Glencore’s first-half results were as grim as its highly orchestrated recent news flow signalled they would be.

But as the company might have feared, the extent of bad news in the H1 report itself, was still enough to push its stock to the latest in a string of all-time lows.

Copper and zinc ‘growth markets’

The key adjusted EBITDA figure was $4.6bn, 29% lower than in H1 a year ago, and slightly light of $5.01bn consensus.

In line with company announcements over the last week in which it disclosed a $790m impairment on oil assets in Chad, and limited capex to $6bn (vs. $6.5bn-$6.8bn planned before) there are few further surprises.

At the same time the company sought to press its strategic edge on Wednesday by stating it was looking for growth opportunities in copper and zinc production in the second half.

“Those in particular are the two commodities that we see going forward fundamentally looking in much better shape than other commodities”, GLEN’s chief financial officer Steve Kalmin told reporters.

This statement gave a short-lived fillip of as much as 4% to the stock, though GLEN was already highly sensitised to a potential bounce after touching new all-time lows in recent days.

Either way, investors were always likely to give more weight to any mention by the company of Chinese commodity demand.

Glencore’s influential CEO, Ivan Glasenberg said China demand was “very difficult to read”, and that the industry should not increase output in anticipation.

Potentially more alarming, Glasenberg went as far as to say Glencore would pull back commodity production if necessary, to support markets.

That would be in stark contrast to the strategy of its rivals, particularly Rio Tinto, which has sought to protect market share and stifle competitors by increasing production relentlessly.

Losing streak

Additional investor misgivings seem partly to do with hazy visibility from GLEN’s dual role as both a producer of commodities and a trader.

Shareholder unease has risen over its status as the world’s largest commodities trading firm in step with an inexorable decline of the majority of natural resources prices.

Glencore makes about a quarter of its earnings from trading, and this business had previously provided it with a buffer against oil and metal price volatility that played havoc with pure-play miners.

Not anymore—this time, ‘marketing’ earnings fell 27% to $1.2bn.

$2.3bn goes down a hole

All in, Glencore swung to a loss of $676m from the profit of $1.72bn it reported at the end of the first half a year ago.

It’s difficult to put a gloss on this, though CEO Glasenberg gave it a shot: despite the “challenging” half-year, he said Glencore was well-positioned to “benefit from any improvement in pricing when it finally and inevitably materializes”.

He’s probably correct.

But on a nearer term view, even after losing 43% in the year to date, Glencore’s stock is still rated more highly than all of its FTSE 100 base metals peers.

All of these, Rio Tinto, BHP Billiton and Anglo American, are higher dividend payers.

Glencore’s premium of 18 times forecast full-year EPS, is probably related to its commodity trading sideline.

Since the edge from that has gone, the temptation to sell the stock outweighed its other merits on Wednesday, pushing it almost 8% lower as this article was going online.

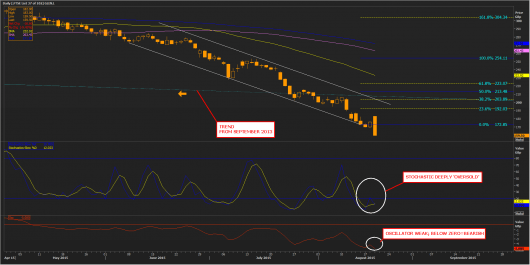

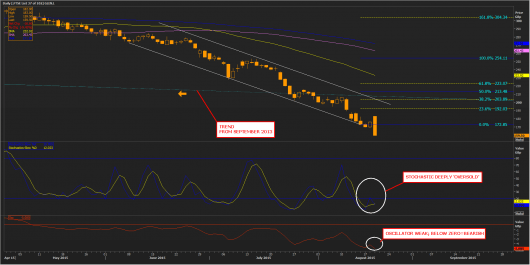

That’s despite the shares having already been even more deeply ‘oversold’ than they were at the end of last week.

Ordinarily, this would tend to increase the arguments for a bounce.

However, as we know, sentiment on assets can remain overstretched (on the upside or downside) for longer than theoretically prescribed. (See Slow Stochastic indicator; blue/yellow lines.)

An additional indicator, a basic oscillator (red line) reflects the persistence of negative sentiment: it is well below the zero balance and barely off its nominal floor.

Even when the bounce comes, it is likely to be challenged by the descending channel from June, especially where the channel conjuncts the important 38.2% retracement around 203p.

That’s c. 20% away from the current price—underlining that there’s little on offer here for near-term bulls.

Especially in such close proximity to the psychological 160p level.

Please click image to enlarge