The Social Democrats (25.9%) under Olaf Scholz hold a narrow lead over the Conservative block of CDU/CSU (24.3%) under Armin Laschet. The Greens appear to have gained approximately 15% of the vote, while the Free Democrats (FDP) have captured about 11.5% of the vote.

The two fringe parties AfD (10.5%) and The Left (5%), lost votes. Importantly for those who feared a big swing to the left, it’s not yet clear if The Left will receive enough votes to reach the 5% threshold needed to be represented in Parliament.

Complex coalition negotiations involving the various parties will now take place in the weeks and even months ahead.

Three coalitions could find a majority. One option would be the repetition of the so-called ‘Grand Coalition’ between the Conservative Block of CDU/CSU and the Social Democrats (SPD) – one that all major politicians have already ruled out.

More likely the successful coalition will see either of the two smaller-sized blocks, the Free Democrats (FDP) and Greens, govern with either the Conservatives (the so-called ‘Jamaica coalition’) or with the Social Democrats (the so-called ‘traffic light coalition’).

Whichever form the new government takes and despite giving the two smaller parties tremendous power as king-makers, it is expected to be seen as a government providing stability and continuing to occupy the centre ground.

The German constitution does not set a time limit when a new government has to be formed. It only puts a time limit when the new Bundestag (Parliament) has to constitute itself at a maximum of 30 days after the election.

If, by that time, no coalition is formed and no majority found to elect a Chancellor, the current government led by Angela Merkel will stay on as a caretaker government for as long as needed.

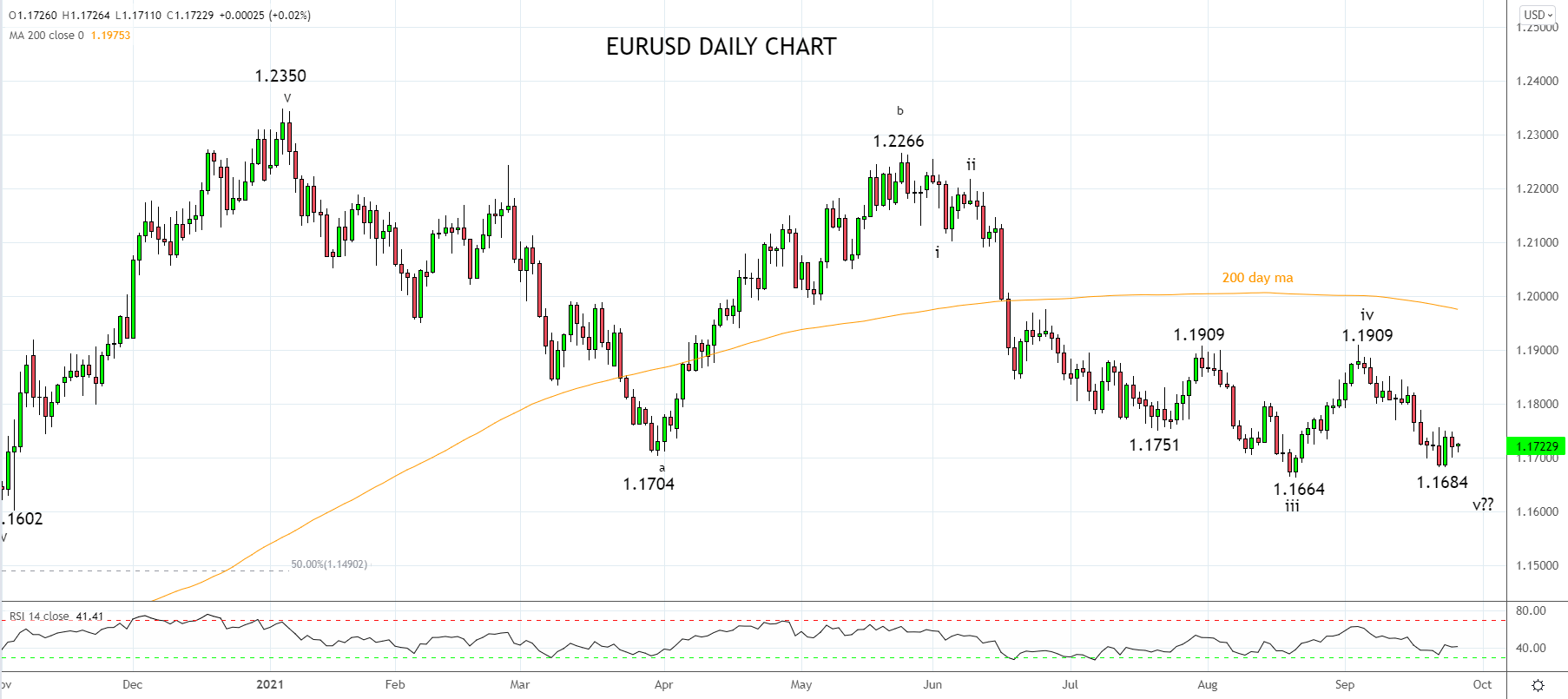

Evidence of this stability is viewed in the EURUSD trading mostly unchanged at the time of writing from its New York close on Friday of 1.1719. The pullback in the EURUSD from the 1.1909 double high is viewed as part of a bottoming pattern that is expected to hold the band of broad support between 1.1650 and 1.1450 before a return to 1.1900/1.2000.

Source Tradingview. The figures stated areas of September 27th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Yesterday 08:33 AM