Gold Intraday: Signs of Losing Steam

The Wall Street Journal reported that U.S. President Donald Trump will consult his advisers on policy options for the next economic stimulus plan. On the other hand, the German government is considering a fresh 100 billion euros aid package, according to Bloomberg.

Meanwhile, Chinese economic activity showed a strong recovery, with the Caixin China Services PMI bouncing to 55.0 in May, much higher than 47.3 expected, from 44.4 in April. The report said "the rate of expansion was the steepest recorded since October 2010".

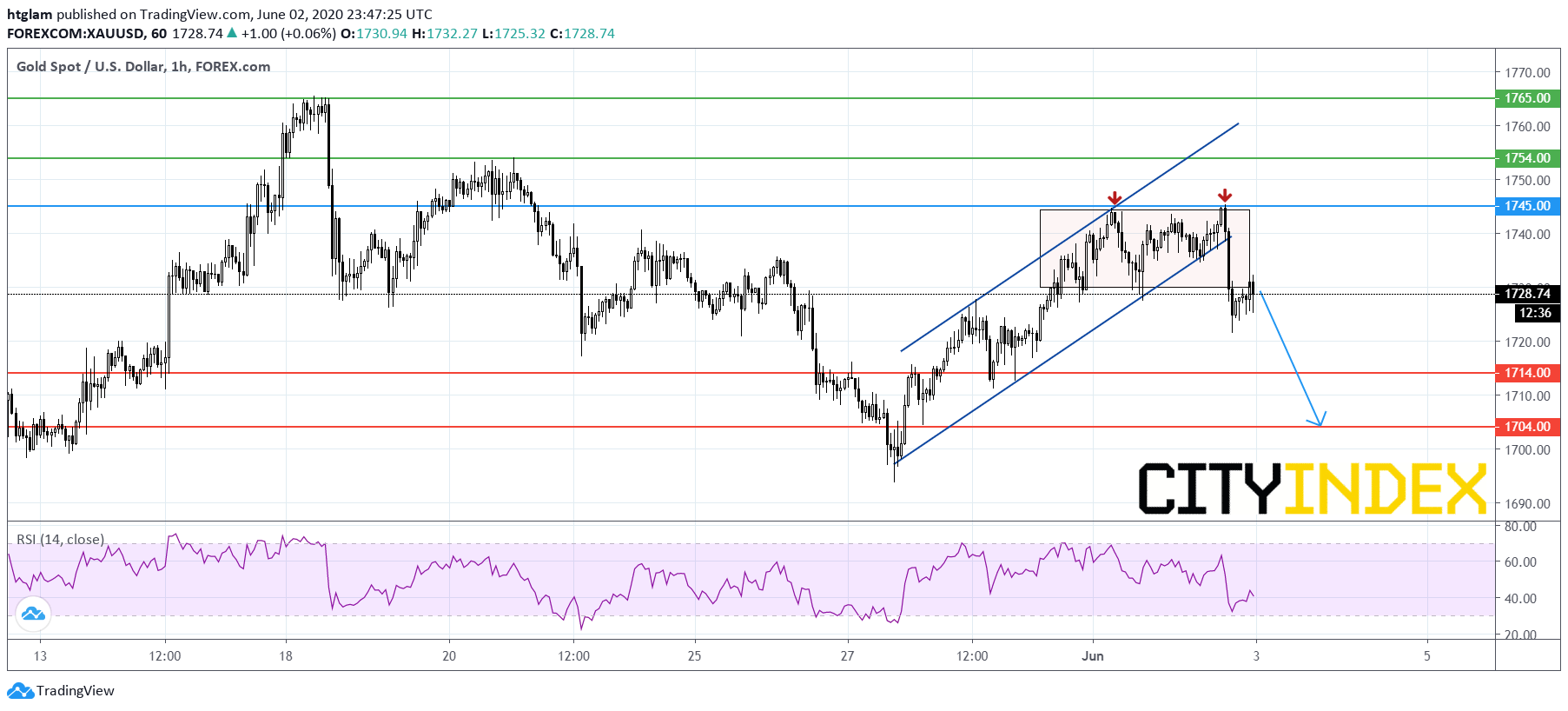

From a technical point of view, spot gold stays on the downside as it has broken below its previous consolidation range as shown on the 1-hour chart. In fact, it has potentially formed a double-top pattern, and has broken below a bullish channel drawn from May 27. Bearish investors may consider $1,745 as the nearest resistance level, with prices likely to test the 1st and 2nd support at $1,714 and $1,704 respectively. Alternatively, a break above $1,745 would open a path to the next resistance at $1,754.

Source: TradingView, Gain Capital