Gold Intraday: Safe-Haven Demand Fades on Easing Coronavirus Cases

Spot gold lost 0.9% on day to $1,714 on Monday and dipped further to $1,704 during Asian trading hours today. According to Johns Hopkins University, U.S. confirmed coronavirus cases rose 2.3% yesterday, the smallest increase in April, while U.K. and Italy also showed slower pace of spread. Global central banks have introduced a series of rate-cuts and quantitative easings during the crisis, and passing the coronavirus peak would imply that ultra-loose monetary policies maybe about to end. Will this mark a downturn for gold price remains to be seen, the intraday outlook for the precious metal does not look decent.

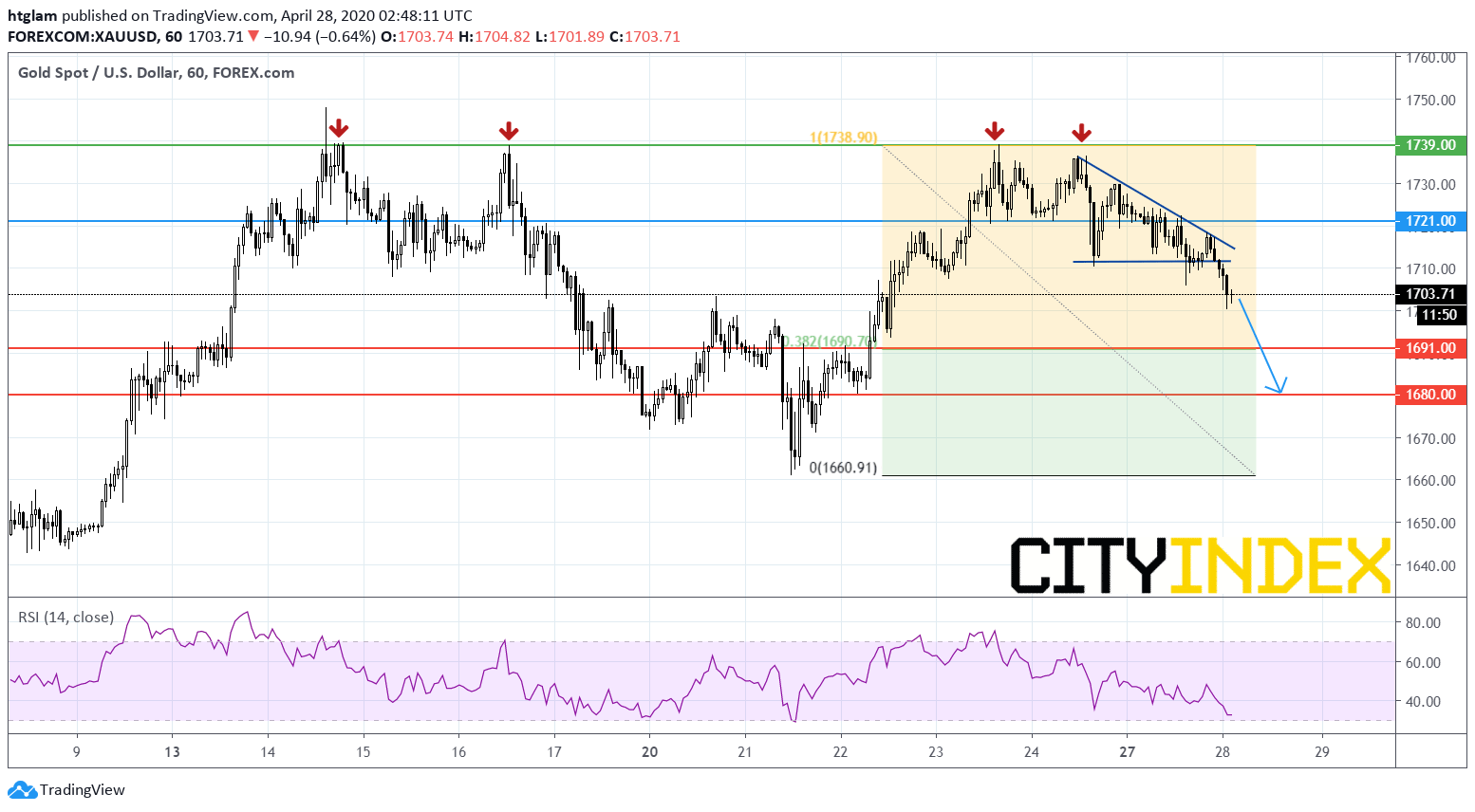

From a technical point of view, spot gold is under pressure as shown on the 1-hour chart. It has retreated after another failed attempt to break through its previous high, and has now broken below a bearish descending triangle pattern. The level at $1,721 may be considered as the nearest resistance, with price likely to head towards $1,691 (38.2% Fibonacci retracement of the rally started in April 21) and $1,680 in extension. In an alternative scenario, a break above $1,721 might suggest that it would test $1,739 again.

Source: TradingView, GAIN Capital