GBP/USD Trading at Key Level

The Construction PMI earlier out of the UK was horrible. The reading was 8.2 vs an expectation of 22, and a reading of 39.3 for March. This was the worst ever reading for the survey. Obviously, this was due to the (nearly) complete stoppage of work for the construction industry for the last month because of the coronavirus.

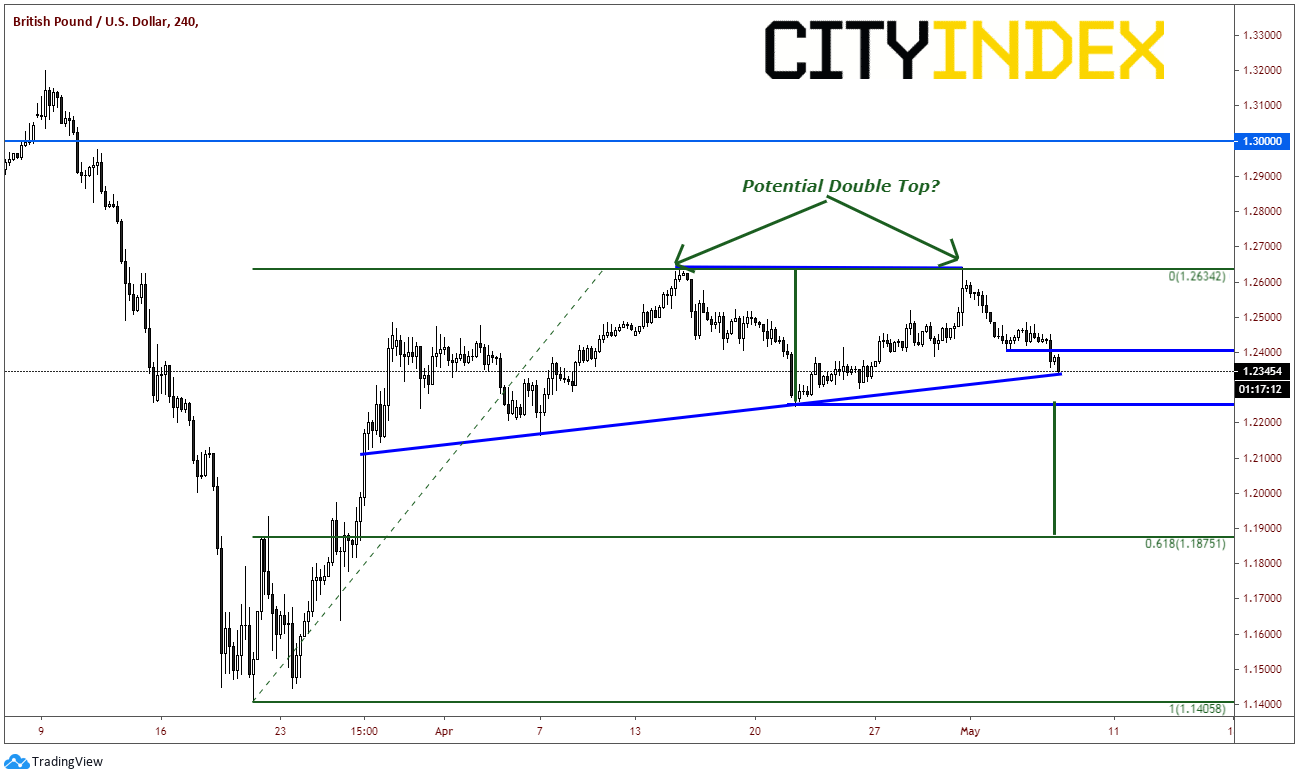

GBP/USD had been falling since Friday. On Thursday, the pair tested recent highs at 1.2643 only to reverse and move lower on Friday, which resulted in 2 failed breakout attempts above the 61.8% Fibonacci retracement level from the highs on March 9th to the lows on March 29th, near 1.2510. Recall that there was a good deal of US Dollar selling into month end, which most likely contributed to the run higher in GBP/USD. The pair is currently trading in a rising triangle formation, which would typically break to the upside. However, GBP/USD is currently trading near the upward sloping trendline of the triangle and if price breaks lower, the pattern will be negated.

Source: Tradingview, City Index

If GBP/USD does break lower, it sets up a possible double top. The neckline would be the recent low from April 21st near 1.2250. A break of the neckline would target 1.1860, which is near the 61.8% Fibonacci retracement level from the March 19th lows to the April 30th highs. First resistance above is at 1.2400.

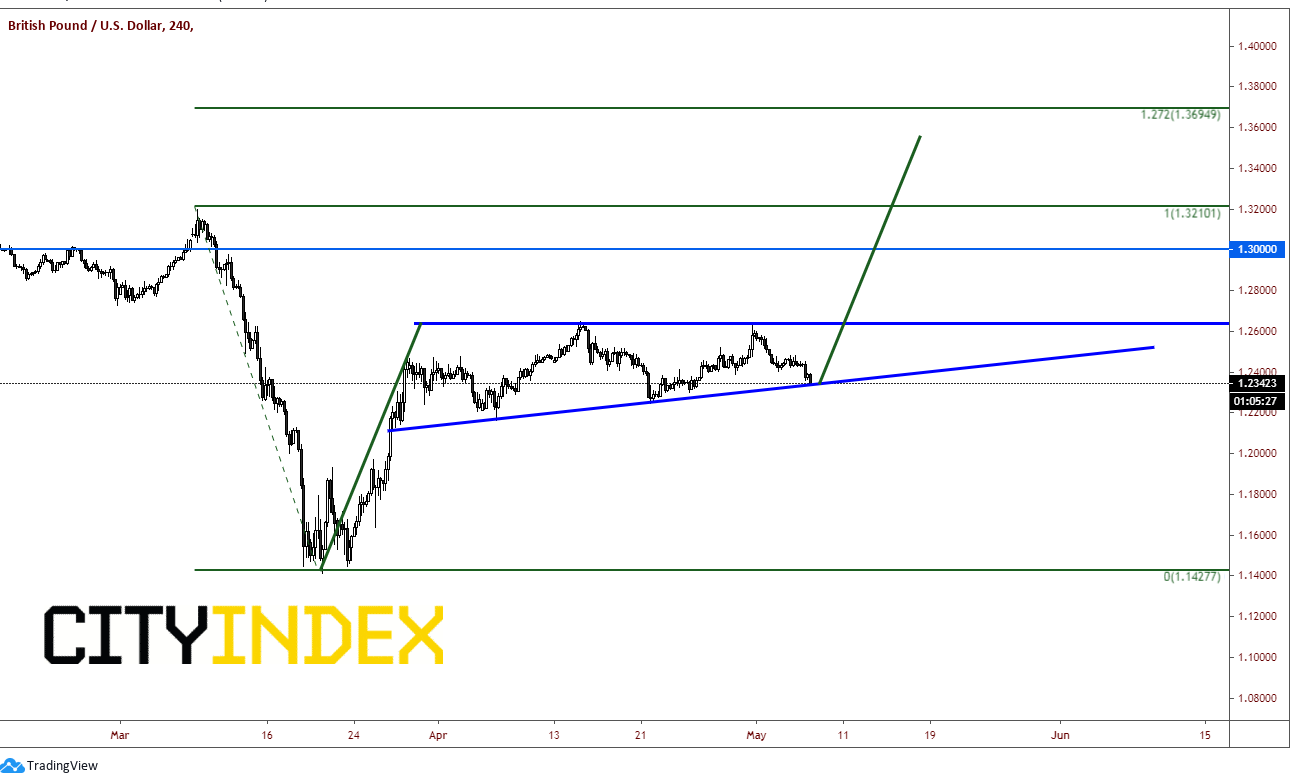

Source: Tradingview, City Index

Conversely, if GBP/USD does hold the rising trendline and move higher above 1.2643, than the rising triangle pattern will have held and would target near 1.3550! The psychological level of 1.3000 and the March 9th highs at 1.3210 would be next resistance levels above.

Source: Tradingview, City Index

One very important factor to consider when looking at this pair is the Bank of England (BOE) interest rate decision meeting on Thursday. As with other central banks, expectations are for unchanged. The prevailing factors from the meeting with be statement (how dovish will they be?) and the guidance (when does the committee believe the economy will begin to get better?). With the selloff the last few days in GBP/USD, it appears traders are looking for a more dovish tone.