Gold and silver climb against weak dollar

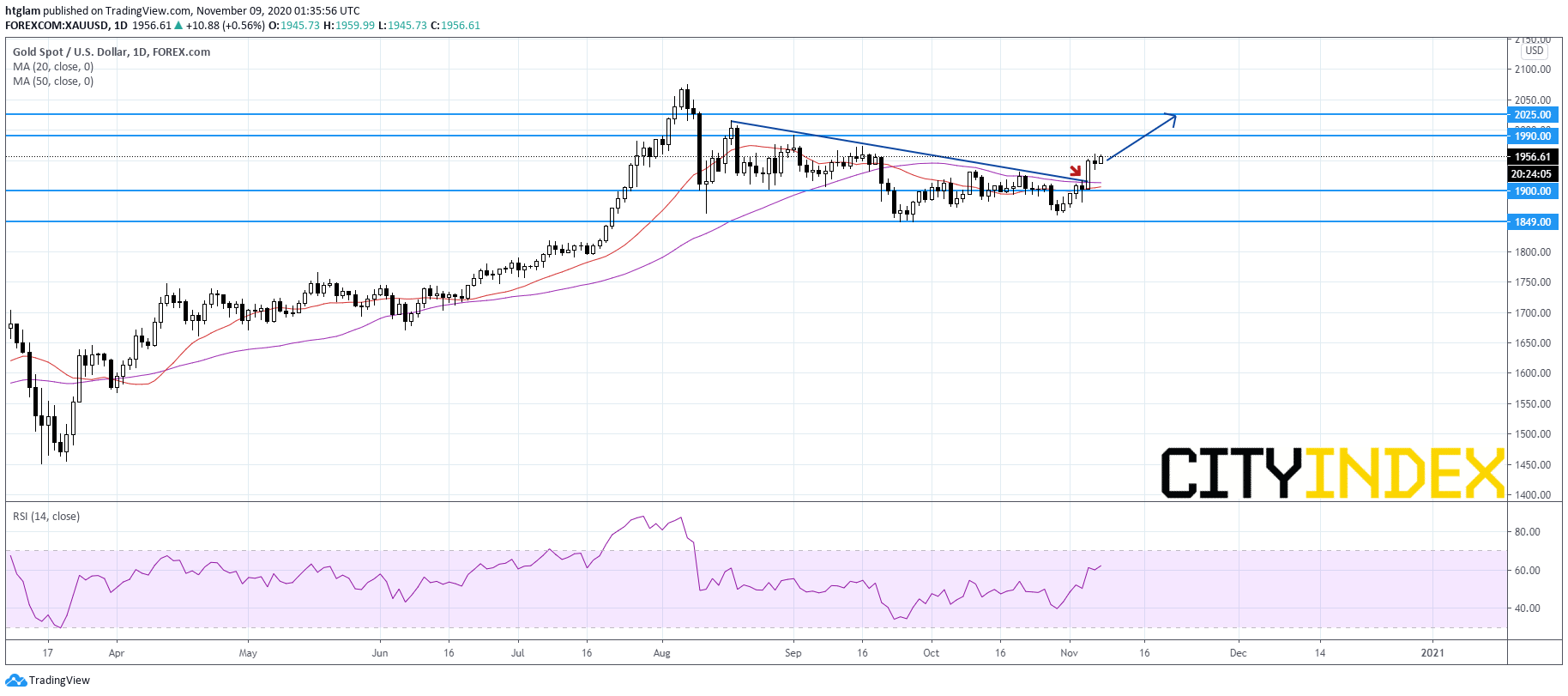

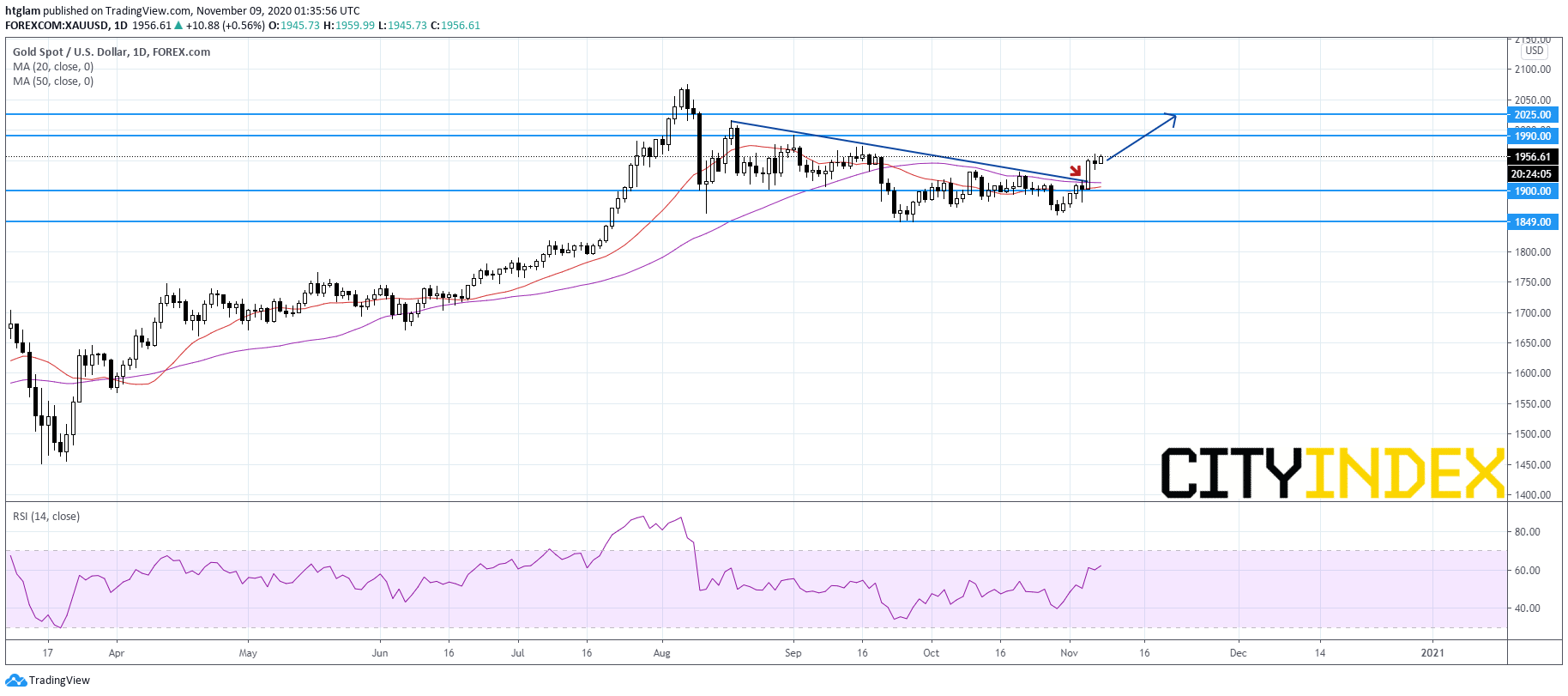

Spot Gold: Extension of Rebound

Spot gold ended up 3.9% last week, the largest weekly advance since April, as the ICE Dollar Index sank to a 2-month low. Despite a stronger-than-expected U.S. nonfarm payrolls report for October, investors stick to view that a large scale of stimulus package is needed for the US economy, which would drive the dollar lower.

On a daily chart, spot gold is holding up well after breaking above a declining trend line drawn from August. In fact, the 20-day moving average is skewing upward and is about to cross above the 50-day one. The level at $1,900 might be considered as the nearest support, while the 1st and 2nd resistance are moved up to $1,990 and $2,025 respectively.

