Gold and Silver Dip as US Dollar Regains Strength

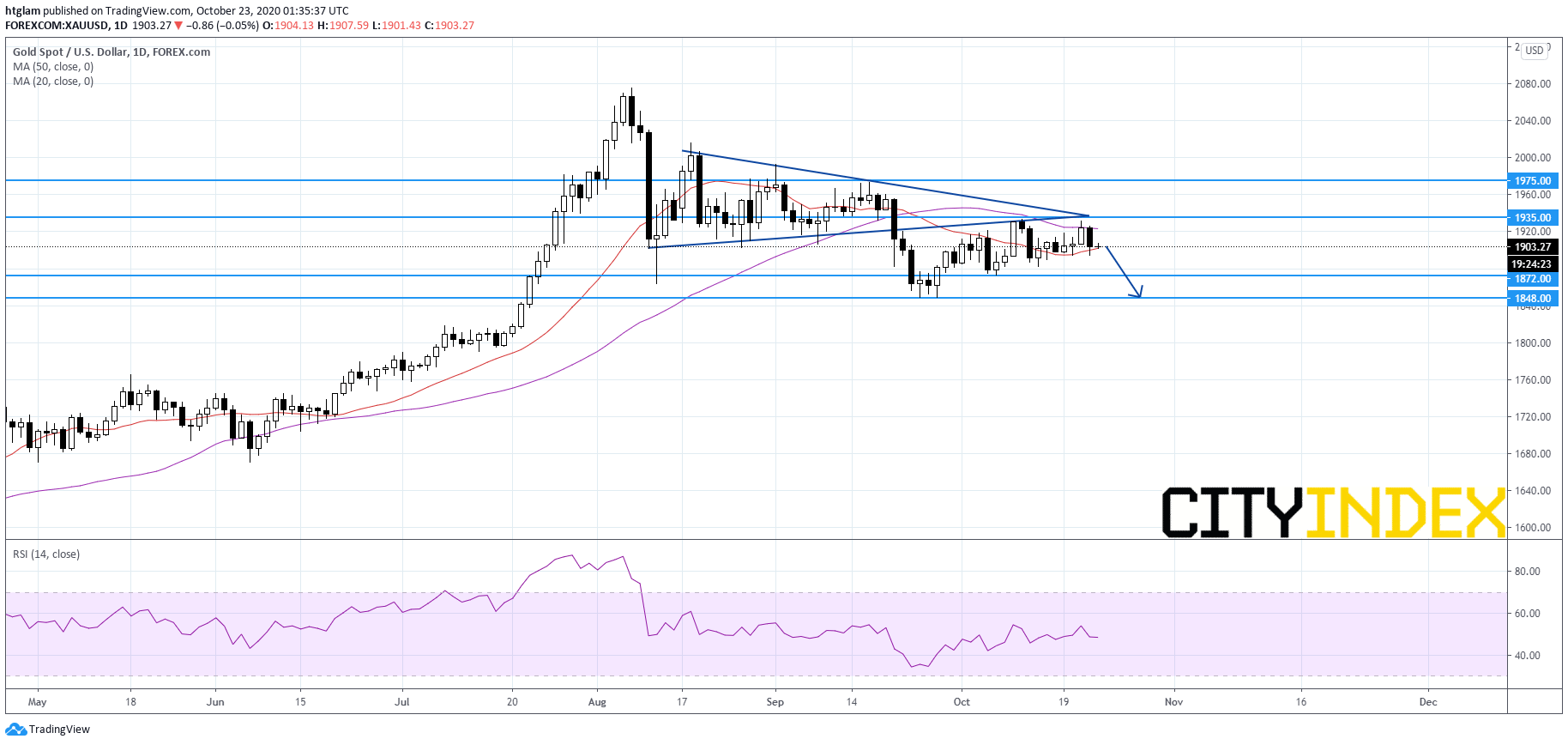

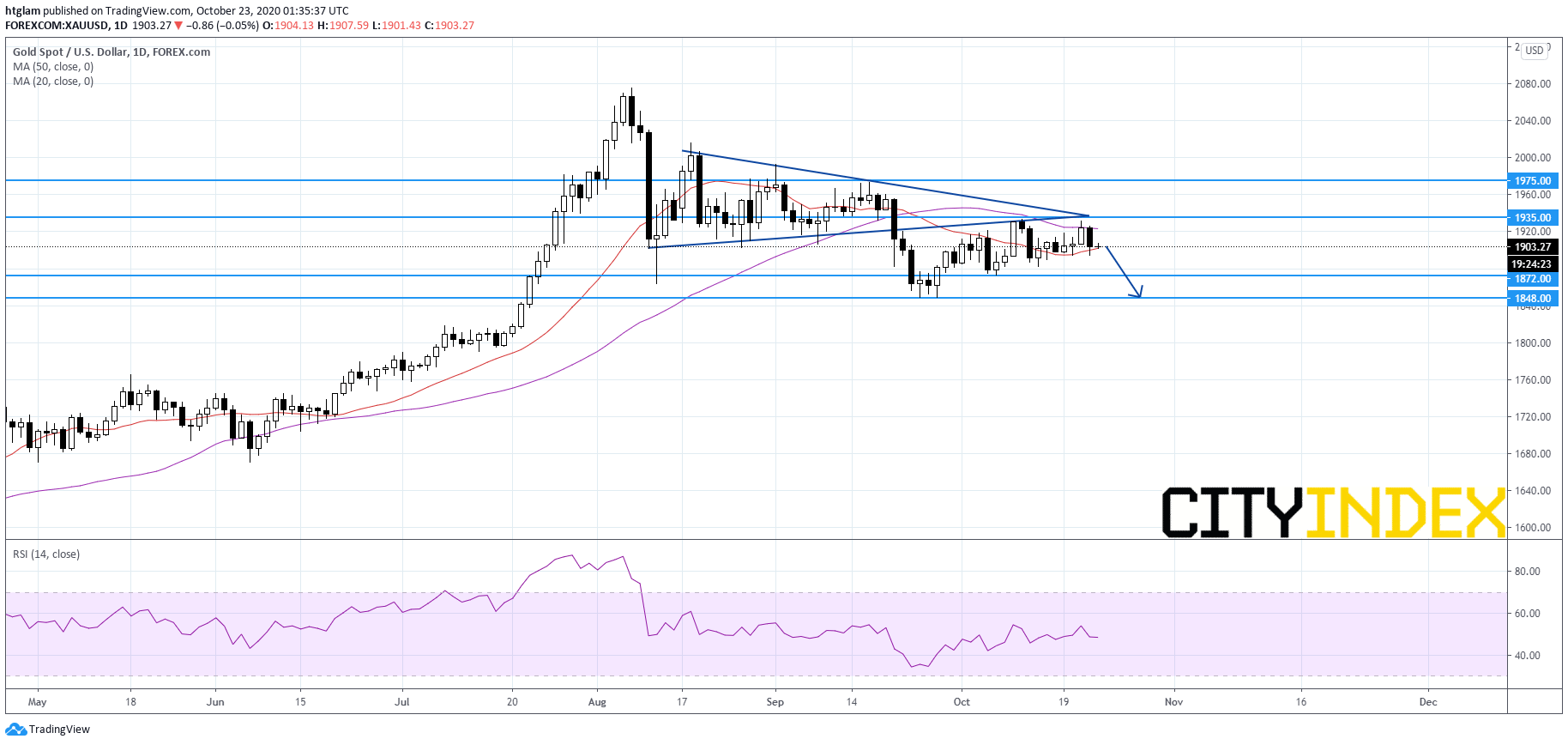

Spot Gold: Key Resistance at $1,935 Still Holds

On Thursday, spot gold and spot silver both drop by more than 1%, as the U.S. dollar regained strength. In addition, investment demand for the precious metals, a catalyst for price rises, has not yet picked up. Bloomberg's data showed that total known ETF holdings of gold was broadly flat in October, compared to the prior month. Total known ETF holdings of silver rebounded 2% month-on-month so far in October, but still below August's level.

From a technical point of view, spot gold remains on the downside as it has failed to break through the key resistance as shown on the daily chart. It has retreated after getting near a declining trend line drawn from August and is also capped by the 50-day moving average. The level at $1,935 may be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $1,872 and $1,848 respectively.

Source: Gain Capital, TradingView

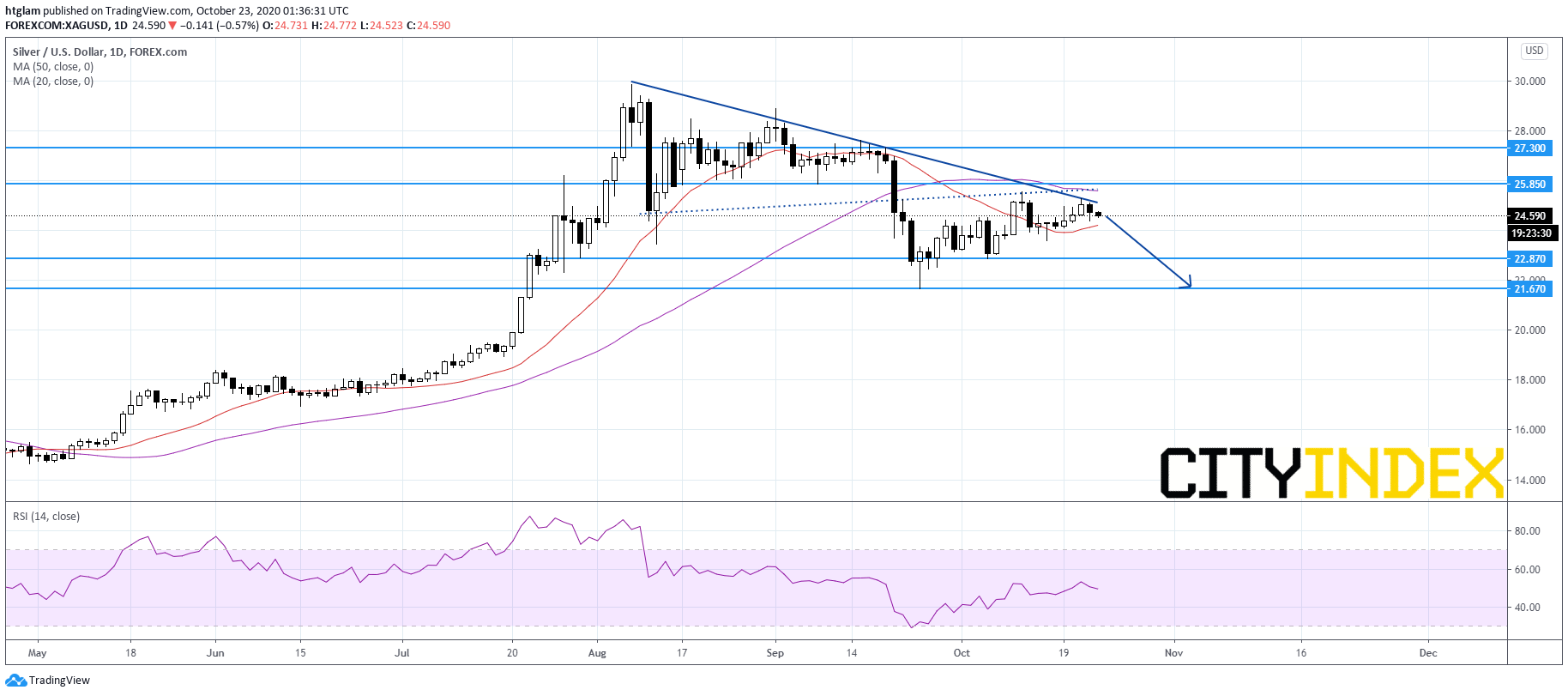

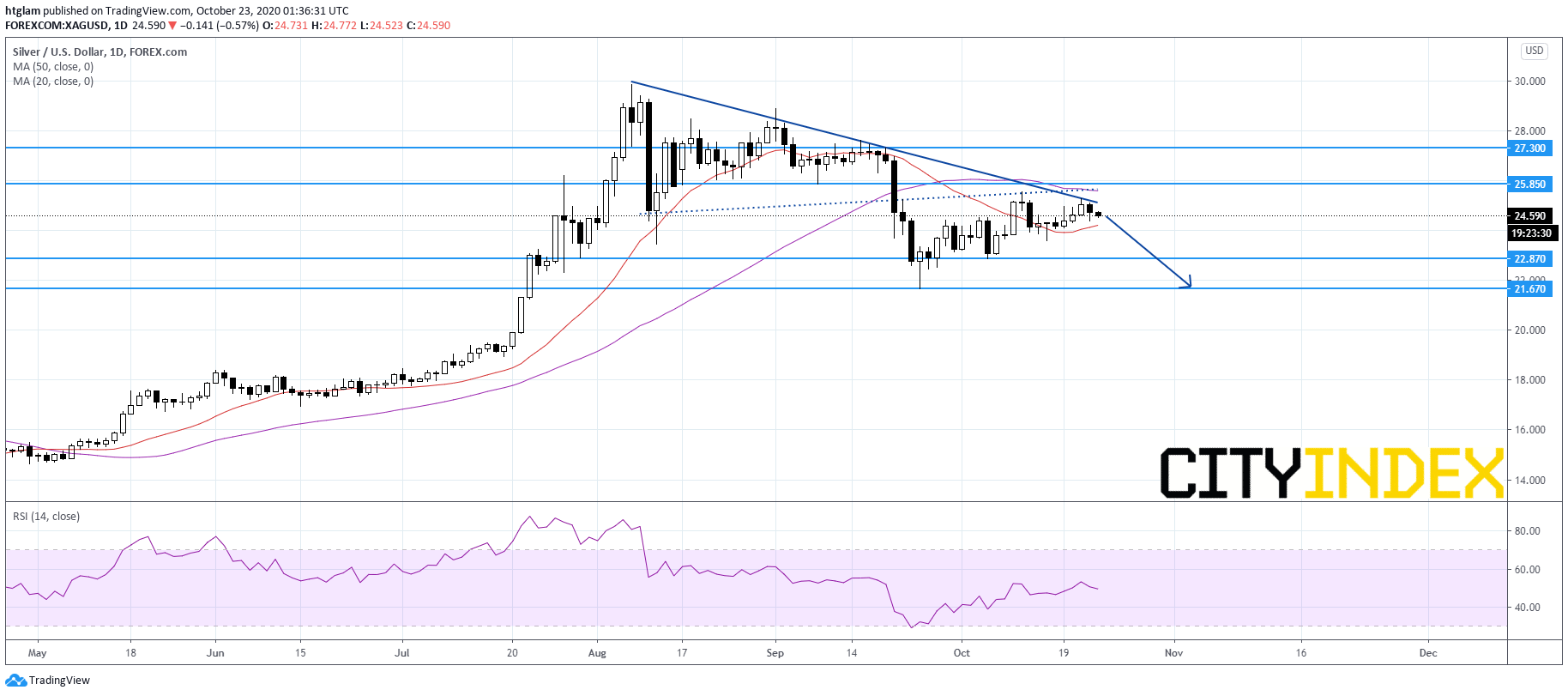

Spot Silver: Bearish Trend Line Intact

On a daily chart, spot silver remains capped by a bearish trend line drawn from August. In fact, it stays at levels below the 50-day moving average, which is skewing downward. The level at $25.85 might be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $22.87 and $21.67 respectively.

Source: Gain Capital, TradingView

Latest market news

Today 08:15 AM