In line with the polls the SPD led by Olaf Scholz won the largest number of votes in the German elections. The SPD won 25.7% of the votes, whilst the CDU/CSU came a close second with 24.1%, the worst performance by the Conservatives in recent history.

The smaller parties, the Green party and the FDP won 14.8% and 11.5% respectively making it a successful night for the minorities.

Coalition talks

The election results pave the way for coalition talks. There are several outcomes which could come about as a result of coalition talks. Olaf Scholz’s centre left social democrats will initially look to seek a coalition with the Greens and the FDP, in the so-called traffic light coalition.

However, the CDU/CSU have also said that they plan to try to form a government with the FDP and the Greens. This has been called the Jamaican coalition. So although the SPD’s narrowly won the election, the FDP and the Greens could actually decide who will lead the next coalition government in Germany.

Coalition talks in 2017 dragged on for six months, many will be hoping that these talks will be quicker given the challenges that lie ahead. Whilst there are other coalition options, the traffic light or the Jamaican coalition are considered a continuation of the status quo in terms of fiscal and EU policies. There could be a slight shift in a policy, particularly in a greener direction but broadly speaking the result indicates continuity.

Market reaction

So far, the market’s reaction has been relatively muted. There have been no surprises. The prospect of at three-way coalition prevents market unfriendly scenarios. The DAX has pushed higher and trades over 15600 thanks in part to likelihood of the business friendly FDP being included in the coalition. See two trades to watch.

Meanwhile the Euro has come under mild pressure, weighed down by the limbo as talks take place.

Where next for the EUR/USD?

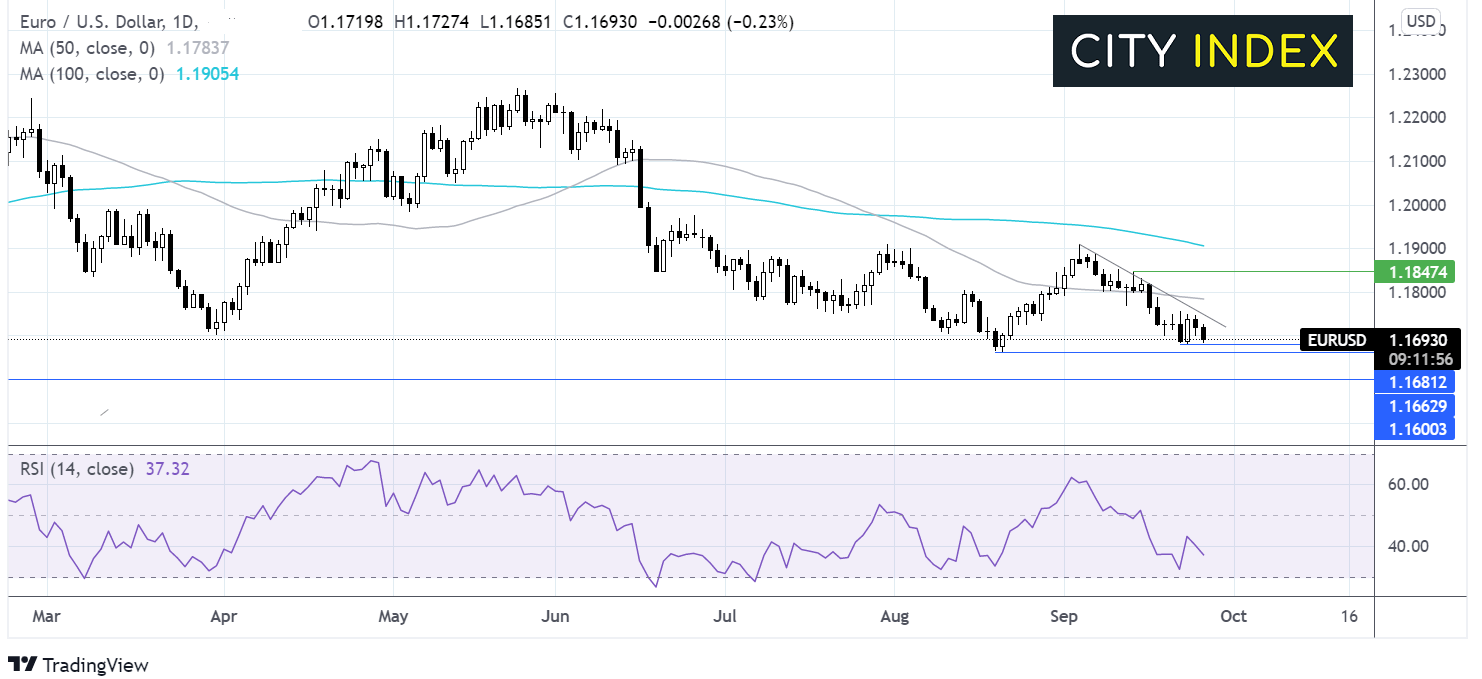

EUR/USD trades below its descending trendline dating back to early September. The RSI points to further losses whilst it remains out of oversold territory. Immediate support can be seen at 1.1680 last week’s low, ahead of 1.1665 the August low. A break below here could expose 1.16 a level last seen in November 2020. On the flip side, a move over 1.1750 the falling trendline and horizontal resistance could negate the near term down trend help the pair towards 1.1790 the 50 sma.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.