Sterling took advantage of the weaker dollar moving northwards after investors had barely reacted to earlier UK GDP data. Thee were no real surprises from the GDP print, with Q1 growth at 1.8% yoy as forecast. Pound traders initially shrugged off the “as expected” data only pushing higher after the weaker US VPI print.

Whilst the headline figure suggests that the UK economy is showing resilience amid lingering Brexit uncertainties, the reality is not quite so rosy. The UK economy performed ok in the first quarter, however than was mainly thanks to stockpiling ahead of the March Brexit deadline. The production and stockpiling of unsold goods is obviously is neither sustainable or commendable as a way of boosting economic growth.

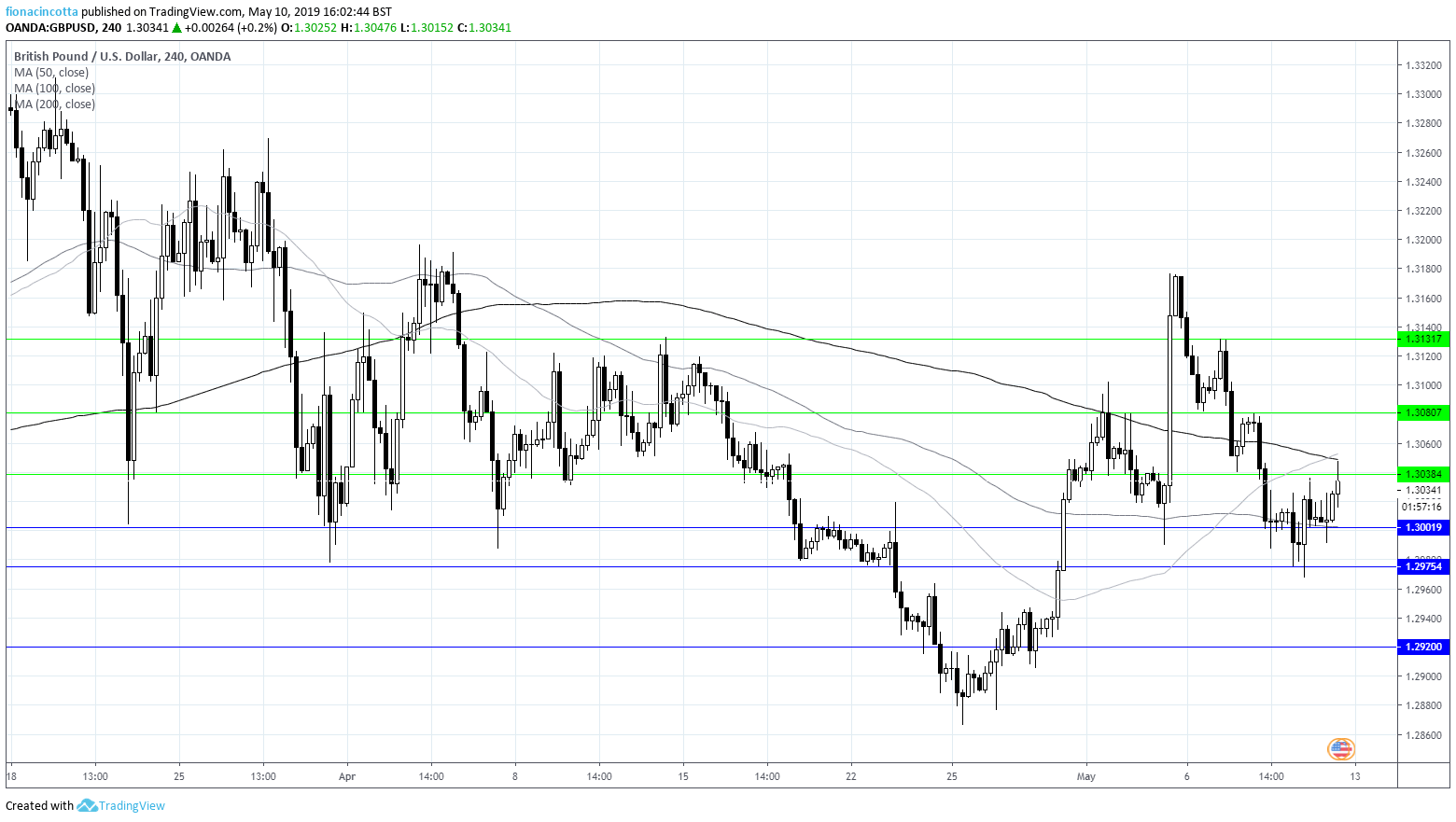

GBP/USD to break above $1.3050?

Following the UK GDP & US CPI, GBP/USD is trading 0.2% higher, with immediate support at $1.30, ahead of support at $1.2975 and $1.2920. On the upside a break through resistance of $1.3053 (50 SMA), could open the door to $1.3080 before $1.3130.