Gold and Silver: Who Will Gain the Upper Hand?

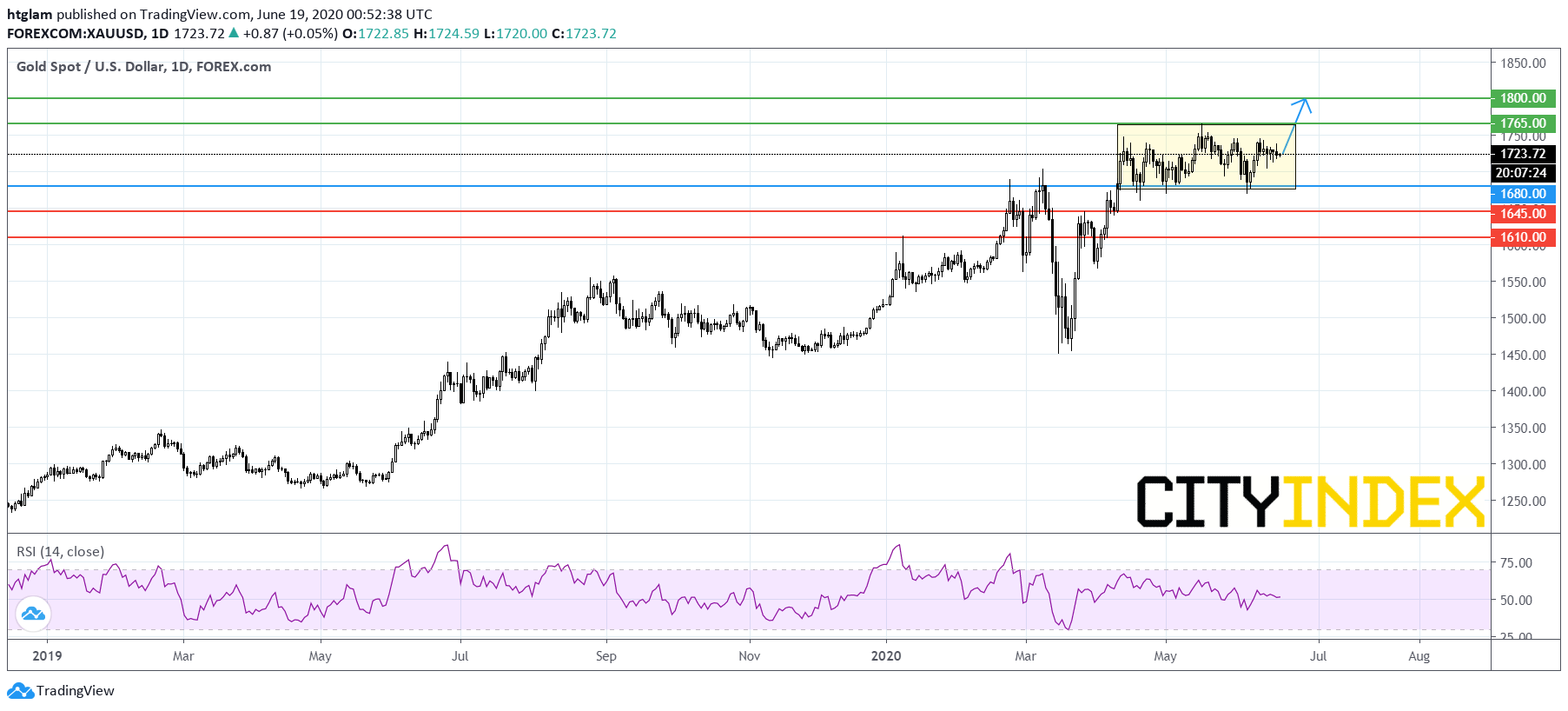

Spot gold ended 0.2% lower yesterday, though the precious metal has been trading within a consolidation range since mid-April, without making a meaningful breakout.

U.S. President Donald Trump tweeted that "a complete decoupling from China" remains a policy option, after Secretary of State Mike Pompeo's meeting with Chinese official Yang Jiechi.

Messages regarding the relationship between the two biggest nations continue to be mixed. Pompeo said China "recommitted to completing and honoring all of the obligations of Phase 1 of the trade deal between" the two countries. However, it is reported that Chinese officials were not "really forthcoming" during the meeting.

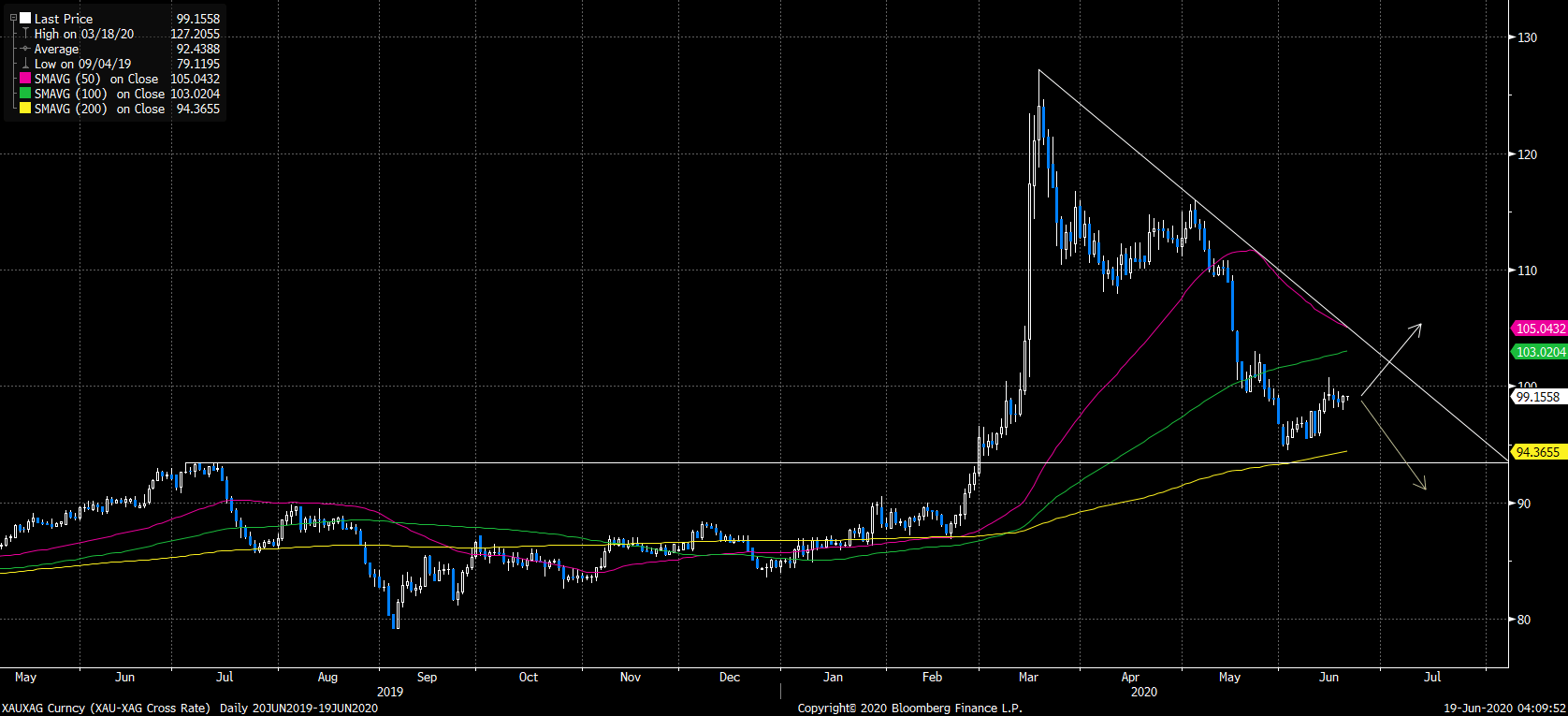

Source: Bloomberg (Gold/Silver Ratio Daily Chart)

Investors are still weighing the pace of economic recovery and the twists and turns in U.S.-China relationship. In fact, gold had outperformed silver when the coronavirus pandemic began, however silver saw a strong rebound since mid-March as major governments and central banks rolled out stimulus measures. Depending on how the key issues evolve, silver might get the upper hand if we see a solid economic recovery, or vice versa if the U.S.-China tension heightens. The gold/silver ratio has nearly erased all of its gains made in early March, and a break-through, either way, seems approaching.

