Expectations

Previously investors had been convinced that the Fed would cut interest rates. However more recently amid the easing of US – Sino tensions that conviction has started to dwindle. The CME Fed Watch tool shows that the market is pricing in 65.8% probability of a rate cut. This is down from over 90% just one week ago and would go some way to explaining the 1.2% decline in gold’s value last week.

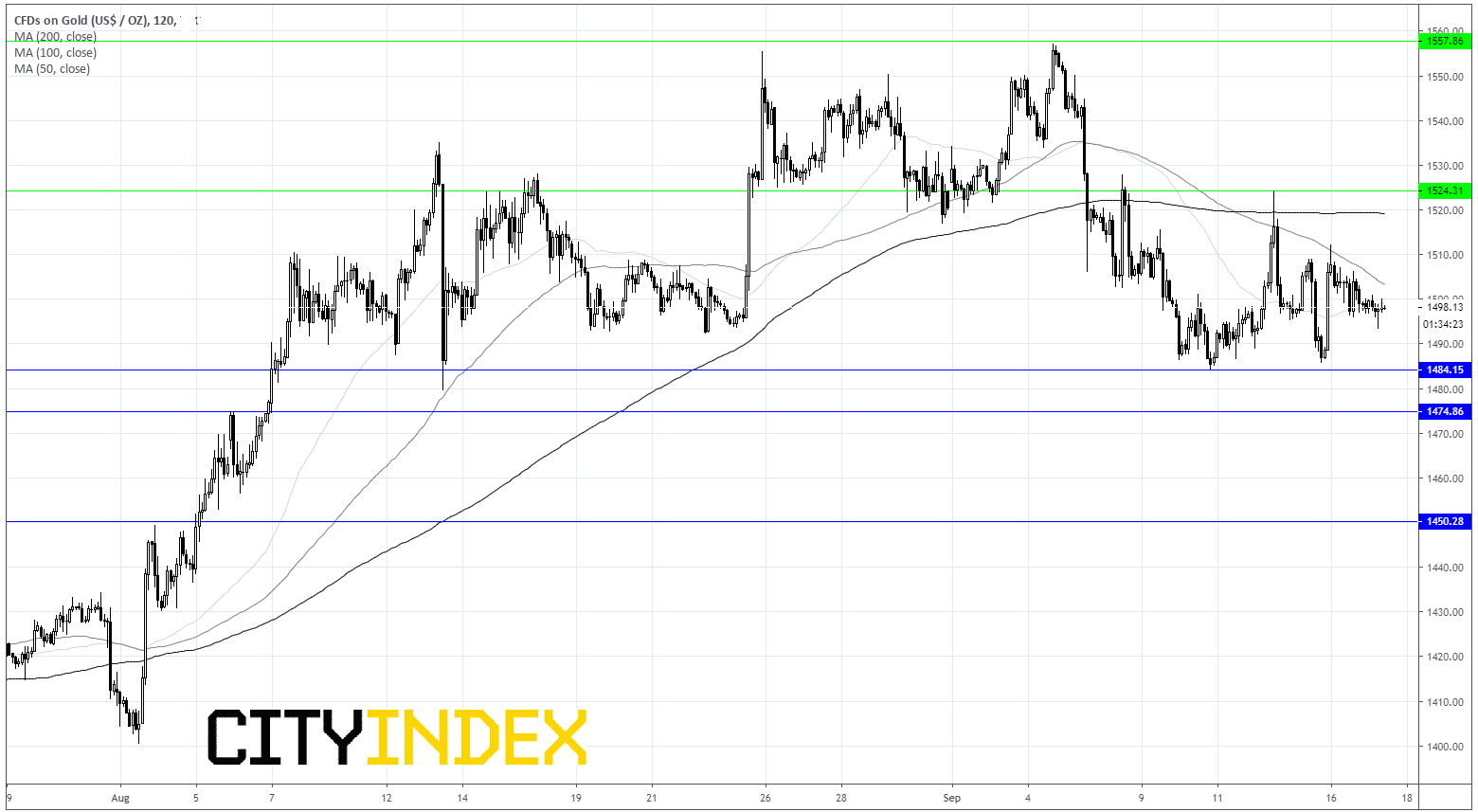

With such mixed expectations the Fed announcement has the potential to stir up volatility in the markets. A rate cut would give gold a boost as the opportunity cost of holding a non-yielding asset falls. Gold could look to target $1550 under these circumstances.

Should the Fed stay pat on rates, and risk the wrath of President Trump, the dollar could push higher and gold decline back towards $1475 level.

A word on safe have flows

In addition to the Fed, gold bugs will be keeping an eye on tensions the Middle East and the response from the US over the Saudi oil attacks. Any renewed increase in tensions and a harsh response from the US could offer support to gold. However, it is also worth keeping in mind that increased tensions in the Middle East could keep oil prices elevated. Higher oil prices boost inflation globally, making it harder for central banks to ease monetary policy keeping pressure on gold. Therefore this would not necessarily be a one way street to higher gold prices over the longer term.