When examining the reasons why gold finally breached the key $1850 support zone overnight, it’s partially been in response to a “third dose” of positive vaccine news. This time from the AstraZeneca/Oxford team who proposed an accelerated timeline for vaccine distribution and whose vaccine only needs to be refrigerated at normal fridge temperature.

Also playing a part, increasing optimism that Brexit negotiations will soon be concluded, as well as a sharp reversal higher in the U.S. dollar in the wake of much stronger than expected U.S Flash PMI data.

The PMI data suggests the U.S. economy is on a stronger footing than expected despite surging COVID-19 cases and raises questions as to how much extra fiscal stimulus is needed. Less stimulus and a higher U.S. dollar, generally act as a headwind to gold.

Finally, this morning, reports that the U.S. General Services Administration informed Joe Biden that President Trump authorised federal agencies to begin working on the transition of power. While this falls short of Trump conceding defeat, it does remove some of the tail risks around a disorderly transition following the election.

Where does this leave gold?

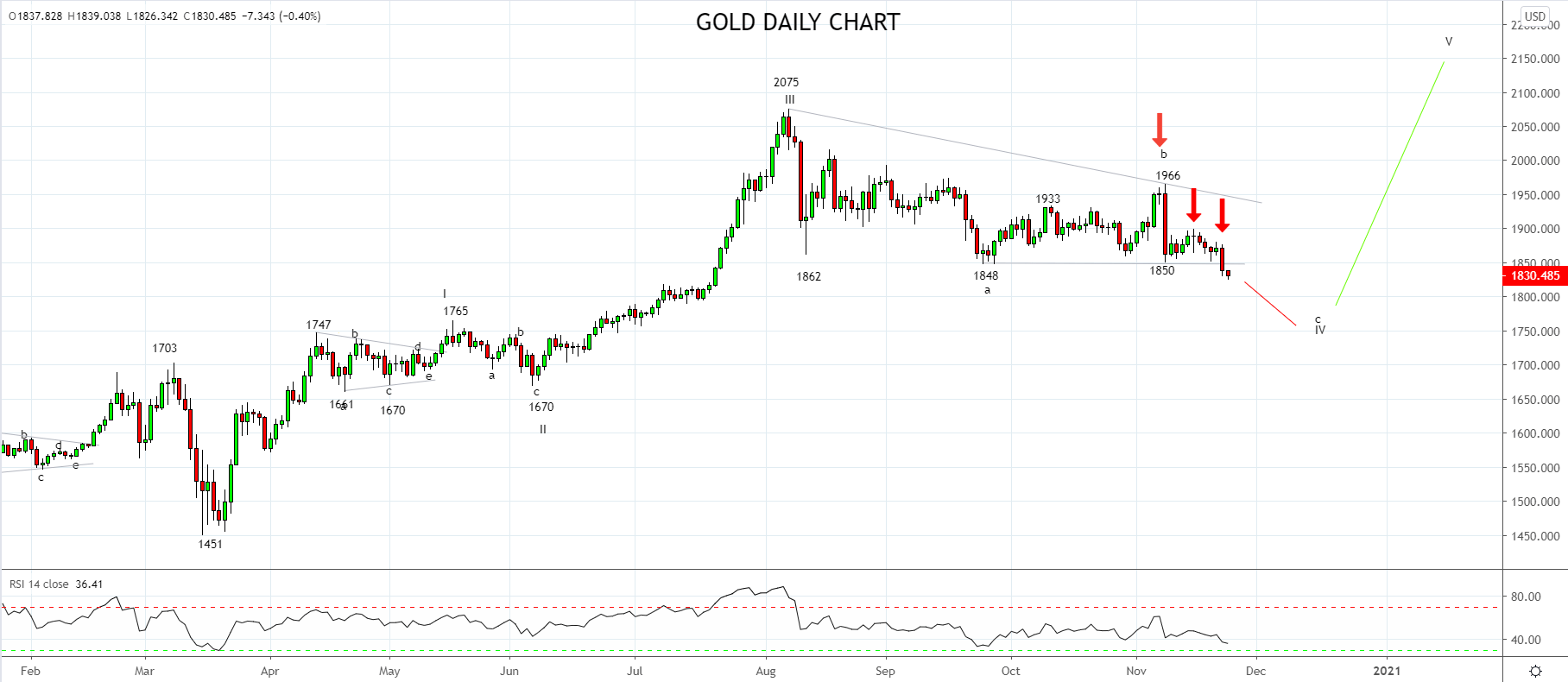

It’s been exactly two months since my last note on Gold here. An accurate reflection of my medium-term bullish view of gold, contrasted with uncertainty in the short term as to whether Gold needed to undertake another leg lower as part of its correction from the August $2075 high.

The break below the $1850 support, warns the next leg of the correction (Wave c of Wave IV) from the November $1966 high is underway, targeting a move towards wave equality at $1740.00. From the $1740 area, I will be looking for signs of stabilisation/basing in anticipation of the uptrend resuming and a buying opportunity.

Keeping in mind, a break close back above $1850/60 formerly support, now resistance would be the first indication the uptrend has resumed and that a retest/break of the $2075 high is underway.

Source Tradingview. The figures stated areas of the 24th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation