Gold Intraday: Downtrend Intact

Despite heightened tensions between the U.S. and China, the three major U.S. stock indices pared early losses to close with modest gains last Friday. Spot gold climbed 0.4% on day but still below its April-high, raising doubts over a false upside breakout seen last week.

Today, the U.S. equity markets are closed to observe the Memorial Day and the U.K. markets are closed for the Spring Bank Holiday. While a relatively quiet trading session may be expected, a lack of more powerful triggering events might continue to put pressure on gold.

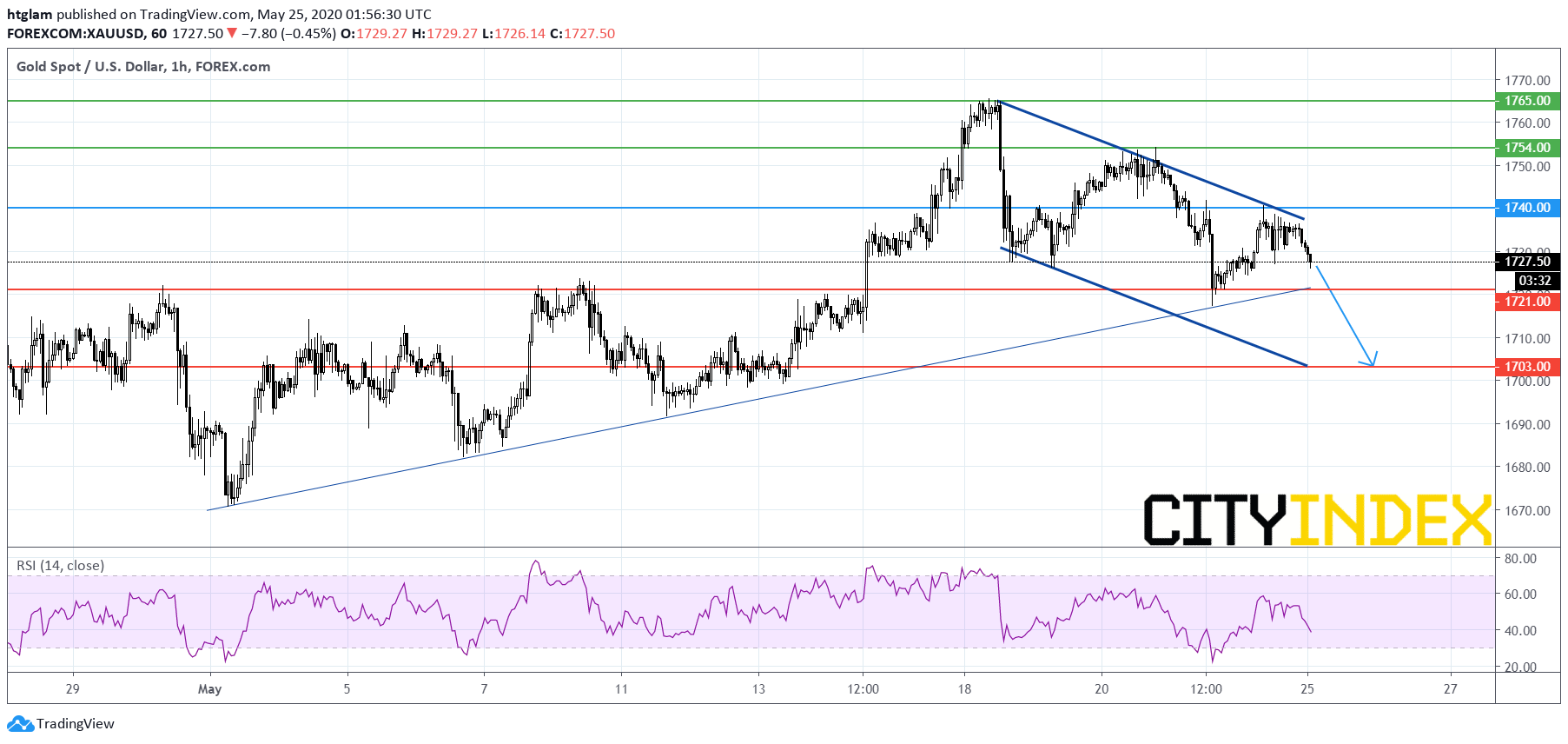

From a technical point of view, spot gold remains on the downside as shown on the 1-hour chart. It has created another lower-high and is heading downward to test its previous low. The level at $1,740 may be considered as the nearest resistance, while a break below the nearest support at $1,721 (where a longer-term rising trend line is located) would be a more bearish signal, and possibly suggesting that the next support at $1,703 is exposed. Alternatively, a break above $1,740 would trigger a re-test to the previous high at $1,754.