Today at 13:30 BST the US non-farm payroll figures will be released. Expectations are for 160,000 jobs to have been created in August. Given the rebound in the dollar in the previous session investors could be hoping for a slightly stronger figure today.

And they could be right. There are several data points which indicate that the number of jobs created in August will surprise to the upside.

1) ADP private payrolls surprised to the upside with the largest increase in private sector jobs in 4 months

2) Jobless claims remained low with no signs of rising layoffs

However, there has also been a slew of data which indicates that the NFP could actually disappoint.

1) Whilst US non-manufacturing print impressed, the employment component of the report was a cause for concern, dropping to the lowest level in 2 years. Given the dominance of the service sector in the US economy, there is a strong correlation between the ISM non-manufacturing employment component and the NFP. This is arguably a stronger lead indicator than the ADP private payrolls print.

2) The manufacturing sector is experiencing a slump. This is being reflected in employment numbers for the sector which have fallen to a three-year low. Whilst this sector accounts for a much smaller area off the economy than services, it adds to the weaker jobs picture.

3) Finally, the University of Michigan confidence indicator experienced the biggest 1 month drop since 2012. Erosion of consumer confidence due to the ongoing US – Sino trade dispute is now well underway, which, whilst there is no trade war solution in sight, doesn’t bode well for the US economy or the labour market.

A print below 150k could well be in the pipeline and will disappoint. A weak figure could stoke slowdown and recession fears in the US economy, boosting expectations of further intervention from the Fed. Under this scenario we expect the dollar to fall.

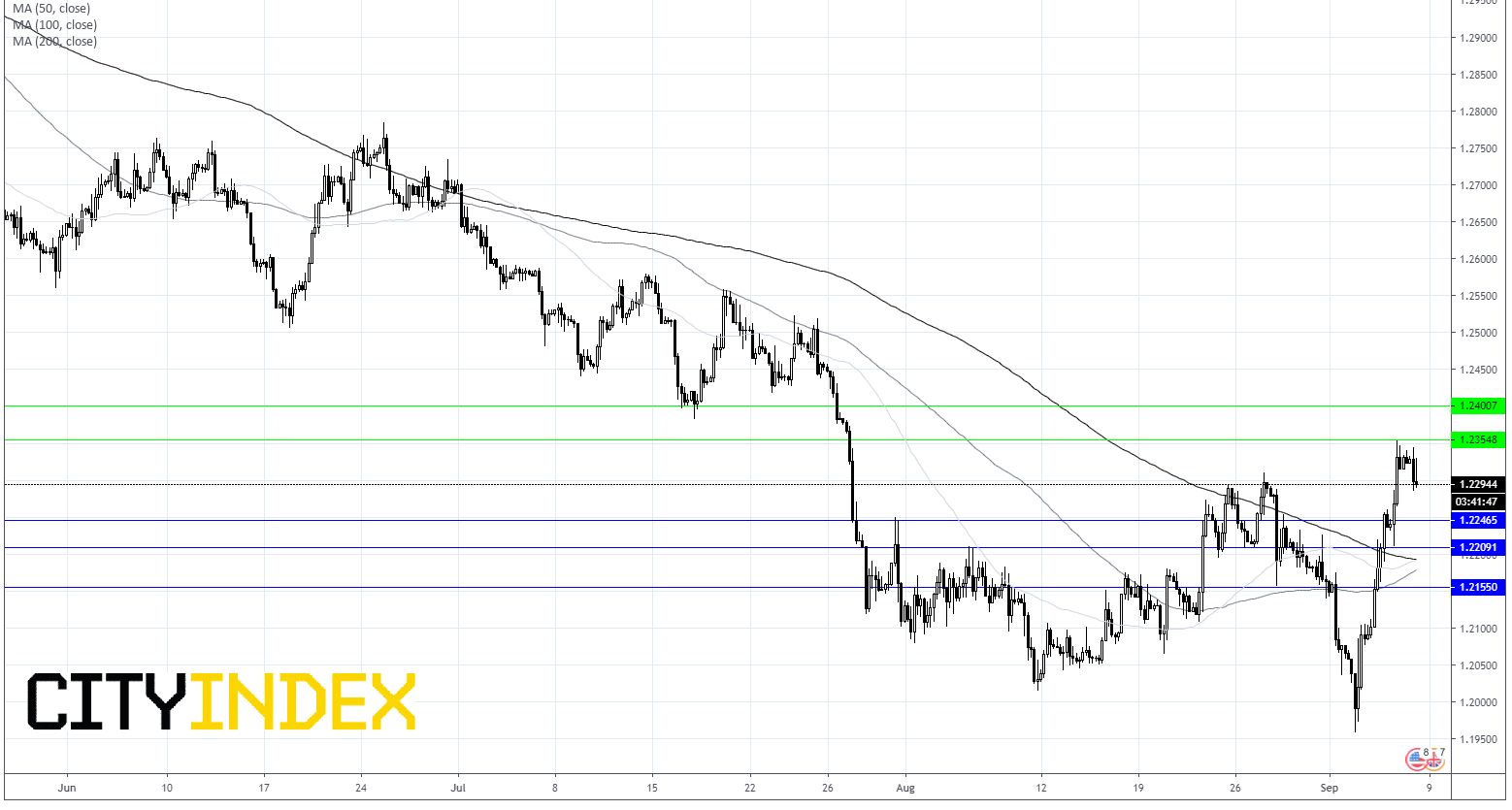

GBPUSD levels to watch:

After three days of Brexit inspired gains GBPUSD has been moving lower in early trade on Friday. A weak US NFP report could see the pair push through resistance at $1.2355 and target $1.24. A stronger than forecast NFP could send GBP/USD lower, testing resistance at $1.2245 prior to $1.2210.