Gold Intraday: Bullish Consolidation

Spot gold ended up 0.5% yesterday, posting a three-day rebound. Despite U.S. stocks climbing higher, investors continue to see gold as a hedging option, given the uncertainty over violent protests in the U.S. and U.S.-China relationship.

Bloomberg data showed that, total known ETFs' holding of gold increased for a twenty seventh straight session, which suggested that investors' demand for the precious metal remains firm.

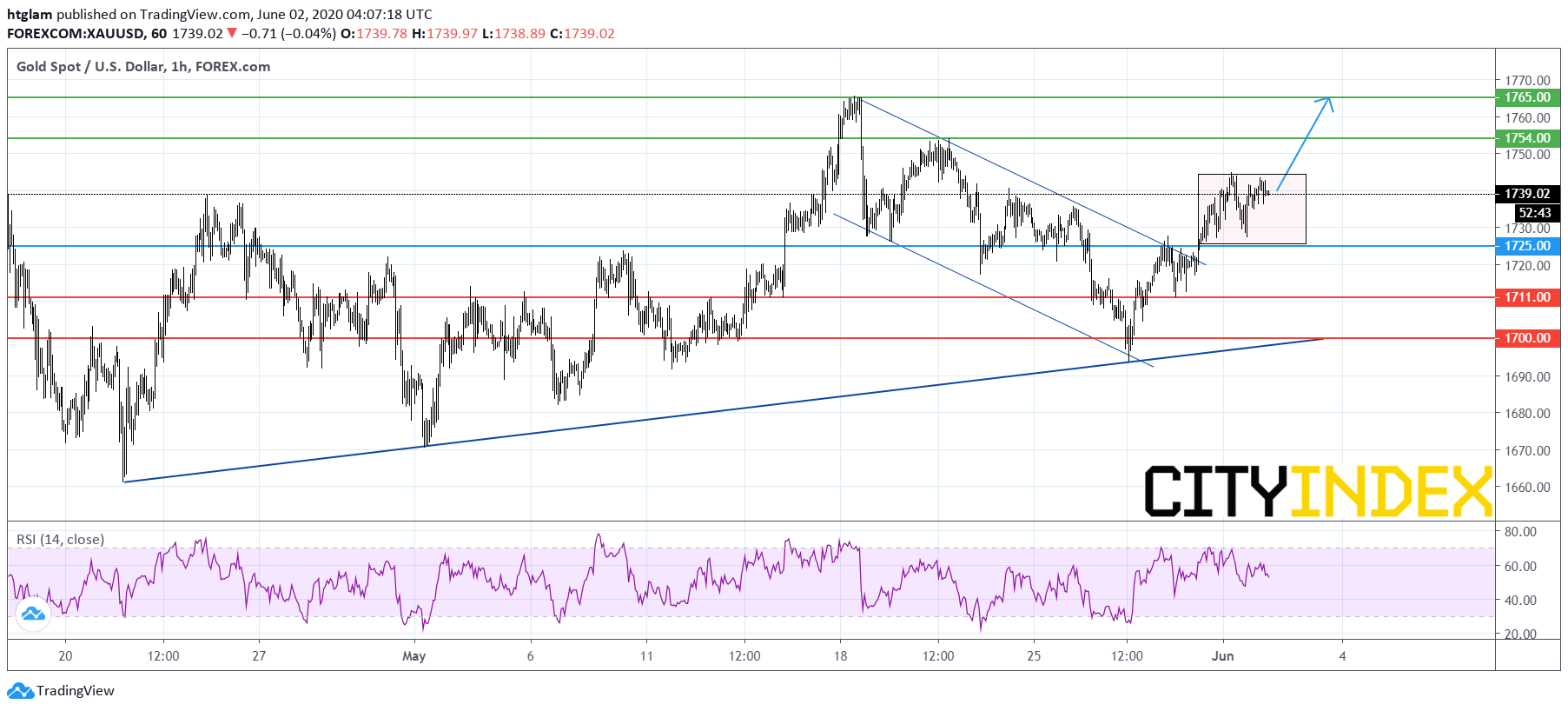

From a technical point of view, spot gold is trading within a consolidation range after a recent rebound. Bullish investors might consider $1,725 as the nearest intraday support, with prices likely to test the 1st and 2nd resistance at $1,754 and $1,765 respectively. In an alternative scenario, a break below $1,725 would indicating that gold is heading back to test the next support at $1,711.

\