May has only just stated and its already looking like a month that the Pound would rather forget. In just two trading days, sterling has wiped out all of its gains from April. However, a weak May isn’t that unusual for sterling, it has been GBP/USD’s worst month each year since 2010.

Negative seasonality, coronavirus lockdown and the Brexit deadline fast approaching are headwinds which are giving investors good reason to sell out of the Pound

In true May fashion, GBP/USD is trading on the back foot in the European session, amid increased risk aversion and ahead of a busy week for the Pound.

In true May fashion, GBP/USD is trading on the back foot in the European session, amid increased risk aversion and ahead of a busy week for the Pound.

The latest Deloitte CFO survey showed that UK business confidence has fallen to the lowest level since records began in 2007. The survey revealed that 53% of CFO’s saw the UK economy in a deep and pro-longed downturn until the end of year. Revenue isn’t expected to return to pre-coronavirus levels for at least a year.

Pound traders will now look ahead to tomorrow’s service sector PMI, which is expected to show a reading of 12.3, yet another record-breaking eye watering level as the coronavirus lockdown paralysed the dominant sector of the UK economy. Whilst some reports of how the British government intends to ease lock down have been released, however without more details on the exit strategy, investors could well get very jittery over such weak figures.

BoE at 7am?

Looking further ahead, BoE will announce its monetary policy decision on Thursday. However, it will be doing so at 7am rather than the usual 12 am. The change in timing raises the question whether this is owing to any big policy announcement or to prevent any leaks.

Looking further ahead, BoE will announce its monetary policy decision on Thursday. However, it will be doing so at 7am rather than the usual 12 am. The change in timing raises the question whether this is owing to any big policy announcement or to prevent any leaks.

Safe haven USD

The US Dollar is bounding higher in risk off trade as US -China tensions rise. US secretary of state Mike Pompeo reiterated President Trump’s efforts to pin the blame of coronavirus on China. Fears of a second chapter to the trade war are being stoked after Trump threatened more trade tariffs.

The US Dollar is bounding higher in risk off trade as US -China tensions rise. US secretary of state Mike Pompeo reiterated President Trump’s efforts to pin the blame of coronavirus on China. Fears of a second chapter to the trade war are being stoked after Trump threatened more trade tariffs.

GBP/USD: Levels to watch

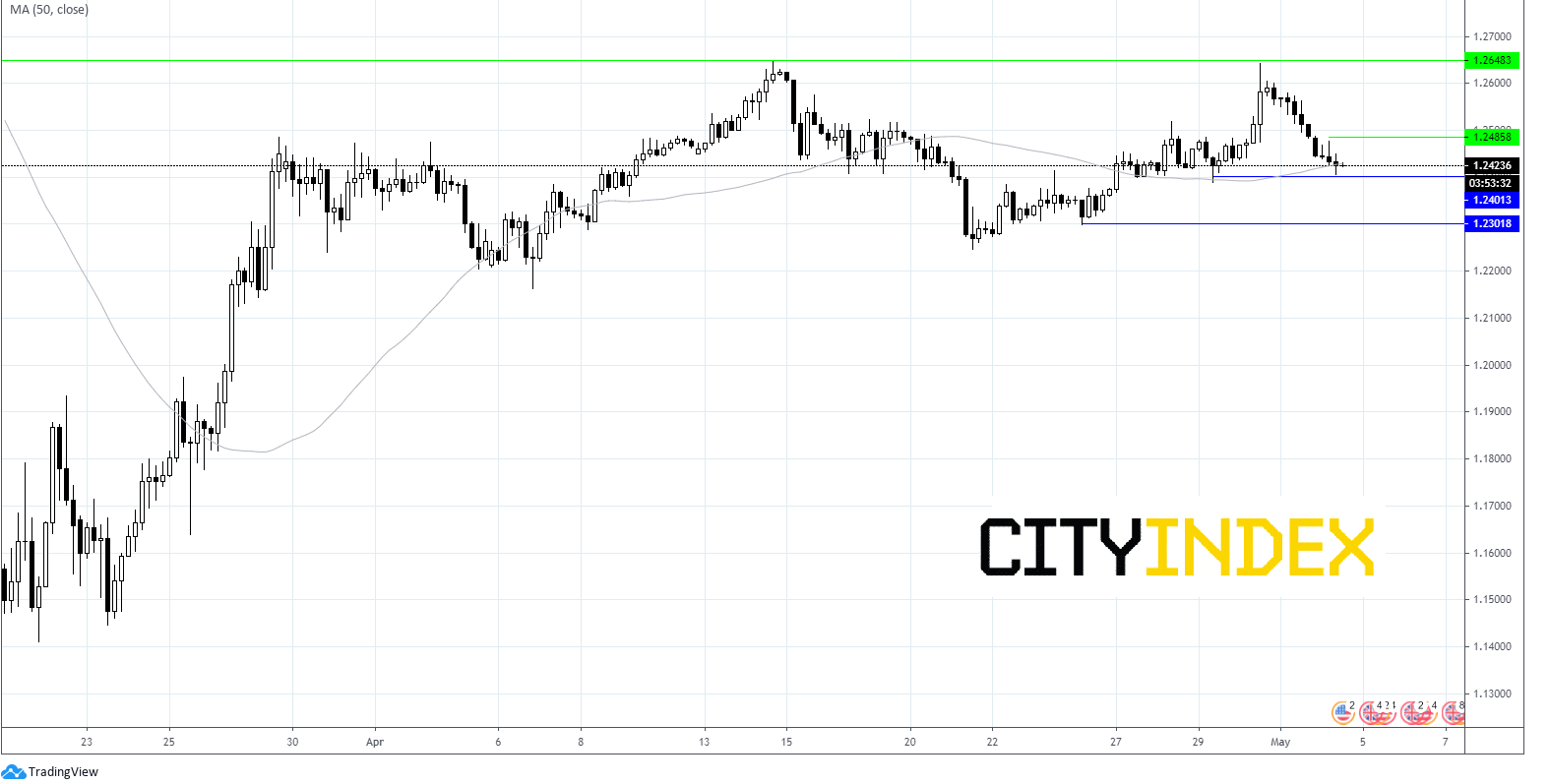

GBP/USD is -0.5% as it tests it 50 sma on 4 hr chart at $1.2430. A meaningful move below this level could see more bears jump in.

Immediate support can be seen at $1.2405 (today’s low) prior to $1.23 low 24th April.

Immediate resistance can be seen at $1.2486 (today’s high) prior to $1.2648 (high 30th April)

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM