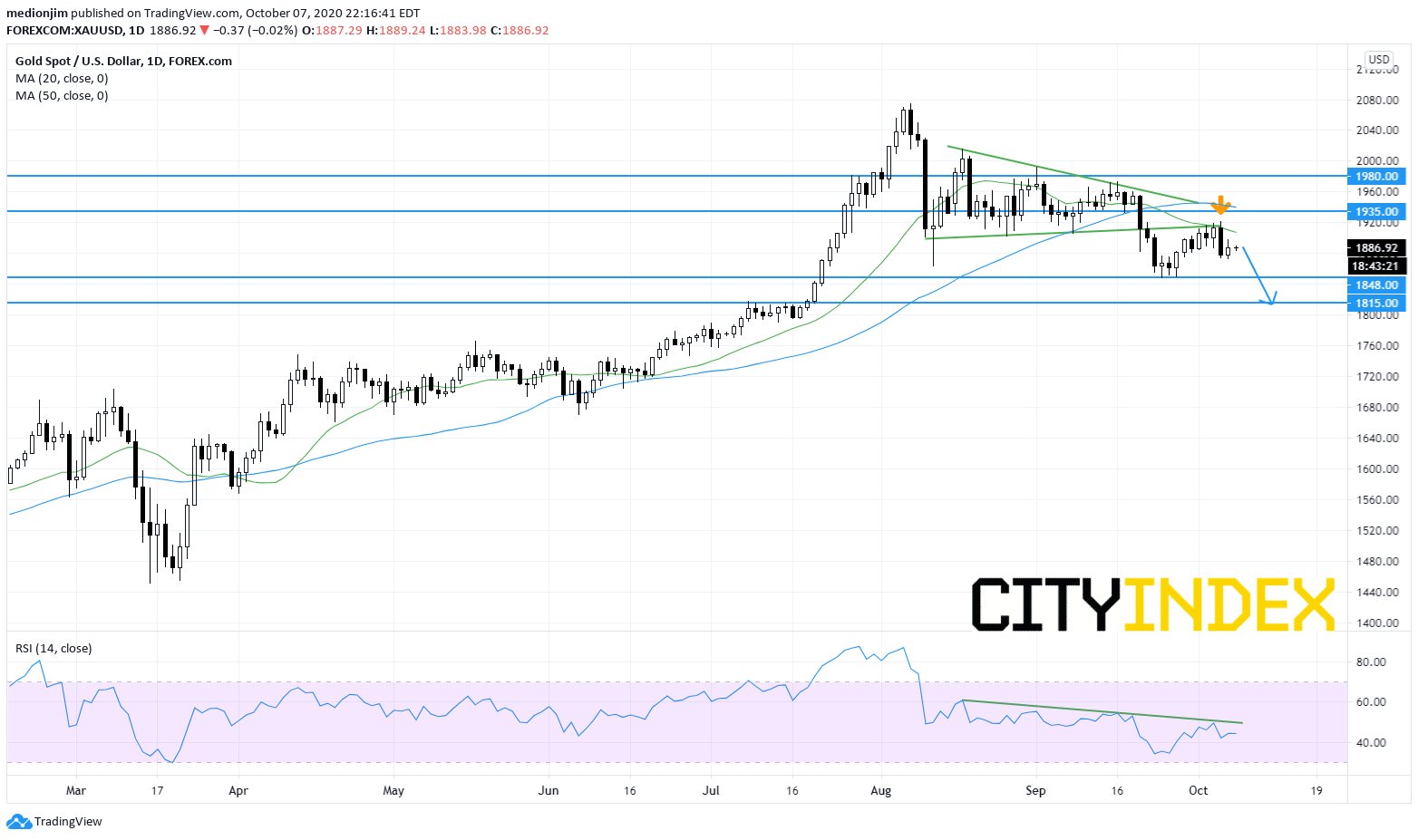

Gold: Bearish Bias Remains

Gold posted a bounce of 0.49% yesterday as the U.S. dollar slipped 0.26%. U.S. President Donald Trump reversed an earlier stance and said he could sign partial fiscal stimulus bills from Congress. This helped to boost market sentiment.

The Federal Open Market Committee's (FOMC) Meeting Minutes stated that on net, financial conditions have eased since the last Meeting. As equity prices have risen and the dollar continues to depreciate, the Fed believes that aggressive monetary and fiscal policy are needed to keep the recovery going strong as market participants still see significant risks ahead.

In fact, the rebound of gold has not taken out the bearish outside bar formed on October 6. In addition, gold prices remain trading below the declining 20-day moving average. Beside, the RSI is also capped by a declining trend line. Those technical configurations would suggest a bearish outlook.

The resistance level remains at $1,935 and $1,980, while support levels are located at $1,848 and $1,815.

Source: Gain Capital, TradingView

The Federal Open Market Committee's (FOMC) Meeting Minutes stated that on net, financial conditions have eased since the last Meeting. As equity prices have risen and the dollar continues to depreciate, the Fed believes that aggressive monetary and fiscal policy are needed to keep the recovery going strong as market participants still see significant risks ahead.

In fact, the rebound of gold has not taken out the bearish outside bar formed on October 6. In addition, gold prices remain trading below the declining 20-day moving average. Beside, the RSI is also capped by a declining trend line. Those technical configurations would suggest a bearish outlook.

The resistance level remains at $1,935 and $1,980, while support levels are located at $1,848 and $1,815.

Source: Gain Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM