GBP/USD has slipped 0.2% across the morning session, slipping off 10-day highs after failing to break its 100 day moving average after Boris Johnson said he is not expecting anything special from EU talks.

Last week the pound rallied over 200 points from US$1.2870, its lowest level since November to $1.3070 on the back of a stronger than forecast GDP release and optimism of an expansionary fiscal policy following Boris Johnson’s cabinet reshuffle.

Sajid Javid’s surprise resignation and his replacement by Rishi Sunak was well received by pound traders. The power grab by No. 10 on the Treasury is seen as boosting the chances of increased fiscal spending; particularly important given that the Budget is due next month. Higher fiscal spending would take the pressure off the BoE to raise rates, thus lifted the pound.

Brexit

That said, any gains in the pound are and will be capped by fears that the EU is adopting a tougher negotiating stance ahead of complex trade talks due to start in March. Fears are also growing that Boris Johnson is aiming for a hard Brexit.

Data

On the data front last week figures showed that the British economy grew at a better than forecast 0.3%, whilst UK construction output increased +0.4% ahead of the -0.4% expected.

Pound traders will now look ahead to tomorrow’s employment figures, followed by inflation data on Wednesday. Expectations are for a fall in inflation which could drag the pound back towards $1.30.

Dollar holds steady

The US dollar is holding steady versus its major peers and fears over coronavirus ease and as investors look ahead to a quiet week on the data front. The release of the minutes from the January FOMC is expected to be a highlight and even then, no surprises are forecast. The Fed have re-affirmed their stance several times across recent weeks meaning the minute are not expected to unveil anything news.

Levels to watch:

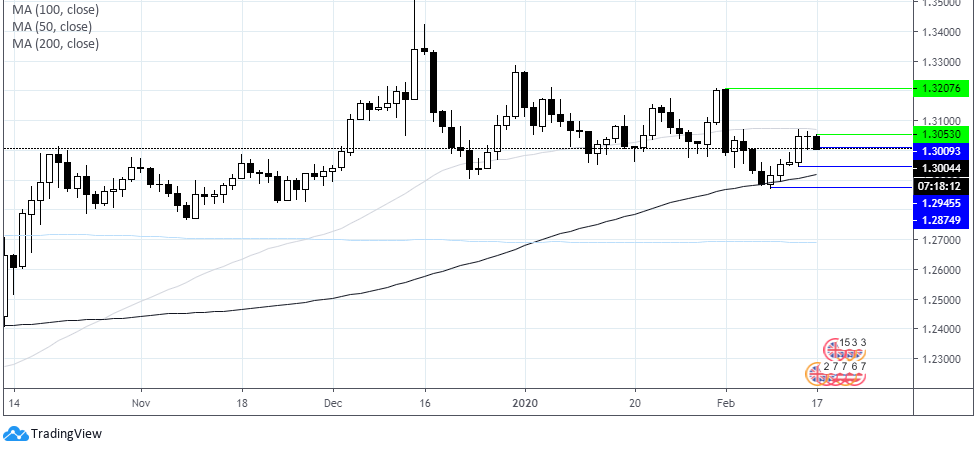

Bull are awaiting a move above the 50 sma, in the meantime $1.30 is offering strong support. GBP/USD trades above its 200 & 100 sma. A move below the 100 sma could put the bears back in control

GBP/USD is testing support at $1.3009, the daily low. A breakthrough here could open the doors to $1.2943(13th Feb low) and $1.2917 (100 sma) before $1.2871 (Feb low)

On the upside resistance stands at $1.3053 (daily high) before $1.3070 (50 sma). A meaningful move above here could see resistance of $1.32 (high 3rd Feb) being tested.