From a technical point of view, both spot gold and spot silver stays on the upside as shown on the daily charts. Spot gold keeps trading within a bullish consolidation range. Investors might consider $1,680 as the nearest support, and a break above the month-high of May at $1,765 is needed for gold to challenge the next resistance at $1,800. Alternatively, a break below $1,680 could be a warning that gold is heading towards the next support at $1,645.

Soucre: TradingView, Gain Capital (Spot Gold Daily Chart)

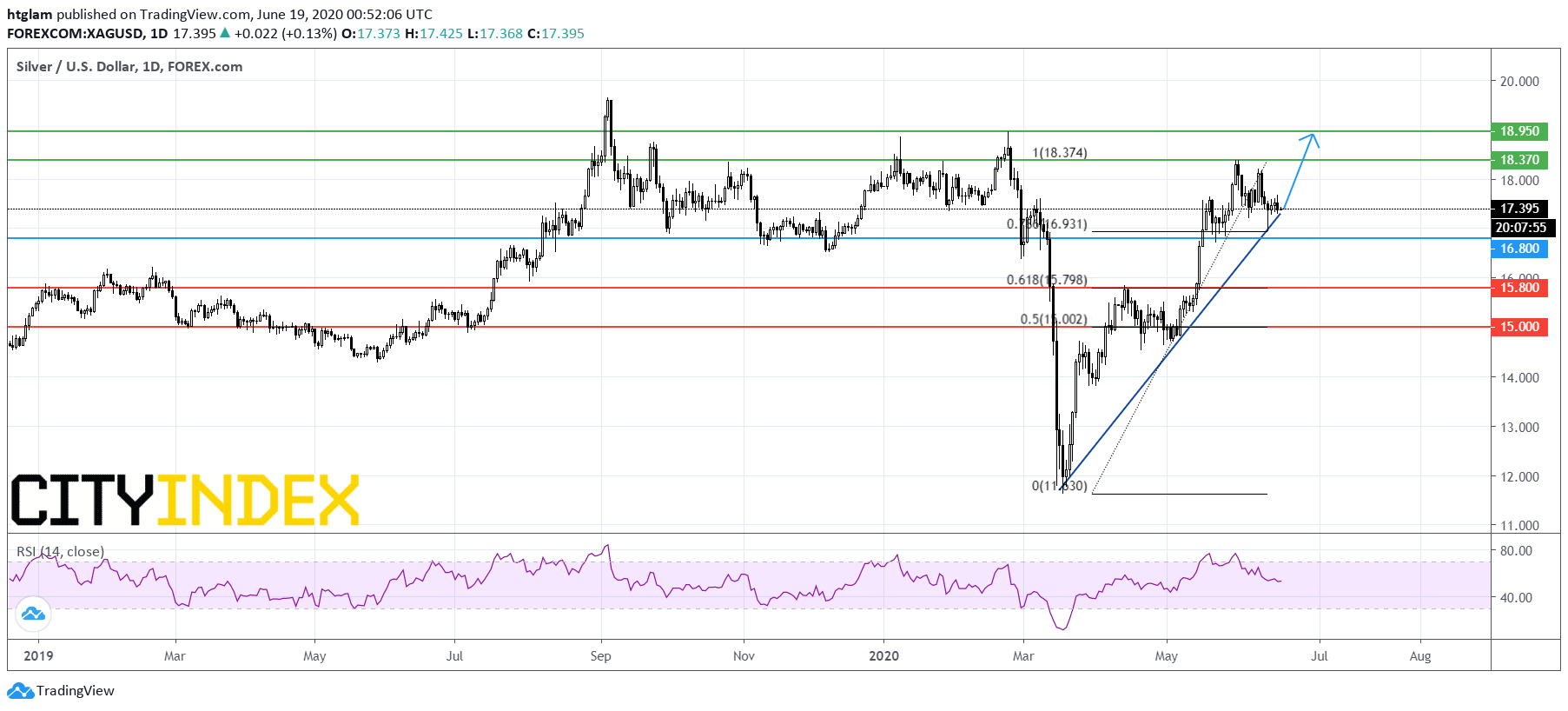

For silver, it remains at levels below 2019's high despite a sharp rebound started in March. Currently, it is supported by a rising trend line and upside momentum remains strong. The level at $16.80 may be considered as the nearest support, with prices likely to test the 1st and 2nd resistance at $18.37 and $18.95 respectively. Alternatively, losing $16.80 would suggest that the next support at $15.80 is exposed.