Learn more about trading indices

The latest US stimulus package, worth slightly over 8% of US GDP, returns to the House on Tuesday for final approval and is likely to be signed off by President Biden shortly after.

Its key features which include a $1400 payment for individuals with incomes of $75,000 or less ($150k for couples) are expected to see US GDP growth rise to 7% this year, the highest rate since 1984. Within that, Q2 2021 GDP is expected to rise by `11%, the biggest single quarterly rise since 1978.

Reinforcing the rapidly improving global economic outlook, Westpac’s respected Chief Economist, Bill Evans today raised his Australian 2021 GDP growth forecast from 4% to 4.5% following last week’s stronger-than-expected Q4 Australian GDP print.

Although the better GDP number reflects a broad-based recovery, it was consumer spending that provided the majority of the beat. This should ensure that another strong consumer sentiment survey (already near-decade highs) is released on Wednesday, as households draw on their large pile of accumulated savings.

The stronger Australian GDP profile is supportive of the ASX200. Additionally, the ASX200 is likely to weather a continued rise in global yields better than other countries' tech stock heavy indices. As noted previously, higher yields are supportive of the bank and resource stocks that are well represented in the ASX200.

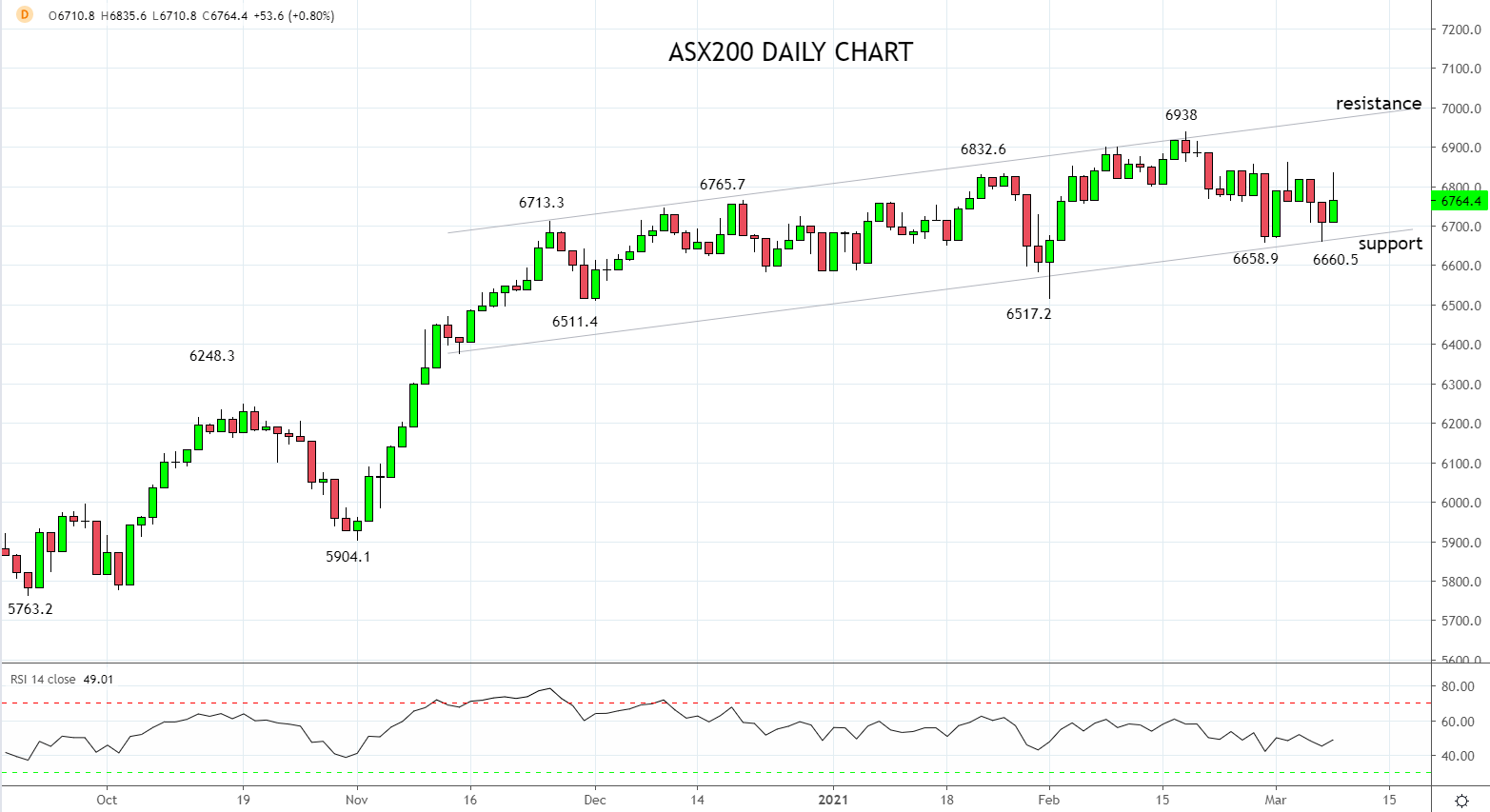

Technically, the ASX200 continues to trade in a choppy fashion, within a well-established uptrend channel. An environment that is suitable for short-term traders, not so good for traders that prefer trending markets.

Trend channel resistance is currently coming in near 7000, where short-term traders may look to short the market in anticipation of lower prices to rebuy. Trend channel support is viewed 6660 area, where short-term buyers are expected to emerge in anticipation of further range trading ahead.

Source Tradingview. The figures stated areas of the 8th of March 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation