Gold Intraday: $1,800 is finally in sight

Spot gold advanced 0.8% yesterday, finally breaking above its consolidation range in the last two months, as coronavirus cases resurged in a number of states in the U.S..

Meanwhile, Morgan Stanley sees gold drifting higher over the next twelve months, supported by high uncertainty from COVID-19, trade tensions and negative real rates. Though it pointed out that a correction may be triggered by a fresh rate-hike cycle expectations in the future.

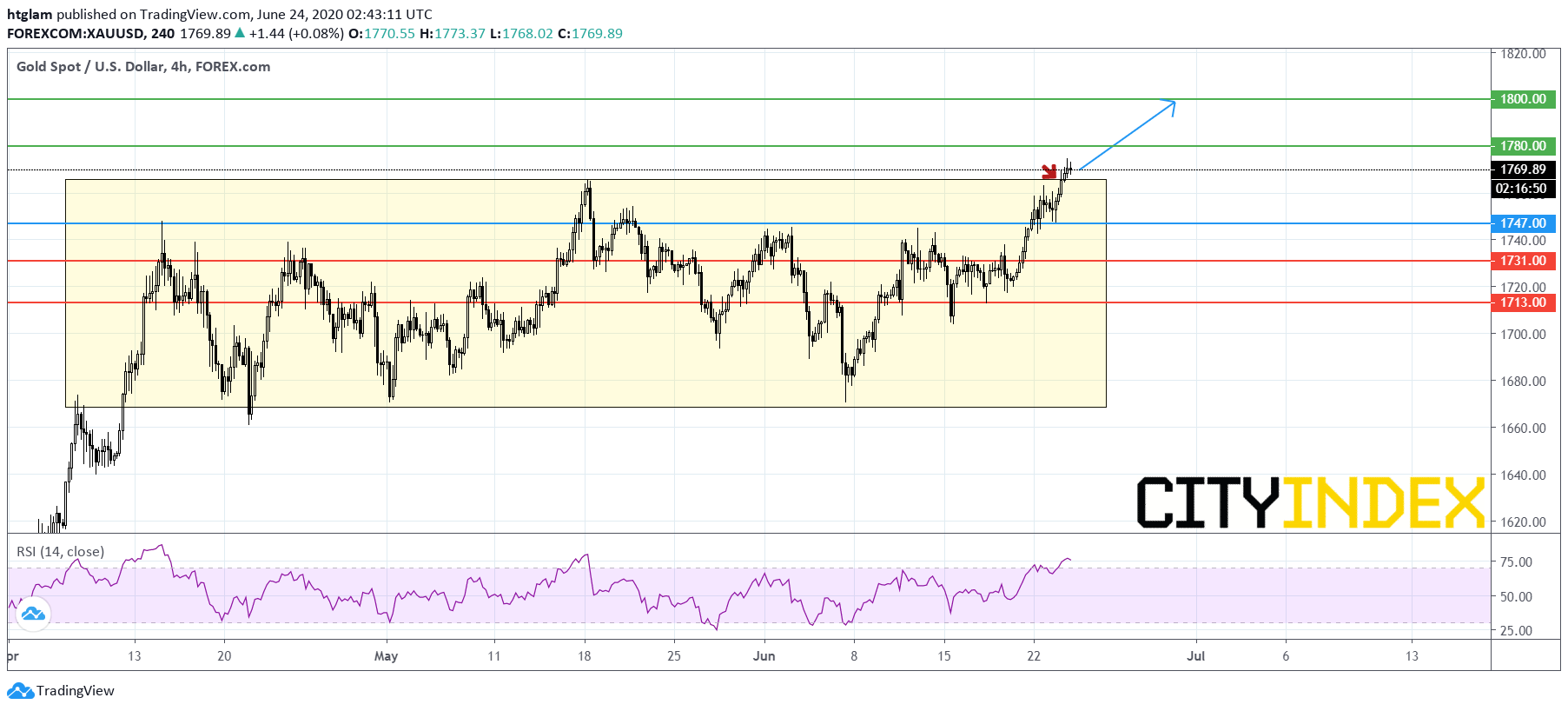

From a technical point of view, spot gold has shown an upside breakout as spotted on the 4-hour chart. It has accelerated to the upside after breaking above a bullish ascending triangle. The level at $1,747 might be considered as the nearest intraday support, while a break above the nearest resistance at $1,780 would open a path to the next resistance at $1,800. Alternatively, losing $1,747 is likely to trigger a pull-back to the next support at $1,731.