A level playing field is what the EU are looking for. Time will tell whether it is what Boris Johnson is prepared to offer. The pound remains under pressure as traders doubt whether 1 year will be sufficient tine to agree a deal.

Dollar Advances After Strong ADP Data

The US dollar was on the front foot at the start of Wednesday boosted by flows into safe haven assets. Yet even as US – Iran tensions eased, and risk sentiment picked up the dollar remained firm thanks in part to strong ADP data.

ADP private payroll report added a whopping 220,000 jobs in December, this was well ahead of expectations of 160,000 jobs and November’s 67,000 jobs created. Despite the impressive data, the dollar is paring gains, as flows towards riskier assets pick up.

Up Next

The British Parliament is expected to vote through the Brexit Withdrawal Bill tomorrow. No hold ups are expected. As tension continues t ease in the Middle East US dollar investors could turn their attention towards Friday’s NFP.

Levels to watch

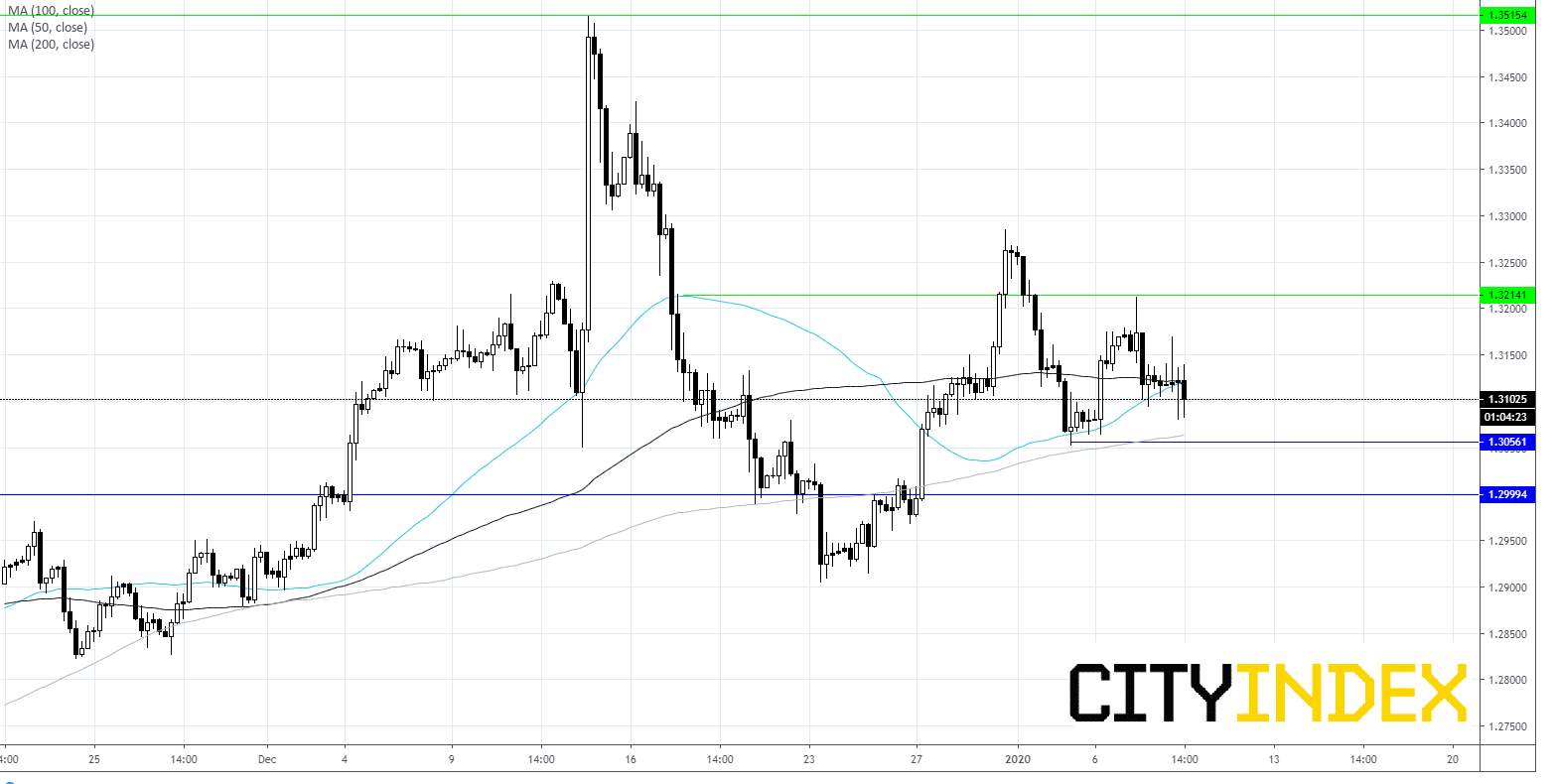

Cable is lacking bullish momentum on 4 hrs chart, below the $1.32 handle and below the 50 sma. GBP/USD is testing support at $1.31. A breakthrough here could see the price test $1.3055 opening the door to $1.30. A break above $1.3212 could bring a more bullish outlook.