Gold Intraday: Drifting Sideways

Yesterday, spot gold marked a day-low near $1,704 before bouncing back to $1,725, still down 0.3% on day. The three major U.S. equity indices were quickly recouping their early losses and ended higher. Investors were initially fearful of a second wave of coronavirus, but sentiment was lifted by the Federal Reserve's announcement that it will start buying individual U.S. corporate bonds.

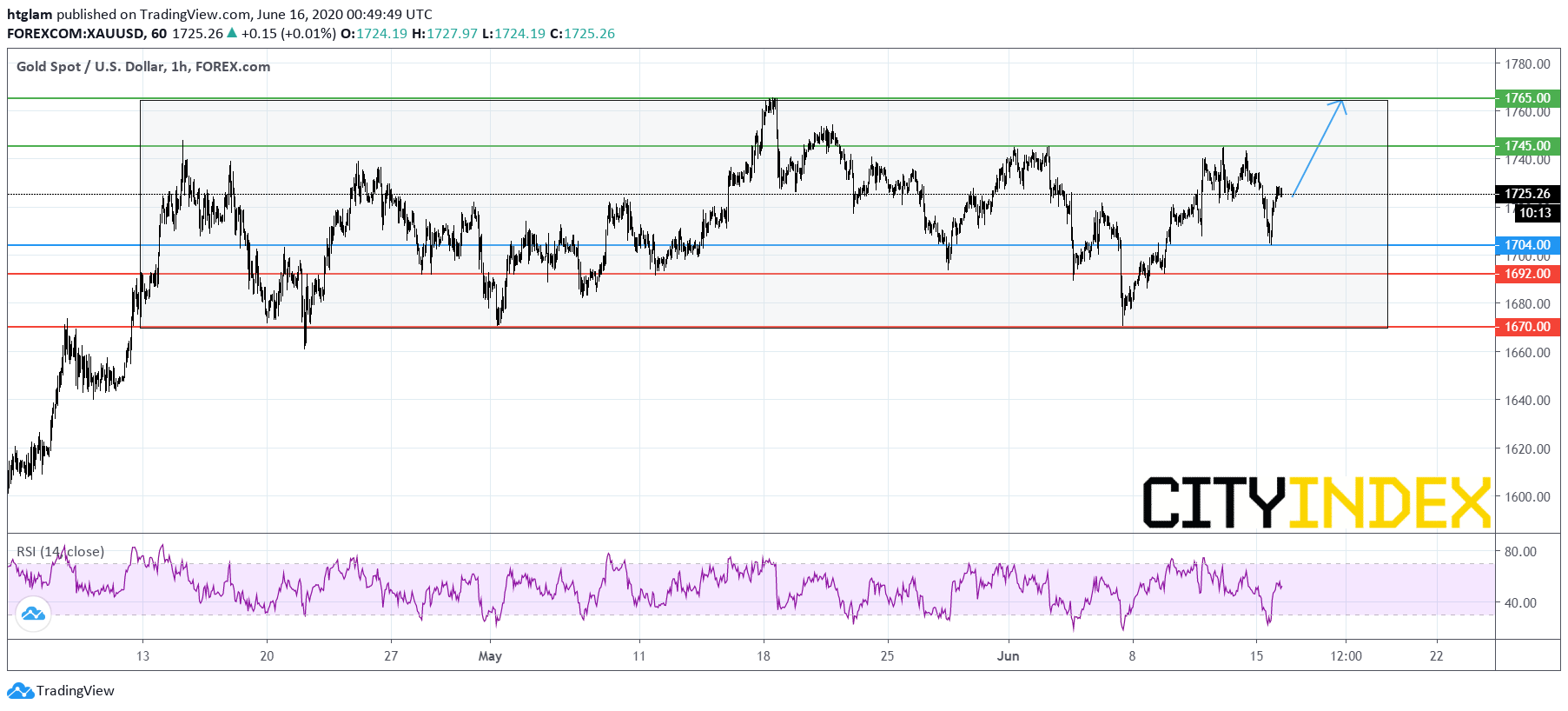

While the views on economic outlook are mixed, gold price may continue to drift sideways.

From a technical point of view, spot gold is trading well within its consolidation range as shown the 1-hour chart. Nevertheless, in the shorter term, it may have formed a higher-low yesterday, following a rebound from the day-low of June 5 at $1,670. The level at $1,704 may be considered as the nearest support, with prices trending to test its 1st and 2nd resistance at $1,745 and $1,765 respectively. Alternatively, a break below $1,704 might open a path to the next supports at $1,692 and $1,670.