Gold breaks below $1800 ahead of PCE tomorrow

The re-election of Jerome Powell for four more years as the head of the Federal Reserve has injected a decent amount of volatility into the markets.

Expectations are that Fed Powell will adopt a more aggressive tone towards monetary policy normalization, which of course is bad news for non-yielding Gold. Not only could the first rate hike happen sooner, but the markets are also ramping up expectation for two hikes next year. Gold trades down around 3.3% so far this week.

Yesterday, the precious metal was one of the biggest losers and today the selloff continued as treasury yields pushed higher.

The yield on the 10-year treasury jumped 4.75% yesterday and rose a further 1% today.

With inflation at a 30 year high the pressure on the Fed to tighten monetary policy is rising.

The PCE deflator due tomorrow, the Fed’s favorite gauge of inflation will be the next key release for Gold. PCE is expected to rise to 4.1% in October, up from 3.6% in September.

Where next for Gold?

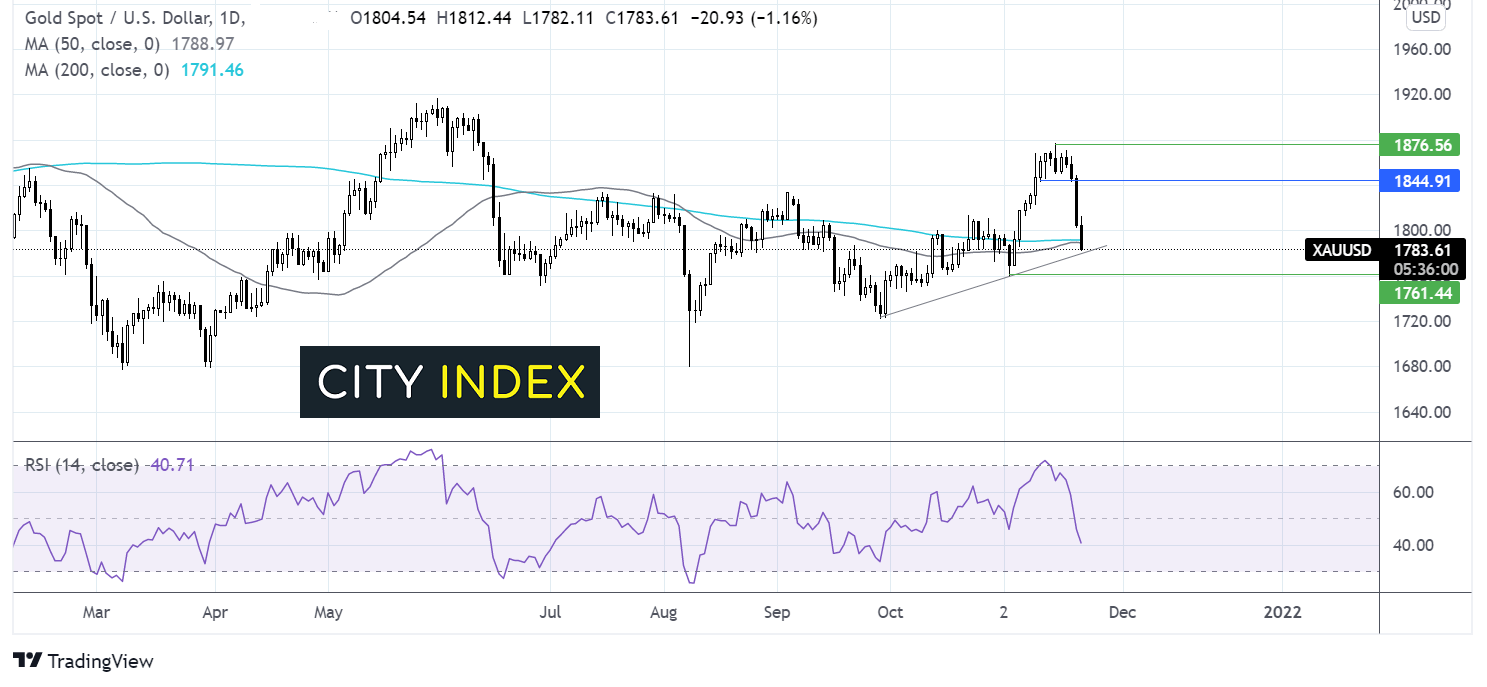

Gold traded relatively range bound last week capped on the upside by $1877 and on the lower side by $1845.

The price broke down the support at $1845 and the 200 sma at $1791. The RSI suggests there is more downside to come. The recent uptrend could be negated with a fall below the rising trendline at 1780. Seller could gain traction beyond 1760 the November low.

Any meaningful recovery needs to retake the 200 sma at $1791 and $1800 round number to target 1810. Beyond here buyers could look back towards $1845.