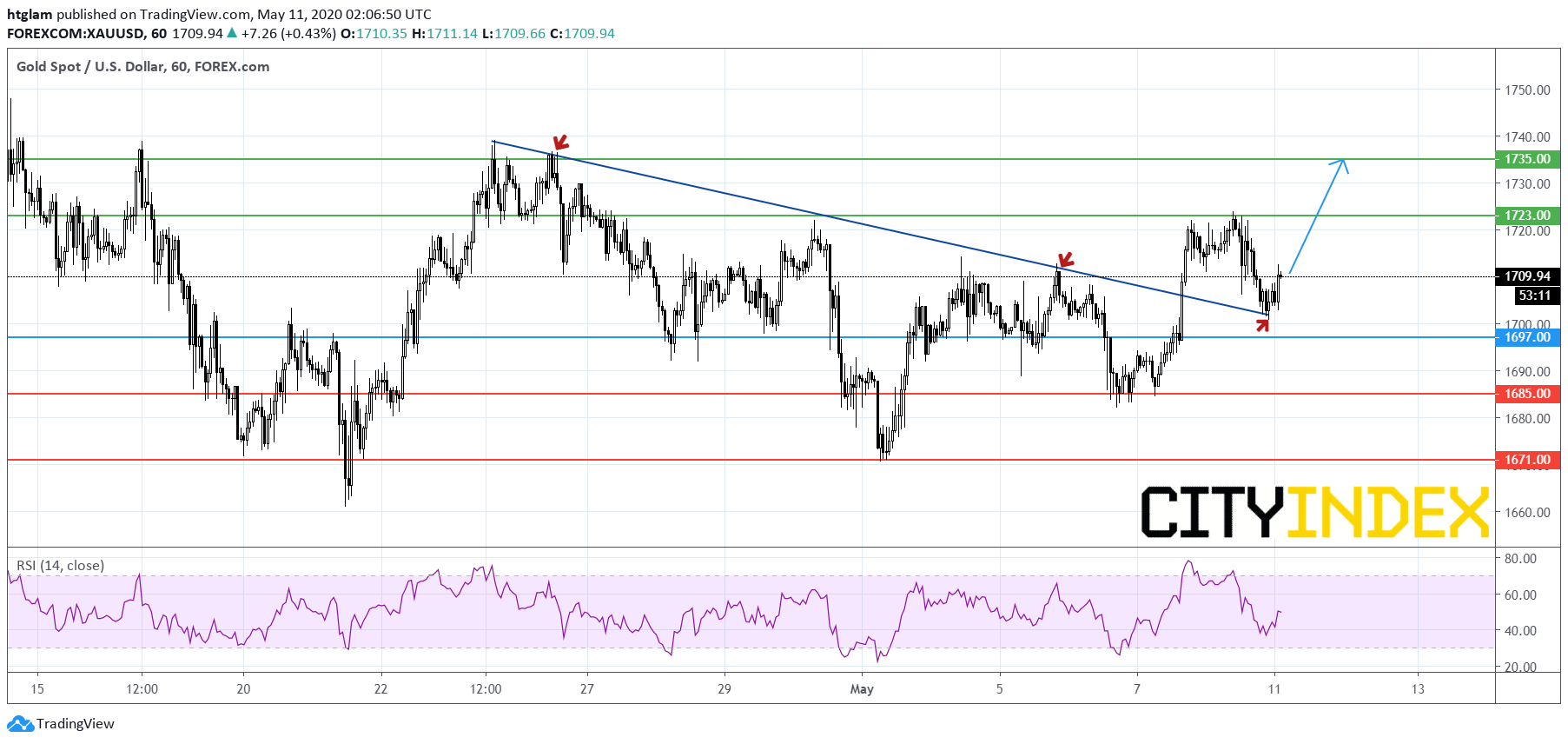

From a technical point of view, spot gold remains on the upside despite a modest pull-back as shown on the 1-hour chart. It has rebounded after retreating to a previously broken bearish trend line, which may now act as a support. Bullish investors might consider $1,697 as the nearest intraday support, with gold likely to test its resistance at $1,723 and $1,735 in extension. In an alternative scenario, losing $1,697 would suggest that gold may retreat further to the next support at $1,685.

Source: TradingView, Gain Capital