Gold Intraday Outlook (Apr 22): Seesaw Battle

Gold, widely considered as a safe haven asset, failed to shine yesterday on the back of sharp declines in U.S. equity markets. Some investors would argue that the continued weakness in oil prices will drag stocks market lower, some would say ultra-low fuel would raise doubts about the inflation outlook, where gold could also be seen as an inflation hedge. The see-saw battle between the bears and the bulls continues.

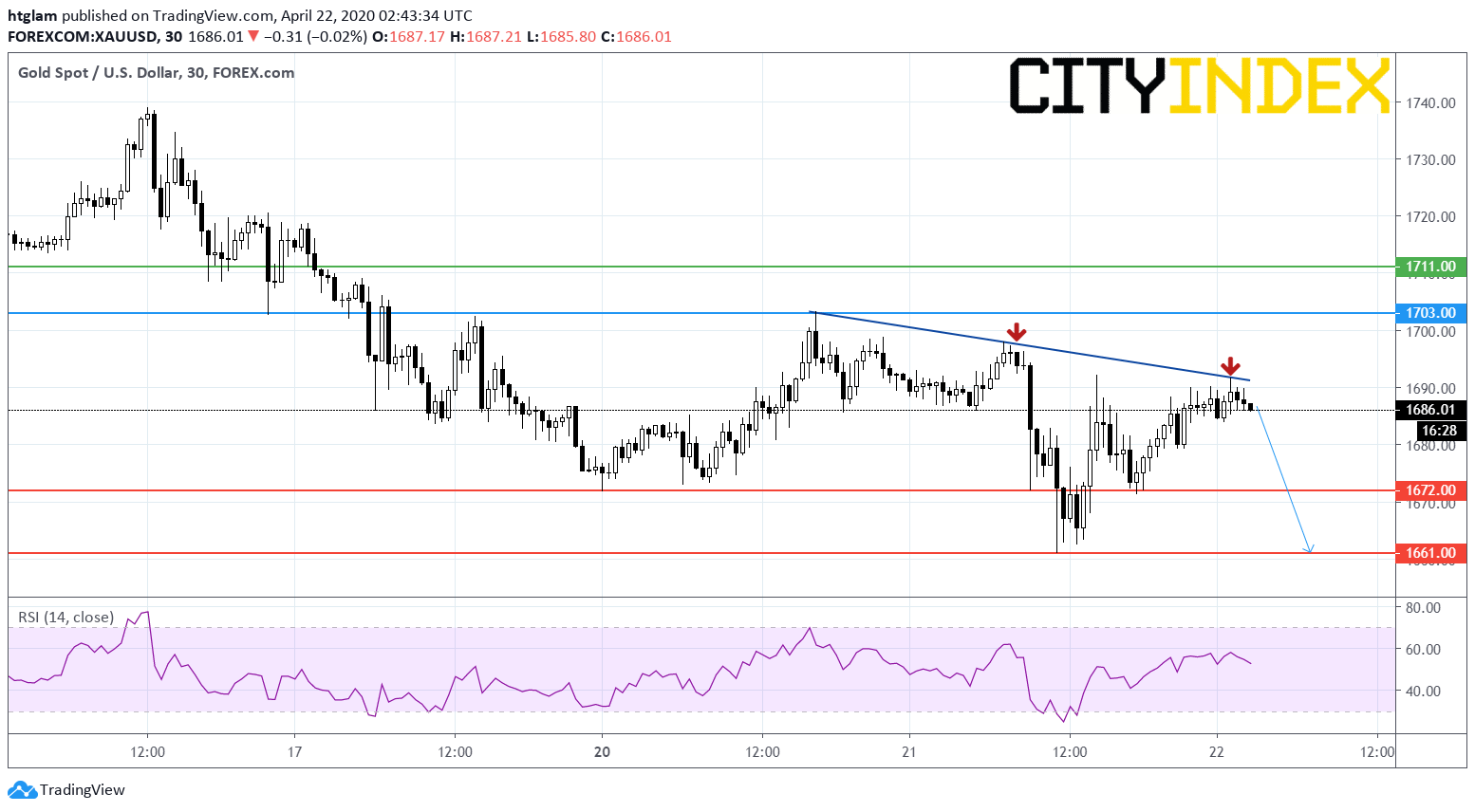

Nevertheless, from a technical point of view, the intraday outlook for gold is skewed to the downside as shown on the 30-minute chart. While it is broadly trading within a consolidation range after a recent decline, lower-highs seems to be formed. Therefore, the top of the range at $1,703 may be considered as the nearest resistance, and the first and second support are likely to be located at $1,672 and $1,661 respectively. In an alternative scenario, a break above might open a path to $1,711 on the upside.

Source : Trading View, GAIN Capital