Geely Automobile (175.hk): Consolidation before the next rally

China Association of Automobile Manufacturers (CAAM) reported that China's auto sales rose 12.5% on year in October to 2.57 million units and year-to-date sales decline narrowed to 4.7% from 6.9%. CAAM said a steady and sustainable recovery is expected for the automotive market.

Meanwhile, Geely Automobile announced that vehicle sales increased 8% on year to 140,026 units in October and totaled 1.0155 million units in the first ten months of the year (-7% on year), achieving 77% of its full-year target.

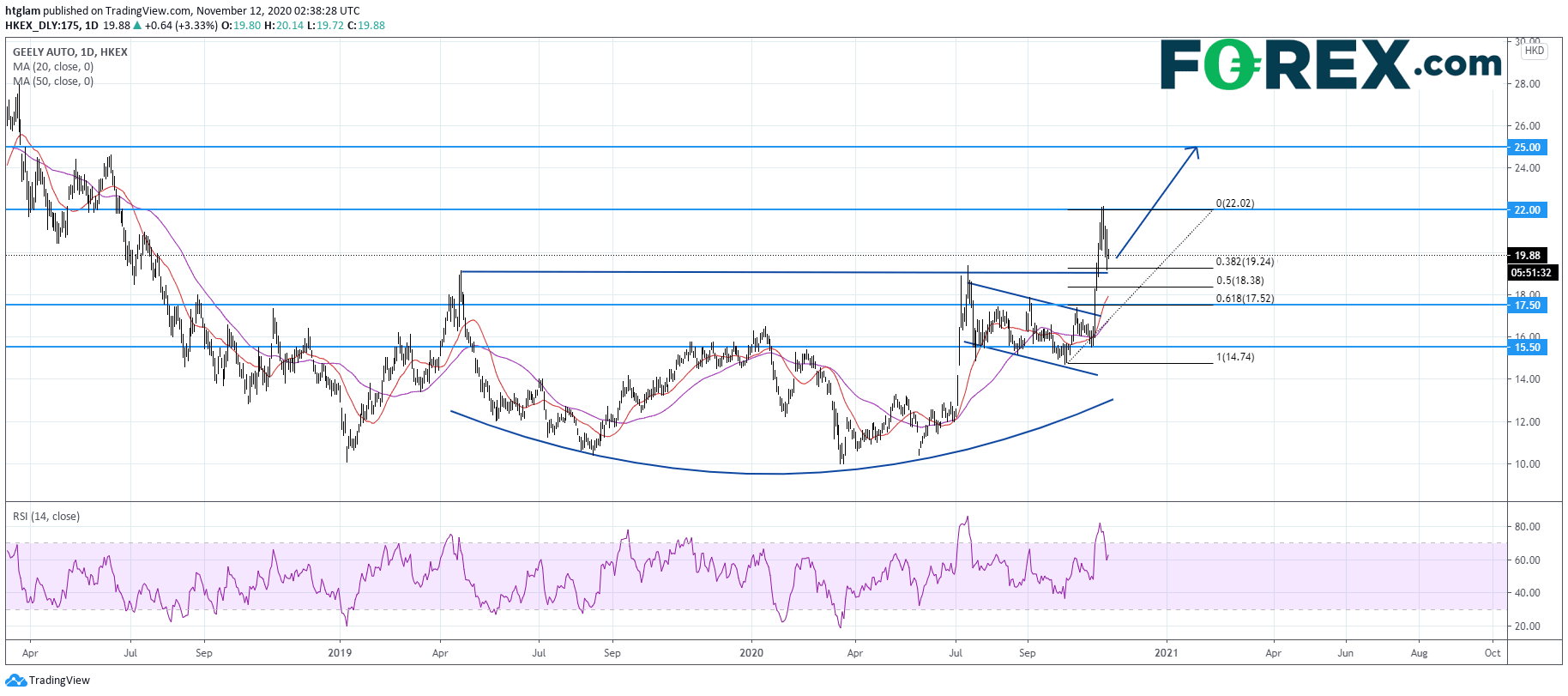

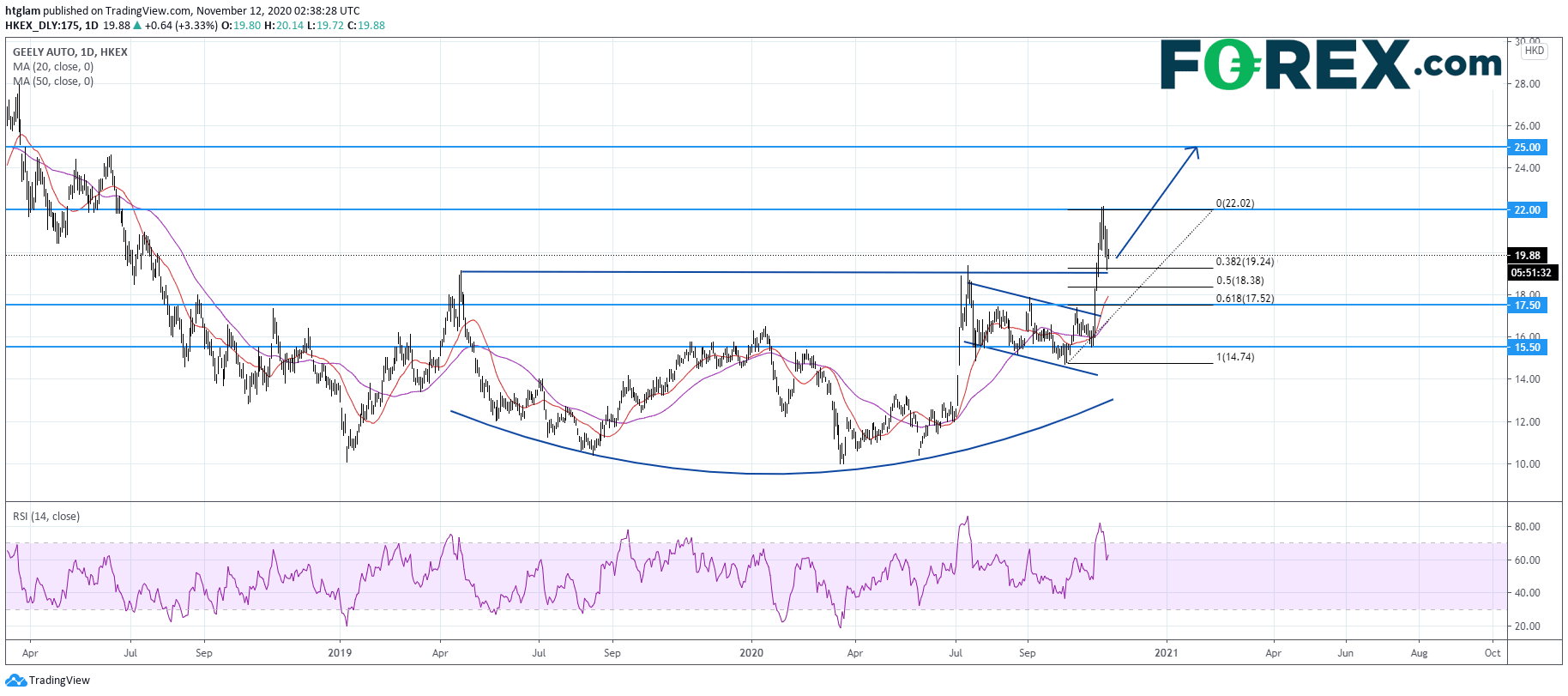

From a technical point of view, Geely Automobile's upside momentum remains solid despite a modest pull-back. It has retreated after reaching the 1st resistance of our previous forecast, but stabilized after reaching the 38.2% Fibonacci retracement support of the most recent rally. The level at $17.50 might be considered as the nearest support, while a break above $22.00 would open a path to the next resistance at $25.00.

Source: GAIN Capital, TradingView

Meanwhile, Geely Automobile announced that vehicle sales increased 8% on year to 140,026 units in October and totaled 1.0155 million units in the first ten months of the year (-7% on year), achieving 77% of its full-year target.

From a technical point of view, Geely Automobile's upside momentum remains solid despite a modest pull-back. It has retreated after reaching the 1st resistance of our previous forecast, but stabilized after reaching the 38.2% Fibonacci retracement support of the most recent rally. The level at $17.50 might be considered as the nearest support, while a break above $22.00 would open a path to the next resistance at $25.00.

Source: GAIN Capital, TradingView

Latest market news

Today 04:47 AM

Yesterday 11:23 PM

Yesterday 10:19 PM

Yesterday 08:00 PM

Yesterday 04:54 PM