Gold Intraday: Continuous Sideways

On Thursday, spot gold failed to maintain its recent rebound, ending 0.8% lower to $1,944. However, U.S. equity market was dragged lower by tech stocks, as Nasdaq 100 dropped 1.5%, wiping out the gains made earlier this week.

It is reported that the Trump administration has asked U.S. gaming company Riot Games and Epic Games, owned or partly owned by Chinese tech giant Tencent, to provide information about their data-security protocols involving Tencent.

The increasing uncertainty over the U.S.-China relationship may spur safe-haven demand. During Asian trading hours today, spot gold rebounded 0.4%.

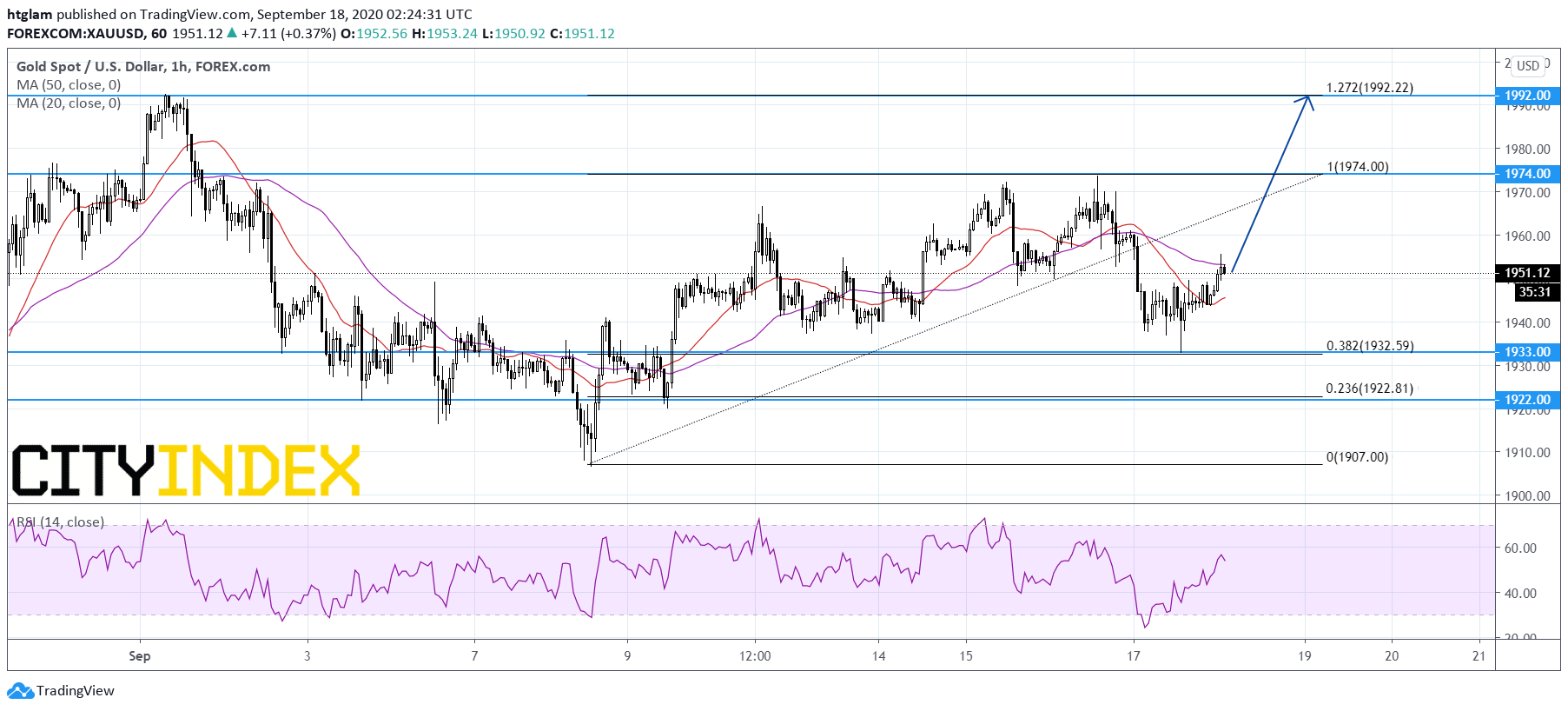

On the 1-hour chart, spot gold remains trading with its recent range despite yesterday's pull-back. In fact, it has rebounded after reaching the 38.2% Fibonacci retracement support of the rally started from September 8. The level at $1,933 may be considered as the nearest support level, while the 1st and 2nd resistance are expected to be located at $1,974 and $1,992 respectively. Alternatively, losing $1,933 would suggest that the next support at $1,922 may be exposed.