Source: GAIN Capital, TradingView

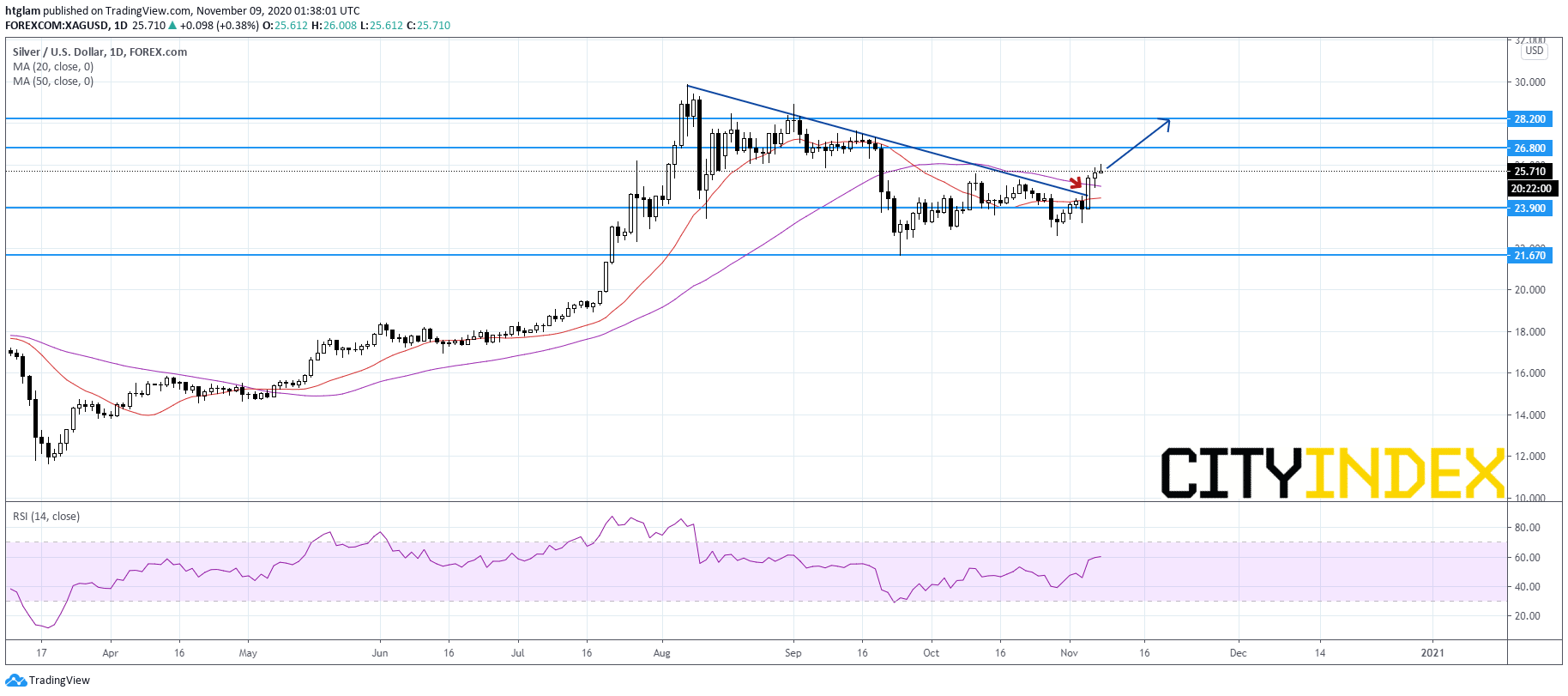

Spot Silver: Towards September's High

From a technical point of view, spot silver is gathering more upside momentum as shown on the daily chart. Similar to spot gold, it has broken above a bearish trend line drawn from August and stands above both the 20-day and 50-day moving average. The level at $23.90 might be considered as the nearest support, while the 1st and 2nd support are expected to be located at $26.80 and $28.20 respectively.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM