Gold Intraday: Gathering More Upside Momentum

On Tuesday, spot gold advanced 0.6% to an 8-year high of $1,794.8. The impacts of vaccine progress last week on gold prices proven to be short-lived, and investors are turning their focus on the resurgence of coronavirus cases.

Federal Reserve Bank of Atlanta President Raphael Bostic said the coronavirus impacts might go on longer than they had expected, and they need to be mindful of a lack of confidence among consumers and businesses. On the other hand, Fed Vice Chairman Richard Clarida said there is more that the Fed can do if necessary.

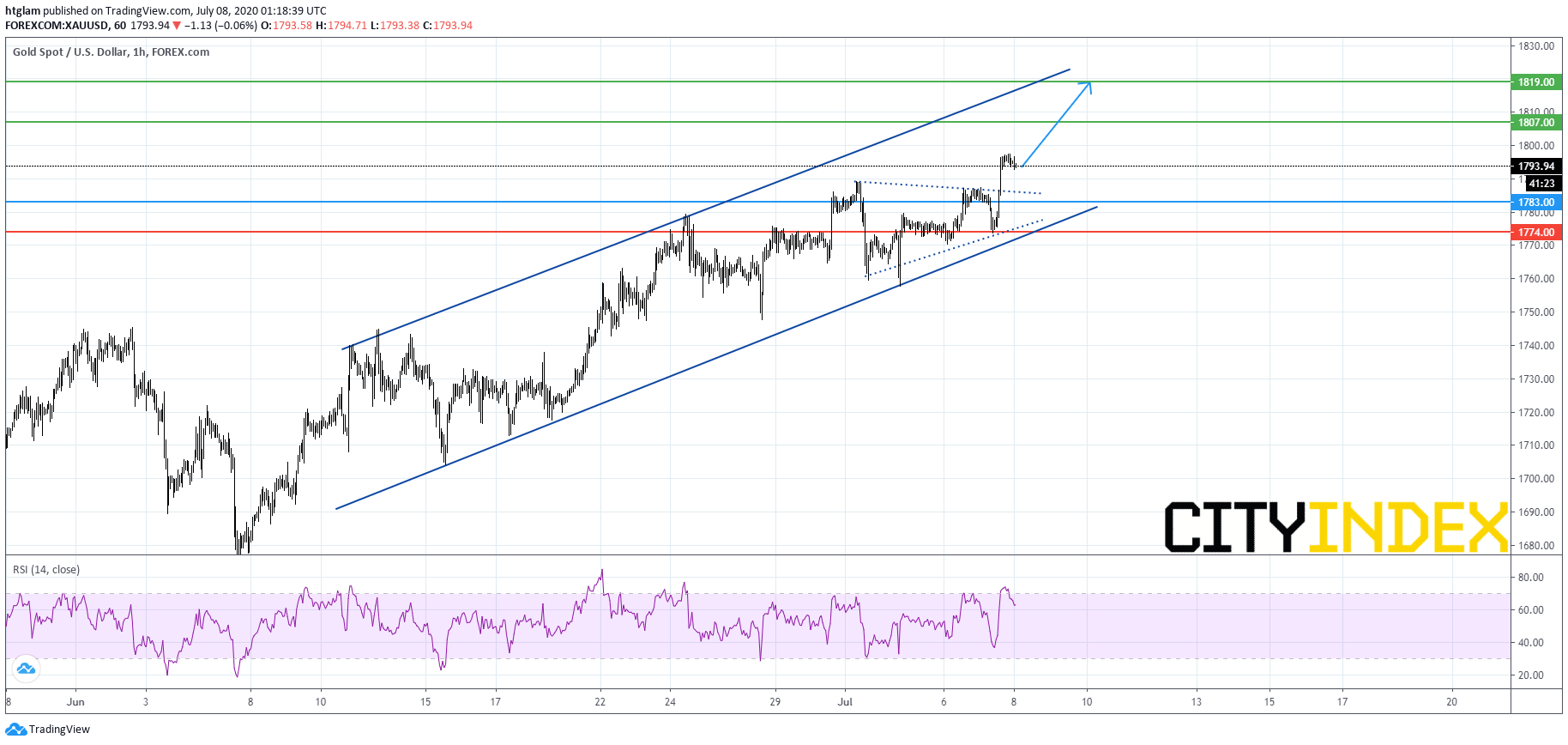

From an intraday point of view, spot gold is gathering more upside momentum as shown on the 1-hour chart. It stays on the upside after breaking above a symmetrical triangle, while the longer-term bullish channel is still intact. Bullish investors might consider $1,783 as the nearest support, with prices likely to test the 1st and 2nd resistance at $1,807 and $1,819 respectively. Alternatively, a break below $1,783 might trigger a pull-back to the next support at $1,774.