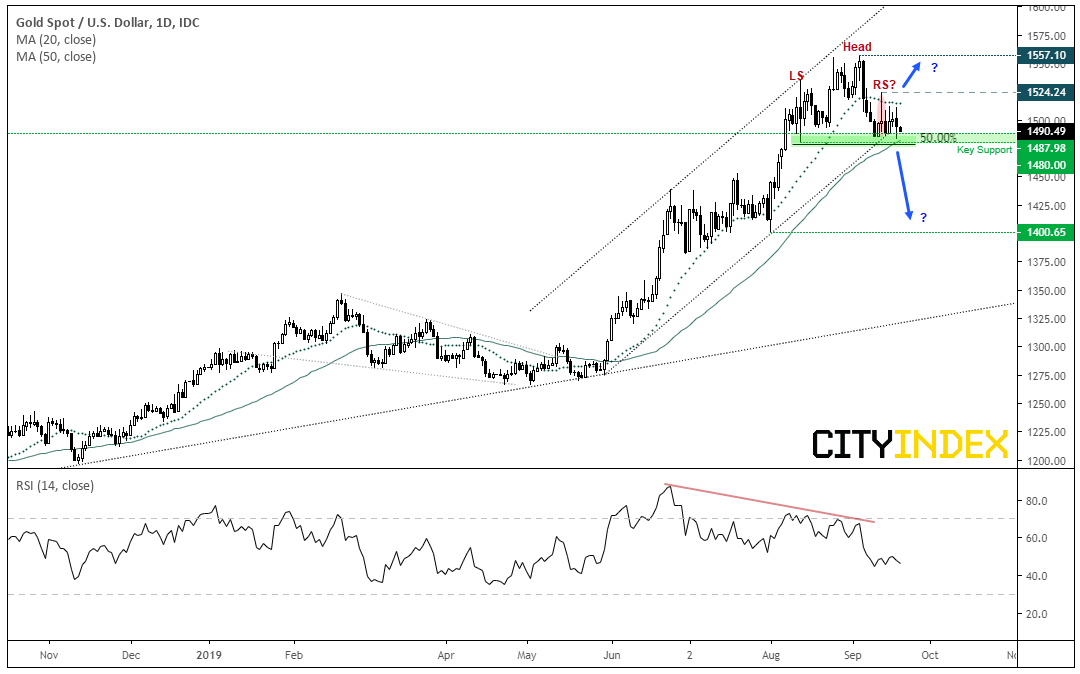

The zone around $1480 remains key as it could be the difference between a bearish reversal or bullish continuation.

Part of the reason gold has rallied so well this year is due to the markets expectation that the Fed are now on an easing cycle. So, it could be argued that gold is holding up surprisingly well following the Fed’s hawkish cut (relative to market expectations anyway). That said, Powell did go on to say during the press conference that “a more extensive sequence of rate cuts could be appropriate” if the economy does turn down which places them in a holding pattern.

However, perhaps a more pressing concern for investors is the liquidity squeeze in short-term funding. Whilst the Fed took the additional steps of lowering IOER (interest on excess reserves) by 30 bps to 1.8% and repo function rate to 1.7%, the fact they had to intervene is likely unnerving investors and supporting gold prices. Therefore, gold could face headwinds if the Fed convinces markets they have the liquidity squeeze under control, so traders will continue to monitor their repo actions closely this week.

For now, gold is holding above a pivotal support zone around $1480 which comprises of a 50% retracement level, the 50-day MA and structural lows.

- Bears are likely to take note of the bearish RSI which has been forming since June and the potential head and shoulders top pattern. A bearish pinbar hints at the ‘right shoulder’ and the 20-day MA is capping as resistance. Moreover, yesterday saw an intraday break of the bullish channel.

- If successful, the target projects an initial target around $1400, and bears could look for a clear break below $1480 to confirm the bearish reversal.

- If the support zone hold, bulls could look for a break above $1524.24 to invalidate the head and shoulders scenario and assume a bullish continuation.

- The $1557.10 high becomes the initial target, although we’d be sceptical of too much upside in the current environment; unless liquidity is restored and data improves, we could envisage gold trading in a broader sideways range whilst holding key support.

Related analysis:

FOMC Recap: “Hawkish Cut” Confirmed as Most Fed Members Don’t Expect Another Cut This Year!

Market Brief: Stocks Stage Late Rally Despite Fed’s Caution Toward Further Rate Cuts

Markets mixed after Fed