German stocks sharply underperform Europe again on Ukraine

The German stock market is today again playing the role of unwilling proxy for the conflict in Ukraine. Whilst most major European equities are being […]

The German stock market is today again playing the role of unwilling proxy for the conflict in Ukraine. Whilst most major European equities are being […]

The German stock market is today again playing the role of unwilling proxy for the conflict in Ukraine.

Whilst most major European equities are being hit, the German index has typically, in recent weeks, traded more weakly than its close peers.

Germany’s DAX 30 Index of leading stocks from the region closed Tuesday (12th August) down 1.2%, showing a much deeper decline than France’s benchmark CAC 40, which was 0.8% lower and the UK’s FTSE 100, which closed flat.

German stock indexes in particular have proven markedly sensitive to the conflict between Ukraine and Russian-supported rebels during which over 1,000 people have been killed, including government forces, rebels and civilians, according to UN agencies.

On 17th July, a Malaysian airliner was downed with the deaths of all 298 people on board.

Earlier on Tuesday a key survey of investor sentiment in the eurozone’s largest economy provided more evidence of the conflict’s negative impact on Germany’s business sectors.

The monthly ZEW survey, a series of polls of economic and financial experts conducted by the Centre for European Economic Research (ZEW in German) reflected the turmoil in Ukraine and concern that sanctions and counter-sanctions between Russia and the West may affect Europe’s industrial powerhouse.

The ZEW index hit an 18-month low of 8.6 points in August, having dropped 18.5 points since July, its sharpest fall since June 2012.

On Tuesday, a Russian convoy carrying food, water and other aid set off for eastern Ukraine, where government forces are closing in on pro-Russian rebels, but Ukraine’s government said it would not allow the convoy to pass.

US, French and Australian governments earlier in the week voiced concern that Russia, might use the humanitarian deliveries as a cover for a covert operation to help rebels.

According to Ukrainian sources, Russia has amassed 45,000 troops on its neighbour’s border.

A senior NATO official said on Monday there was a “high probability” Moscow might now intervene militarily in Ukraine.

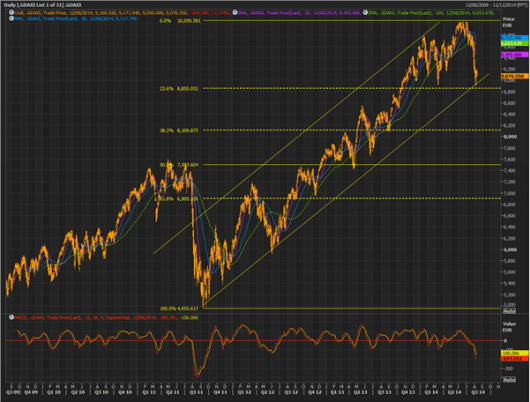

DAX tumbles to support levels whilst long-term uptrend has yet to be broken

The DAX 30 stock index last week sunk to a five-month low, reflecting the strong headwind against its constituent stocks during the escalation of Western sanctions against Moscow, given Germany’s deep trade and energy links with Russia.

On a daily basis (chart shown) the index has fallen through all three key moving averages:

20, 50 and 100-day and is approaching a retracement level traditionally considered to be moderate-to-weak. The Fibonacci retracement levels were drawn from lows reached in 2011 around 4955.61 to highs reached in June this year around 10059.59.

The 23.8% retracement comes in around 8855. It appears close to a level at which the German benchmark gauge found support — 8939, seen in March of this year.

Additionally, a breach would violate the upward trend channel in effect during the same period.

A major question traders will need to answer is whether current events - including signs of an economic pause in Germany, at least partly fuelled by the conflict in Ukraine - justify the DAX 30 weakening any further?