Gold is trading over 0.9% higher and has pushed overt the $1600 mark, as it attempts to pare some of Friday’s losses.

Safe haven

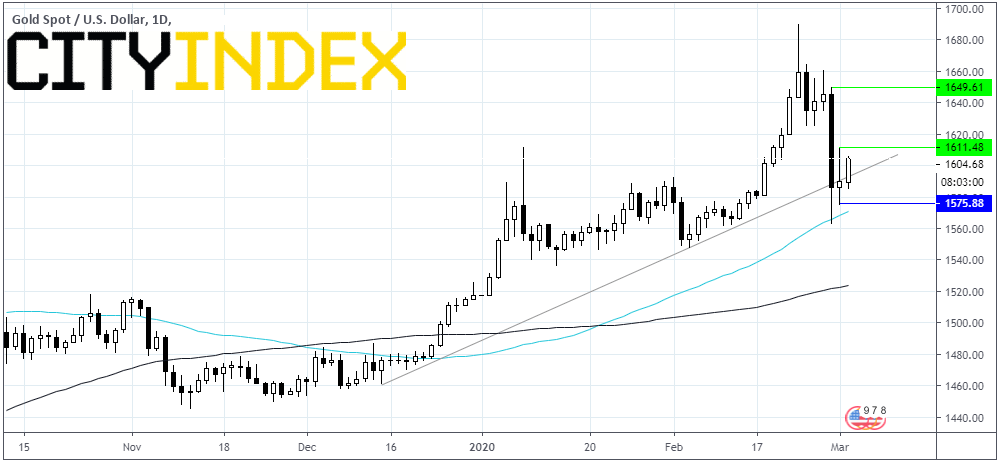

Gold has had an interesting reaction to coronavirus. The price of gold trended steadily higher as coronavirus fears increased flows into safe haven assets. Gold advanced in every trading session par 5 across the month of February. Friday was one of those losing sessions. On Friday, despite coronavirus risks remaining high, gold sold off sharply in a serious bout of profit taking. The price slipped through trend line support, testing the 50 sma before rebounding.

Gold has had an interesting reaction to coronavirus. The price of gold trended steadily higher as coronavirus fears increased flows into safe haven assets. Gold advanced in every trading session par 5 across the month of February. Friday was one of those losing sessions. On Friday, despite coronavirus risks remaining high, gold sold off sharply in a serious bout of profit taking. The price slipped through trend line support, testing the 50 sma before rebounding.

Easing monetary policy

Gold is once again climbing higher after the Federal Reserve hinted that it could ease policy in a bid to shore up the US economy in the face of risks posed by the coronavirus outbreak. The BoE and BoJ alluded to the same, whilst the group of 7 finance ministers (G7) said they would use all appropriate policy tools.

The prospect of the Fed and its peers easing monetary policy is music to the ears of gold bugs. In a lower interest rate environment, the opportunity cost of holding non -yielding gold declines, boosting demand for the precious metal.

Gold is once again climbing higher after the Federal Reserve hinted that it could ease policy in a bid to shore up the US economy in the face of risks posed by the coronavirus outbreak. The BoE and BoJ alluded to the same, whilst the group of 7 finance ministers (G7) said they would use all appropriate policy tools.

The prospect of the Fed and its peers easing monetary policy is music to the ears of gold bugs. In a lower interest rate environment, the opportunity cost of holding non -yielding gold declines, boosting demand for the precious metal.

Level to watch

Gold is trading 0.9% higher, crucially pushing back over the ascending trendline which began last December. A close above the said trend line could initiate another push higher.

Immediate resistance can be seen at $1605 (today’s high) a breakthrough here could open the door to $1611 (yesterday’s high) prior to $1650 (Friday’s high).

Immediate support is at $1595 (trend line) prior to $1575 (yesterday’s low) and $1569 (50 sma).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM