Spot gold jumped 1.2% on day to $1,735 yesterday, the largest daily gains since May 7. The U.S. Federal Reserve officials' median forecast showed that Fed Funds Rate is expected to remain at current level through 2022.

Chairman Jerome Powell said they are "not even thinking about raising rates" and "are strongly committed" to using their tools. He played down the surprising growth in May nonfarm payrolls, pointed out that there will be a significant chunk, where people do not get back to their old jobs and the labour market would take time to recover.

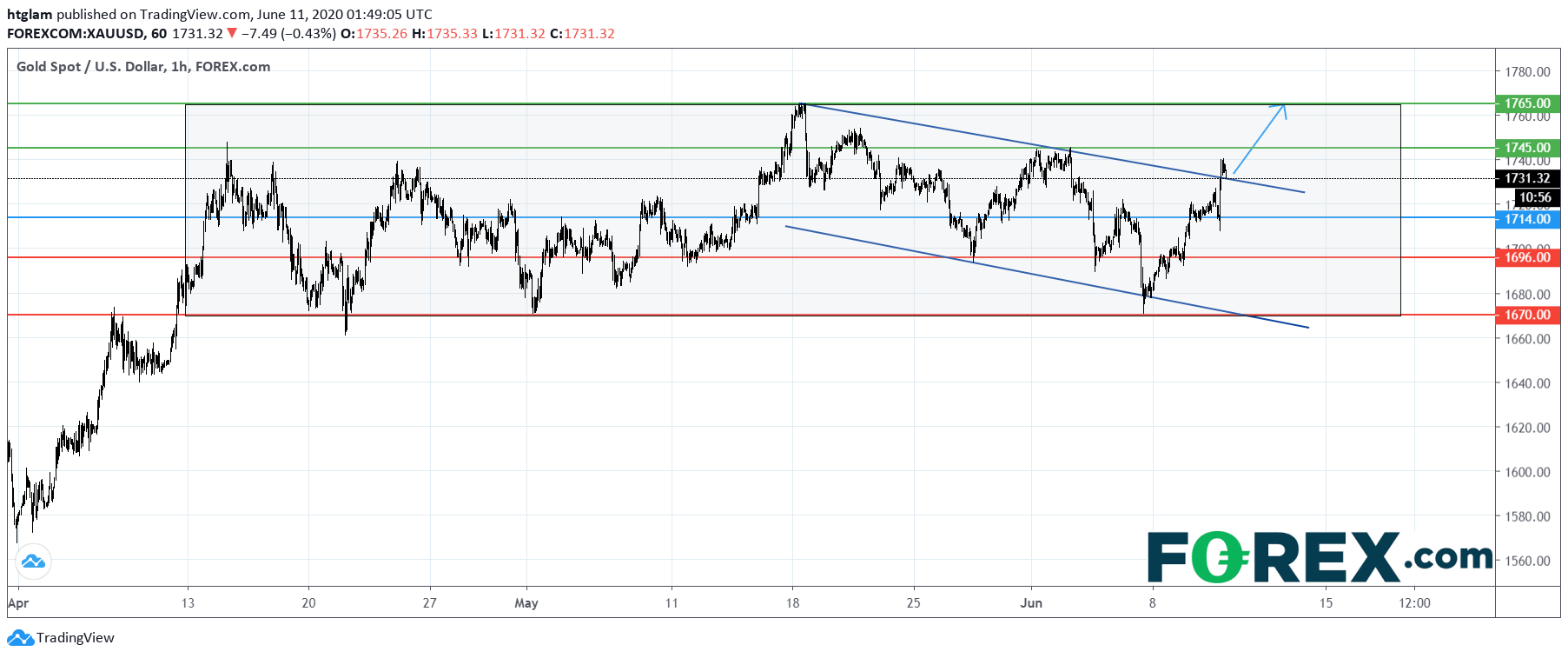

From a technical point of view, spot gold has broken above a bearish channel drawn from May 18 as shown on the 1-hour chart. The longer-term consolidation range is still valid after the recent rebound. Despite possible sideways drifts within the range, the level at $1,714 might be considered as the nearest support level (around the mid-point of the range), while the 1st and 2nd resistances are likely to be located at $1,745 and $1,765 respectively. Alternatively, a break below $1,714 may open a path to the next support at $1,696.