Gold is advancing for the 8th straight session on Thursday and has climbed for 12 out of the past 13 sessions amid increased flows into safe havens. The metal’s historical value and scarcity, in addition to the fact that it is non yielding mean it’s a popular hedge for those expecting the financial markets to slump in the near future.

Safe haven flows

Gold has advanced in tandem with rising fears over the impact of the coronavirus outbreak. Coronavirus has weighed on economic growth forecasts and stock prices alike in recent weeks, leaving investors in search of havens for gains.

Gold has advanced in tandem with rising fears over the impact of the coronavirus outbreak. Coronavirus has weighed on economic growth forecasts and stock prices alike in recent weeks, leaving investors in search of havens for gains.

Interestingly, even on the days that the broader financial market has seen an uptick in demand for riskier assets, gold has managed to hold its own and trend northwards regardless. As long as coronavirus remains a threat and is in the headlines, we can expect gold to be well supported. Should the situation deteriorate then gold prices could pusher further northwards.

Latest coronavirus developments

Today news that the number of coronavirus cases in South Korea doubled and that two died onboard the Diamond Princess cruise ship rocked investor nerves. China posting a sharp drop in the number of new cases failed to ease fears, partly because of another change in diagnostic criteria which is creating a level of distrust surrounding the figures. China had just 394 new cases on Wednesday, down from 1749 the previous day. The total number of confirmed cases is at 74,576.

Today news that the number of coronavirus cases in South Korea doubled and that two died onboard the Diamond Princess cruise ship rocked investor nerves. China posting a sharp drop in the number of new cases failed to ease fears, partly because of another change in diagnostic criteria which is creating a level of distrust surrounding the figures. China had just 394 new cases on Wednesday, down from 1749 the previous day. The total number of confirmed cases is at 74,576.

Levels to watch

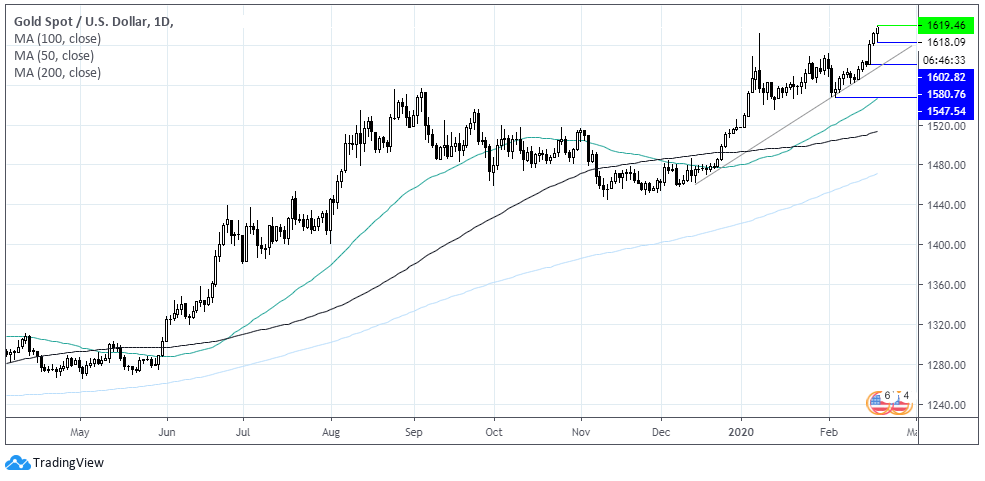

Gold is trading at a 7 year high, up 0.6% today. It trades comfortably above its 50, 100 & 200 sma on the daily chart, with bullish momentum firmly intact. A break below the trend line around $1590 could negate the bullish trend, otherwise gold could advance towards $1650 (round number) and $1685 (high Feb 2013)

Immediate support can be seen at $1603 (today’s low) prior to $1580 (low 18th Feb & trend line support). This could open the doors to $1550 (low 4th Feb & trend line support).

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM