Gold Intraday: Steady Up Trend

On Friday, spot gold marked a day-high near $1,811 before closing 0.3% lower at $1,799. Investors were caught between the latest development in coronavirus treatment and uncertainty over U.S.-China relationship.

U.S. biopharmaceutical giant Gilead Sciences released additional data on remdesivir, an investigational antiviral for the treatment of COVID-19, which showed an improvement in clinical recovery and a 62 percent reduction in the risk of mortality compared with standard of care.

Meanwhile, U.S. President Donald Trump said he is not considering a phase two trade deal and "the relationship with China has been severely damaged".

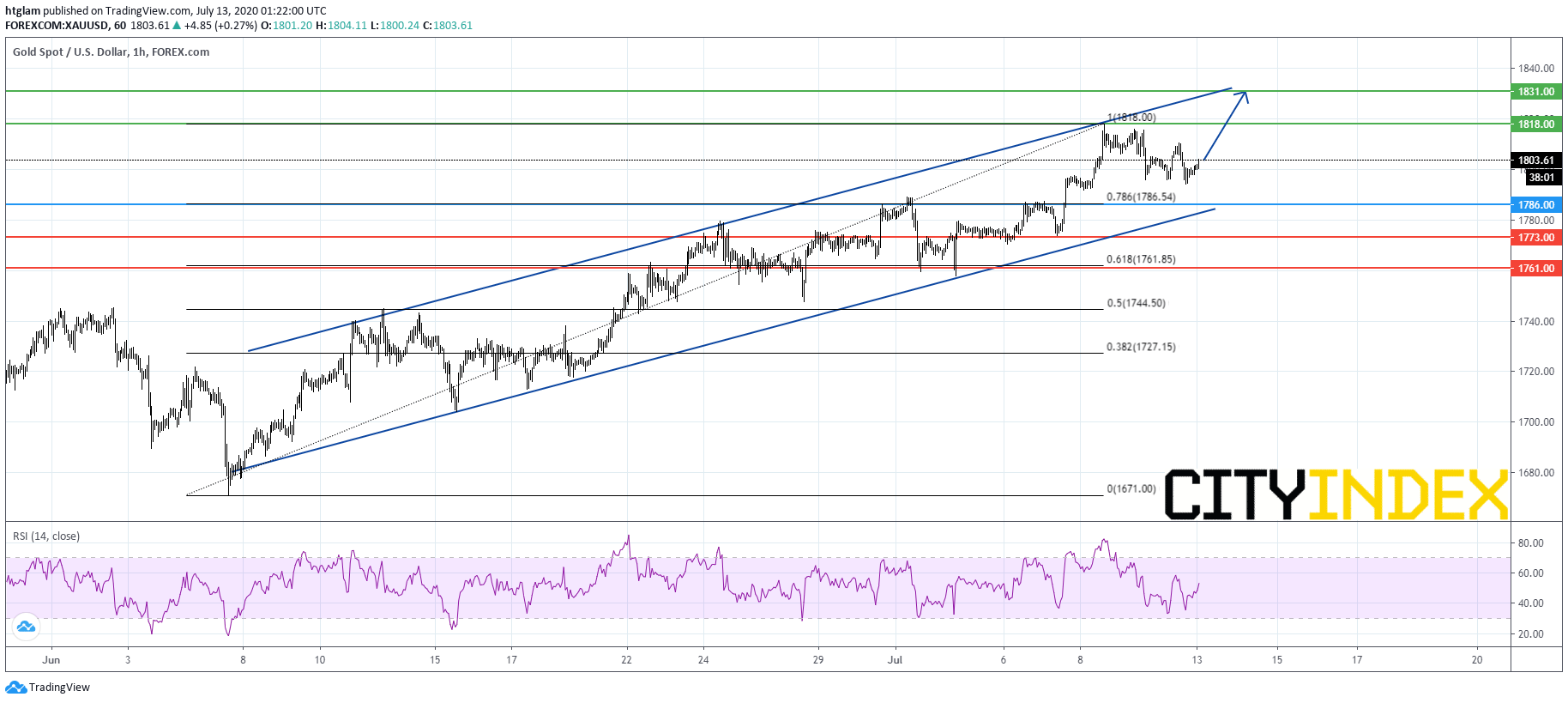

From a technical point of view, spot gold maintains a steady up trend as shown on the 1-hour chart. It is currently trading at the middle of a bullish channel drawn from July 5. The level at $1,786 might be consider as the nearest support, which is located close to the lower boundary of the channel and the 78.6% Fibonacci retracement support of the rally from July 5, while a break above the nearest resistance at $1,818 would open a path to the next resistance at $1,831.

In an alternative scenario, losing $1,786 would suggest that the next support at $1,773 is exposed.