Gold Intraday: Narrowing Range

Yesterday, the three major U.S. stock indices ended up more than 1%, lifted by the banking and financial sectors, while spot gold edged up 0.2%.

The Federal Reserve released the results of its stress tests, stating: "The banking system has been a source of strength during this crisis, and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks."

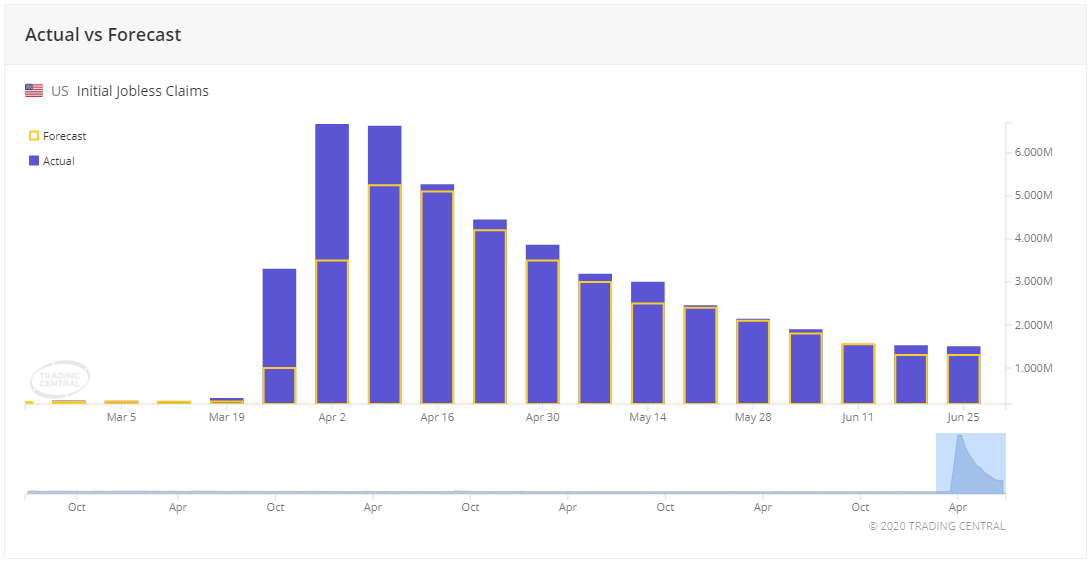

Source: Trading Economics, Trading Central

The latest U.S. initial jobless calms data was rather neutral to gold prices. The number fell slightly to 1.48 million in the week ended June 20 from 1.54 million in the prior week, but more than 1.32 million estimated. It was the second consecutive week of missing expectations, suggesting that the pace of recovery has been somewhat slowed down.

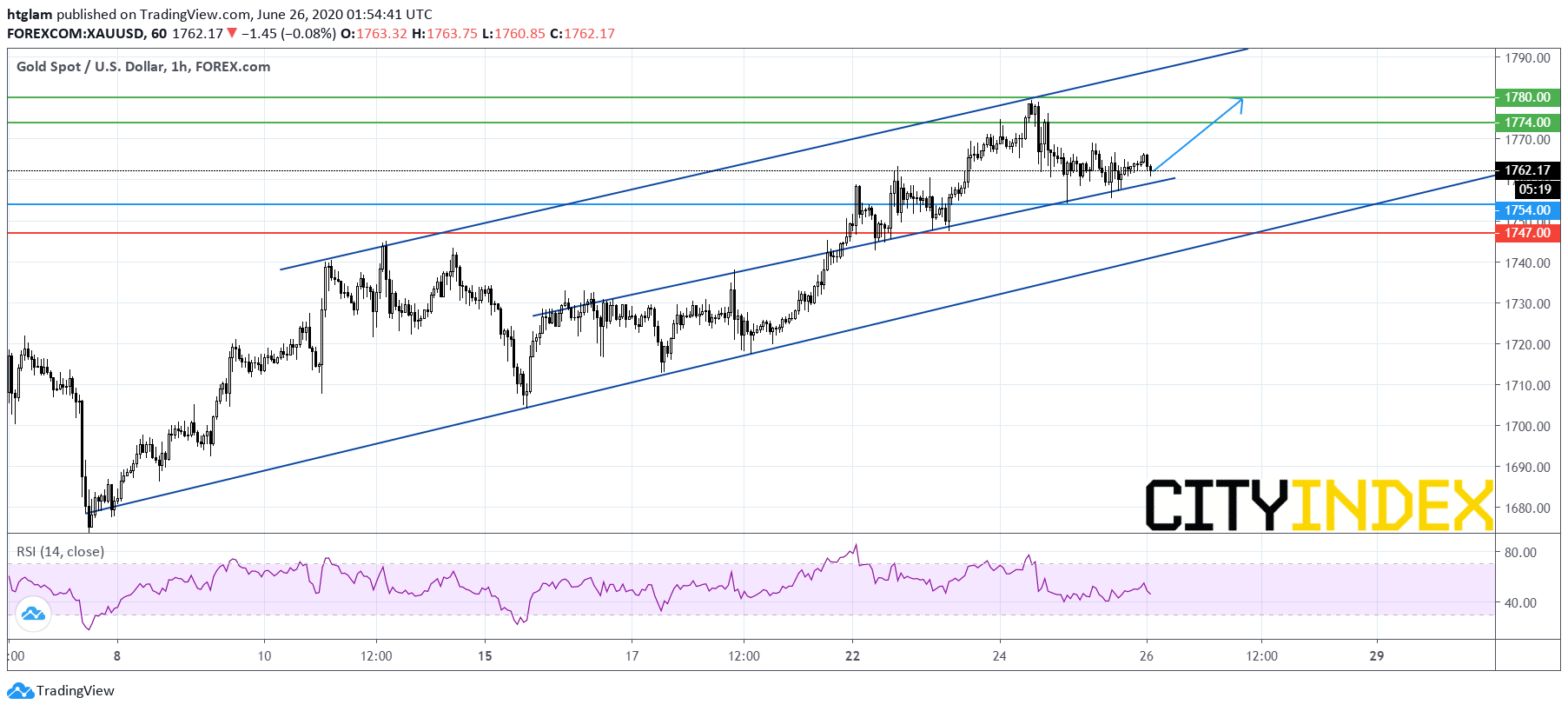

From an intraday point of view, the trading range of spot gold is narrowing as shown on the 1-hour chart. Nevertheless, it remains trading within a bullish channel, and in the shorter term, it is still supported by a rising trend line drawn from June 22. The level at $1,754 might be considered as the nearest intraday support, with the 1st and 2nd resistance likely to be located at $1,774 and $1,780. Alternatively, a break below $1,754 might trigger a pull-back to $1,747.